Your platform will fail unless you help CFOs rebuild cost transparency from the ground up

Vendors must prove real cost transparency as Aussie CFOs push to rebuild data discipline and steer AI investment with confidence.

Australian enterprises are entering a decisive stage in their shift from digital experiments to disciplined intelligence.

Finance leaders now guide decisions that determine how quickly their organisations can adapt, how confidently they can invest, and how safely they can deploy AI.

Yet even as the ambition for AI rises, the underlying systems and human performance models remain uneven.

CFOs want partners who strengthen the intelligence that runs through the business, not platforms that add complexity without improving decision clarity.

At ADAPT’s 16th CFO Edge at The Fullerton in Sydney, more than 150 senior finance leaders responsible for about one fifth of Australia’s GDP examined this tension.

They revealed a consistent view. CFOs have become co architects of enterprise transformation, but their organisations are still constrained by fragmented data, reactive processes, and variable capability.

Vendors selling to this audience must recognise the shift. CFOs do not want more dashboards.

They want decision intelligence that improves cost transparency and creates the conditions for enterprise adaptability.

The CFO must move from financial steward to architect of enterprise adaptability

CFOs described a role changing faster than the systems around it.

They spend less time stewarding financial accuracy and more time shaping organisational rhythm, capability, and resilience.

CFO Edge attendees reinforced this shift by revealing that 60% of Australian CFOs now act as strategic partners in co building technology, placing finance at the centre of transformation decisions.

This shift dominated the reflections of The Hon Victor Dominello, former New South Wales Minister for Customer Service, together with Dom Price, Work Futurist and ADAPT Advisor .

Victor returned to a pattern he had witnessed repeatedly in government and large enterprises.

Organisations attempt to modernise by digitising existing workflows rather than redesigning the system beneath them.

They convert paper to web forms and call it transformation.

They buy new tools while legacy processes remain untouched. He described this as creating an expressway that still reaches a goat track.

Progress only began when he rebuilt decision machinery through agile data flows, rapid escalation paths, and funding models that rewarded experimentation.

Dom emphasised the human dimension of the same challenge.

He saw enterprises conditioned for consistency struggle to navigate environments shaped by uncertainty.

Leaders still rely on perfect business cases even though assumptions collapse quickly.

He encouraged CFOs to embrace controlled experimentation and share lessons openly so capability compounds across the organisation.

Finance leaders strengthen enterprise adaptability by enabling agile data, agile decisions, and agile funding.

Vendors must support this shift rather than reinforce static processes that restrict learning.

Finance must transform into an intelligence platform that fuels decisions across the enterprise

CFOs repeatedly explained that finance can no longer operate as a reporting engine. It must become the platform that connects data, decisions, and investment logic across the business.

This message gained its sharpest articulation from Solly Brown, Partner at McKinsey and Co Leader of QuantumBlack Australia and New Zealand.

Solly outlined how Agentic AI reshapes finance through systems that understand context, plan across long sequences of activity, and complete complex tasks autonomously.

He showed how this pushes finance beyond siloed use cases toward integrated processes with shared logic and shared data.

He explained that only 7% of global enterprises have scaled AI effectively. The gap is architectural.

High performers set transformative ambitions, invest more than 20% of their technology budgets into AI, and redesign entire processes instead of automating old ones.

They focus on integration rather than scattered tools.

