ResMed’s Head of Finance on empowering business leaders with real time data and AI driven analytics

In this CFO Edge interview, Chris Merjane, Head of Finance at ResMed, explains how democratised data, embedded analytics and early AI adoption are reshaping finance decision making.In this CFO Edge interview, Chris Merjane, Head of Finance at ResMed, explains how democratised data, embedded analytics and early AI adoption are reshaping finance decision making.

He explains that his team moves beyond traditional month-end activities by automating routine processes and giving cost-centre owners real-time visibility of their spending.

This shift, he says, enables better decision-making and encourages business leaders to take genuine ownership of their numbers.

Chris also highlights the importance of pairing a strong FP&A capability with embedded data scientists, creating a unified function that can rethink processes end-to-end rather than simply producing “cool dashboards.”

He outlines how finance, technology and HR work together to build a more capable and future-ready workforce.

Chris stresses that good FinOps practice helps ResMed reduce technology sprawl, optimise software usage and prepare the organisation for AI by consolidating platforms.

At the same time, partnership with HR ensures the development of a strategic workforce plan that builds AI capability year by year.

Chris believes mobility is essential: he actively encourages his team to consider roles within and beyond finance, aiming to grow financially savvy talent across the organisation.

For him, retaining people is less important than ensuring they grow, remain engaged and contribute meaningfully to the business.

AI is already reshaping ResMed’s finance function.

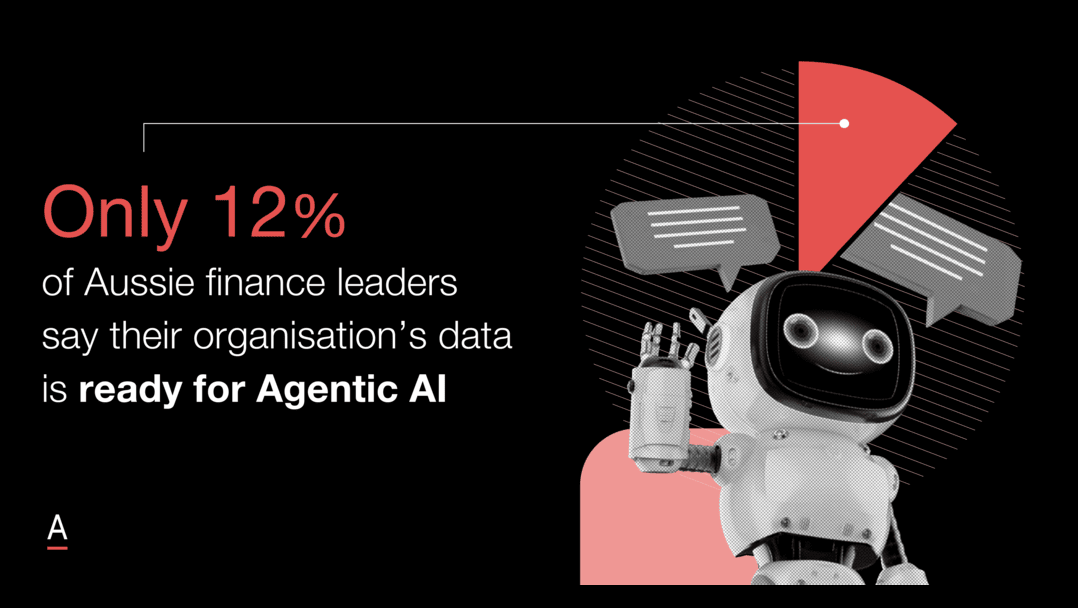

He notes early experiments such as using co-pilot tools to generate automated cost-centre summaries and exploring agentic AI to collect, verify and insert forecasting data without human intervention.

He reports strong internal appetite for removing manual work, with resistance far lower than expected.

Chris values the collaborative culture at ResMed, where teams co-design solutions rather than having change imposed from above.

Key takeaways:

- Democratisation of finance drives better decision-making: Giving business leaders real-time access to financial data and embedding analytics within finance to empower cost-centre owners to take ownership and make informed decisions.

- Strategic workforce planning and cross-functional collaboration are key: Partnering finance with HR and technology ensures teams are AI-capable, roles are mobile, and tech investments are optimised for the future.

- AI adoption enhances efficiency and strategic value: ResMed experiments with co-pilot and agentic AI to automate routine tasks, freeing finance teams to focus on advisory work, while strong change management and a collaborative culture encourage adoption.