AI will stall in your organisation until the CFO fixes the system around it

AI fails in rigid systems. CFOs must redesign funding, data, decisions and team behaviours to create the adaptability intelligent finance requires.

Australian organisations continue to invest in AI with confidence that it will unlock accuracy, efficiency and new forms of value.

Yet the real friction point is rarely the technology itself.

The system around it is rigid, slow and structurally unprepared.

AI cannot create impact inside environments that do not evolve, do not share data freely and do not support the behavioural demands of rapid decision making.

Across CFO Edge 2025, finance leaders were clear. AI progress is a systems problem, a governance problem and a leadership problem.

You can introduce new tools, but only you can redesign the environment that allows those tools to work.

The next stage of enterprise intelligence depends on adaptability, unified finance platforms and people capable of absorbing the speed of transformation.

The CFO must move from financial steward to architect of enterprise adaptability

AI breaks in rigid environments. It stalls inside slow funding cycles, overloaded governance gates and decision rhythms built for another era.

CFOs reported that this is where transformation collapses.

You carry the accountability for enterprise investment, operating discipline and risk appetite, yet the surrounding system still behaves as if change arrives in orderly waves.

This tension grounded the perspective of The Hon Victor Dominello, former New South Wales Minister for Customer Service, who drew a critical line between short bursts of transformation and genuine organisational evolution.

Victor explained how teams often treat digital change as isolated upgrades rather than a continuous capability.

His Government 0 to Government 4 framing showed the shift from static, compliance based delivery to environments shaped by agile data, agile decisions and agile funding.

AI cannot flow through a structure that only updates when a program ends or a budget cycle resets. It needs a system that evolves every day, not once a year.

Dom Price, Work Futurist and ADAPT Advisor, reinforced this by warning that many organisations continue to digitise junk.

They place new tools on top of outdated workflows and assume they have transformed.

Dom argued that AI amplifies any weakness in the underlying process.

If the workflow is fragmented or the decision gate slow, AI simply accelerates dysfunction.

The consequences of structural drag are most visible in the tech estate.

David Walker, Group CTO at Westpac and DBS Bank, spoke to the hidden cost of complexity inside large enterprises.

Legacy stacks, inconsistent architectures and compounding point solutions prevent AI from scaling.

David explained that CFOs and technology leaders must work together to rationalise the estate and build an environment where agentic workflows can move end to end.

This theme continued when Samantha Randall, CFO ANZ at Accenture, described a shared ownership model between finance and technology.

She stressed that transformation fails when these groups operate separately.

Success requires a unified cadence where funding, architecture, delivery and measures of value move together.

You already hold the mandate to lead this redesign.

ADAPT research shows that 60% of Australian CFOs now co build technology strategy, positioning you at the centre of enterprise adaptability.

To keep pace with AI, you must now rebuild your decision systems.

Funding cycles must match the speed of insight, governance gates must support experimentation and operating rhythms must enable continuous learning.

AI only creates value when the environment beneath it adapts.

Finance must transform into an intelligence platform that fuels decisions across the enterprise

AI cannot produce value in isolation. It needs clean data, connected workflows and real time pathways through which insights can move.

Finance becomes the enterprise intelligence layer when it unifies these elements into a platform rather than a traditional function.

This future was outlined by Shilpa Bhale, Director of Strategy and Product Management at Oracle, who described a model where embedded AI agents reduce manual work, generate predictive insights and trigger connected actions.

She emphasised that the shift from isolated use cases to end to end finance redesign is the only way to achieve touchless operations.

AI agents cannot navigate broken processes or reconcile conflicting data.

Solly Brown, Partner at McKinsey and Co Leader of QuantumBlack Australia and New Zealand, reinforced this with the most architectural message of the event.

Solly showed how agentic AI delivers impact when it spans entire processes rather than fragments.

He observed that most Australian organisations still rely on scattered tools that create localised gains but fail to move enterprise performance.

Agentic AI depends on integrated architectures, unified pipelines and simplified tech environments.