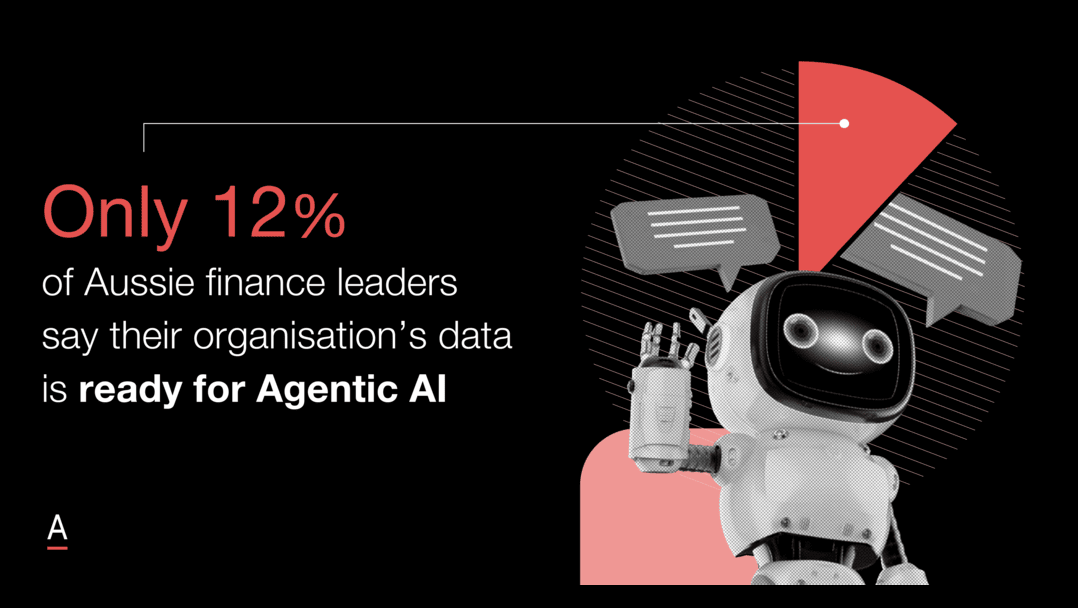

CFO Edge participants acknowledged how far they still must travel.

Only 12% believe their data is ready for Agentic AI. Only 15% consider their technology teams effective at cost transparency.

Leaders described architectures weighed down by tool sprawl, inconsistent data, and workflows that fracture across silos.

Chris Merjane, Head of Finance for Corporate Functions at ResMed, demonstrated how finance evolves into a decision intelligence engine.

He explained how his team democratises data by giving business leaders real time visibility of spending.

This shifts accountability and removes the old habit of waiting for finance interpretation.

Chris pairs FP and A with data scientists and systems specialists so the entire finance function operates from shared data and redesigned processes.

His FinOps partnership consolidates platforms and reduces vendor proliferation so AI has clean foundations to build on.

Ali Mehfooz, Group Financial Controller at Bendigo and Adelaide Bank, expanded this theme through capability uplift.

Encouraging teams to use AI personally opened their thinking to enterprise application.

As experimentation grew, so did insight quality.

Ali sees AI shaping forecasting, reconciliation, analytics, and board reporting, but only when governance, security, and human oversight advance together.

Finance becomes an enterprise intelligence platform when systems are simplified, data is trustworthy at the source, and teams operate through shared workflows.

Vendors must prove how their technology removes complexity, improves cost visibility, and strengthens the operating model CFOs depend on.

Human performance is now the primary determinant of digital performance

Even the strongest data foundations cannot compensate for teams that cannot absorb change.

CFO Performance Coach at Imperative Advisory Florian Pecher framed this reality by examining the human system surrounding every digital initiative.

Florian argued that AI outcomes fail when teams operate in states of distraction, overload, or disconnection.

He described how the brain filters most stimuli even at the best of times, and how modern work patterns intensify errors.

Improving digital performance begins with restoring attention, clarity, and regulation so teams can collaborate at the pace AI requires.

He connected individual tendencies to team behaviour, showing how drive, collaboration, and rigorous problem solving must evolve together.

When teams understand their predispositions and learn to modulate their responses, they strengthen the judgment and relational quality that determine whether AI investments deliver impact or friction.

Chris reinforced this when he explained how ResMed embeds people into experimentation cycles rather than imposing new tools from above.

Ali added that hunger, curiosity, and willingness to challenge old patterns matter more than narrow technical expertise.

CFOs made it clear.

Human performance determines digital performance.

Vendors must design solutions that reduce cognitive load, clarify workflows, and increase the confidence with which finance teams make decisions.

Recommended actions for technology vendors

CFOs were explicit about the type of support they need.

Vendors must help finance leaders rebuild the systems and behaviours that underpin cost transparency, decision intelligence, and adaptability.

Show how your platform strengthens adaptability

Demonstrate how your technology improves data fluidity, accelerates decision cycles, and supports iterative redesign of workflows.

CFOs expect systems that evolve with the business.

Lift data quality and simplify the environment

CFOs want platforms that consolidate systems, align data structures, and reveal true cost signals.

They will invest where data becomes cleaner, utilisation becomes visible, and waste becomes actionable.

Enable the performance of finance teams

CFOs prioritise systems that free time for analysis, improve clarity, and enhance judgment.

Show how your solution supports new operating rhythms, improves coordination with technology teams, and reduces manual effort.

Vendors who can raise data quality at the source, expose real unit economics, and automate the cost signals CFOs rely on to steer the business will be the ones invited into long term planning cycles.

CFO Edge showed how quickly finance is shifting toward intelligence, clarity, and adaptability.

CFOs want partners who stabilise data, simplify systems, and strengthen the human capability needed to run AI enabled finance models.

Vendors who expose true cost signals, integrate clean data into finance workflows, and support the operating rhythm of modern teams will influence how Australia’s enterprises evolve. Those who cannot will be left out of CFO decision cycles.