In his CFO Edge keynote, Gabby Fredkin, Head of Analytics and Insights at ADAPT, examines how finance leaders can balance AI innovation with rising governance risks.

Gabby explores the “light and dark sides” of artificial intelligence (AI) in finance, likening them to a Star Wars battle between innovation and risk.

On the light side are productivity gains, new operating models and creative opportunities, while the dark side includes cyber, compliance and financial risks.

This includes the cost of inaction. Gabby stresses that most organisations’ main vulnerability lies in AI governance, describing it as their “single point of failure.”

ADAPT’s research shows that risk and compliance remain the number-one factor when allocating AI budgets, yet only 24% of organisations feel confident in their ability to secure AI safely.

Moreover, 62% of data leaders report having only basic or minimal data governance controls, and just 3% have automated systems, creating what Gabby calls a persistent “garbage in, garbage out” challenge.

Turning to AI use in finance, Gabby notes that common use cases include expense and invoice management, fraud detection, and workflow automation, with growing interest in using AI for financial forecasting and ESG reporting.

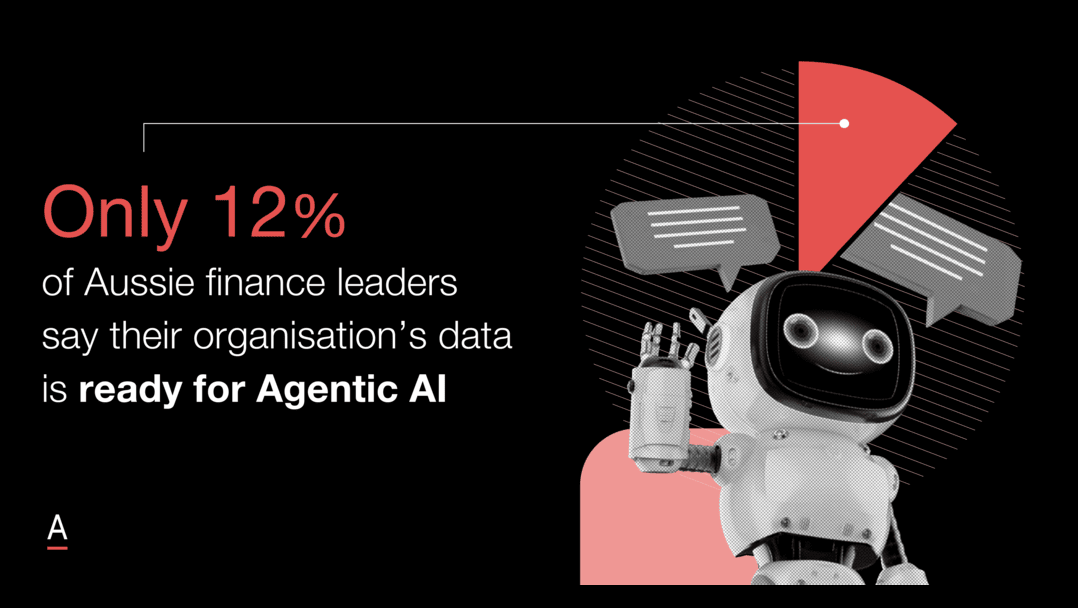

However, poor data quality, fragmented systems, and outdated enterprise resource planning (ERP) platforms constrain progress.

Only 14% of organisations have fully modernised ERPs. While 61% of finance leaders plan to invest in business performance management powered by AI, Gabby warns that inconsistent data definitions across departments (for example, differing interpretations of “revenue”) limit the effectiveness of automation.

Despite these challenges, he highlights promising examples such as Commonwealth Bank’s real-time AI fraud detection project and Lendi Group’s 95% AI adoption, which has saved 55,000 hours of human work and lifted customer satisfaction by 20%.

Gabby reflects on the CFO’s evolving role in making organisations AI-ready.

ADAPT research shows that 40% of deployed technology in organisations goes unused, and 80% of finance leaders rate their AI return on investment as “low but still being evaluated”.

He argues that clearer success metrics and better alignment between finance and technology teams are critical to progress.

A major barrier, however, is human capability: only 6% of organisations mandate AI awareness training, despite widespread concerns about data leakage and shadow AI.

Gabby urges CFOs to take a strategic, governance-led approach, asking who owns and manages AI risk, how data quality is maintained, and how end-user adoption is built into every project.

He frames AI as both an ethical and operational balancing act, where innovation must be encouraged, “like flying a kite”, while maintaining enough compliance tension to stay in control.

Key takeaways:

- AI governance is the critical gap: Only 24% of organisations feel confident about securing AI effectively, and just 3% have automated data governance, leaving most exposed to compliance and data quality risks.

- Finance teams are experimenting but lack readiness: While 61% of CFOs are investing in AI for business performance management, poor data quality and legacy systems, with only 14% running modern ERPs, limit the value they can realise.

- Human capability is the missing link: Despite rising adoption, 80% of finance leaders say AI ROI remains unclear, and only 6% of organisations provide mandatory AI awareness training, a major barrier to responsible, value-driven AI use.