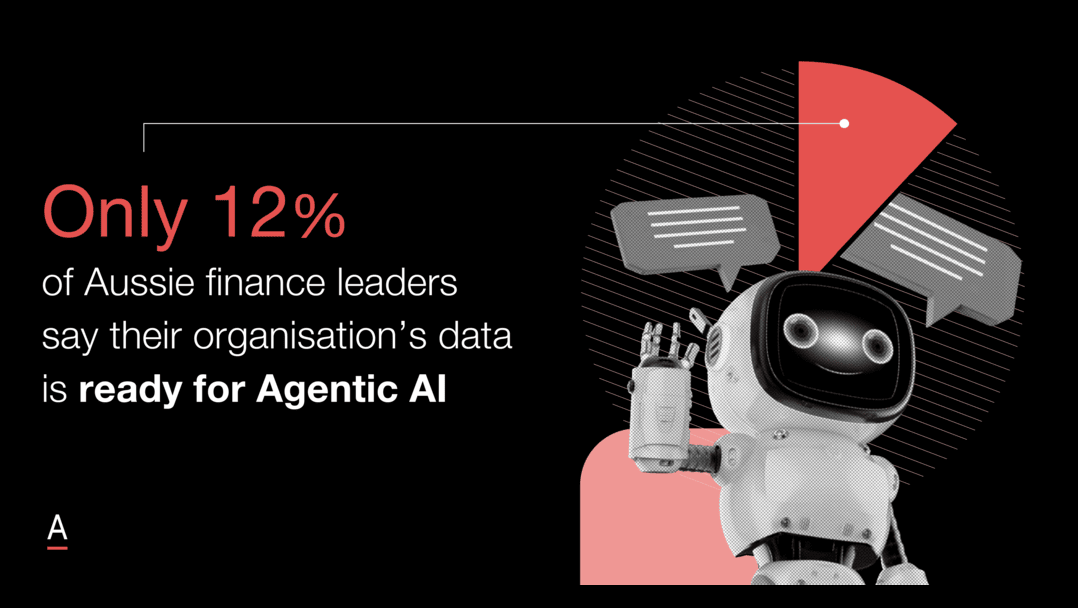

ADAPT research revealed the scale of the challenge.

Only 12% of Australian finance leaders say their data is ready for agentic AI, a signal that the foundation is the constraint.

The failure does not sit in the model but in the data and workflows beneath it.

Finance leaders at CFO Edge demonstrated how to correct these limitations.

Chris Merjane, Head of Finance for Corporate Functions at ResMed, described how his team democratises financial data so business leaders see their spending and performance in real time, shifting accountability and freeing finance from reactive cycles .

Chris integrated FP&A, data analytics and systems into a single function so insights and workflows align.

His FinOps partnership consolidates vendors, reduces sprawl and prepares the environment for agentic layers of automation.

Ali Mehfooz, Group Financial Controller at Bendigo and Adelaide Bank, explained how raising AI awareness begins with personal use and experimentation, which builds curiosity and confidence .

Ali stressed that AI cannot succeed without strong data governance and a workforce capable of evaluating outputs, testing assumptions and embedding new processes.

Finance becomes the real time signal system of the enterprise when data is unified, processes are connected and teams operate at the same rhythm.

AI amplifies these functions only when finance builds the foundations that allow insight to move freely across the organisation.

Human performance is now the primary determinant of digital performance

The final barrier to AI value is human. AI accelerates workflows, compresses decision windows and exposes weak behavioural patterns.

Teams that cannot adapt, regulate or collaborate will slow adoption, regardless of technology capability.

This reality grounded the session from Florian Pecher, CFO Performance Coach at Imperative Advisory, who argued that performance in the AI era depends on drive, collaboration and rigorous problem solving, all shaped by personality patterns and state management.

Florian showed how distraction, overload and misalignment create rework and erode trust. AI magnifies this dysfunction by increasing cognitive demand.

Dom Price returned to this theme with reflections on human systems integration.

He explained that transformation fails when teams cannot collaborate across disciplines or absorb the behavioural impact of rapid change. Technology accelerates failure when the human system is weak.

Samantha Randall added that transformation is career making work. She highlighted the need for behavioural alignment, leadership clarity and tight communication between finance and technology teams. When people share purpose and expectations, transformation accelerates.

Jean-Baptiste Naudet, CFO at the Australian Red Cross, grounded this in purpose.

JB explained that teams adapt faster when they understand why change matters and how their work contributes to a broader mission.

Fear slows adoption. Purpose strengthens it.

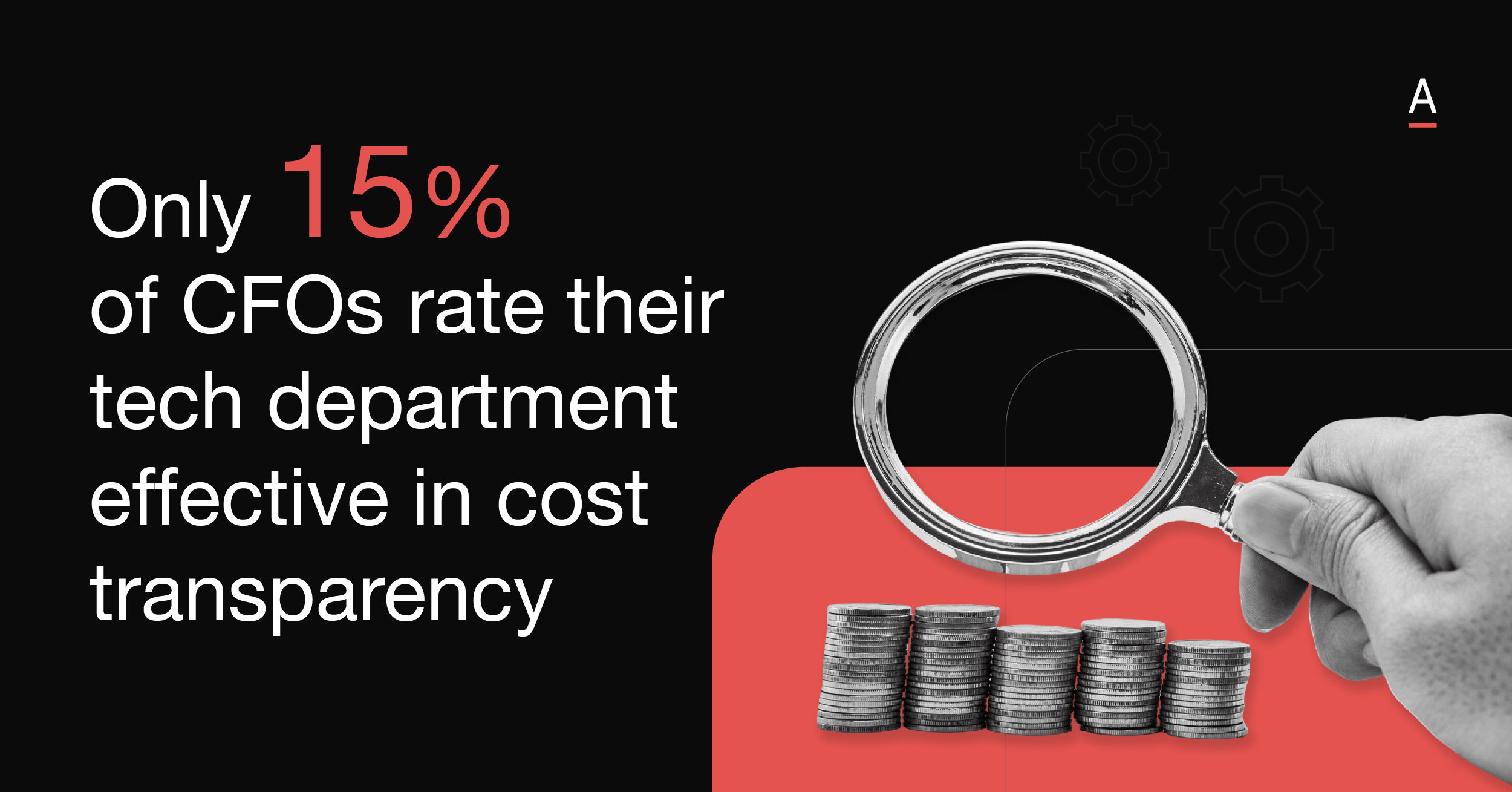

ADAPT research highlights the human barrier.

Only 15% of CFOs rate their technology department effective in cost transparency, a signal of misalignment rather than a tooling gap.

AI demands new decision habits, communication rhythms and behavioural standards.

Without these, agentic systems stall because teams cannot absorb or act on their outputs.

Recommended actions for CFOs

The discussions at CFO Edge made it clear that AI will only scale when CFOs correct the structural conditions holding it back.

The following actions capture the system level work that finance must lead to unlock intelligent performance across the organisation.

- Redesign funding cycles and decision rhythms to match the pace of AI

Annual planning sequences cannot support intelligent systems that learn every day.

Shift investment into shorter cycles with rapid checkpoints that allow experimentation and accelerated insight.

- Strengthen data at its source so AI has reliable inputs

Fragmented definitions and manual reconciliation slow every initiative. Build unified data pathways and raise accountability for quality at the point of creation.

- Deliver clearer cost visibility and remove architectural drag

AI needs clean signals about utilisation and value.

Simplify estates, confront the true cost of complexity and work with technology leaders to rationalise overlapping platforms.

- Treat human adaptability as a core transformation requirement

AI increases velocity, so teams must build the skills to match its pace. Cultivate clarity, presence and collaborative discipline across finance and the organisation.

- Confront the organisational constraints that hold AI back

Governance friction and process debt block AI from working end to end. Expose these constraints and redesign the environment that surrounds intelligent systems.

CFO Edge 2025 made clear that AI does not fail because the models are weak.

It fails because the system around them is outdated, fragmented or behaviourally unprepared.

You now carry the mandate to rebuild adaptability, unify finance intelligence and strengthen human capability.

Organisations that confront these structural gaps early will unlock a new era of intelligent finance.

Those that delay will watch AI stall inside environments that cannot support its pace.