As Australian organisations reassess growth targets and apply sharper scrutiny to transformation initiatives, CFOs are stepping beyond cost control.

They are actively shaping how technology strategies are defined, deployed, and measured.

With deeper involvement in AI, cloud, and automation decisions, finance leaders are pushing for greater alignment between IT execution and enterprise outcomes.

CFOs want every dollar of digital investment tied to productivity, efficiency, or business resilience.

But legacy systems, disconnected metrics, and unclear ownership are slowing visibility into impact.

ADAPT’s latest Analyst Market Briefing presented exclusive insights from over 150 senior finance leaders across ANZ.

The research shows how CFOs are reframing their role and what technology providers must understand to stay relevant.

The above video is only an excerpt.

ADAPT’s Research and Advisory Advantage clients can access the full webinar and slides.

Register to access the full webinar recording: Engaging the Modern CFO – Positioning Tech Investments for Business Outcomes

CFOs take responsibility for tech outcomes, but visibility is low

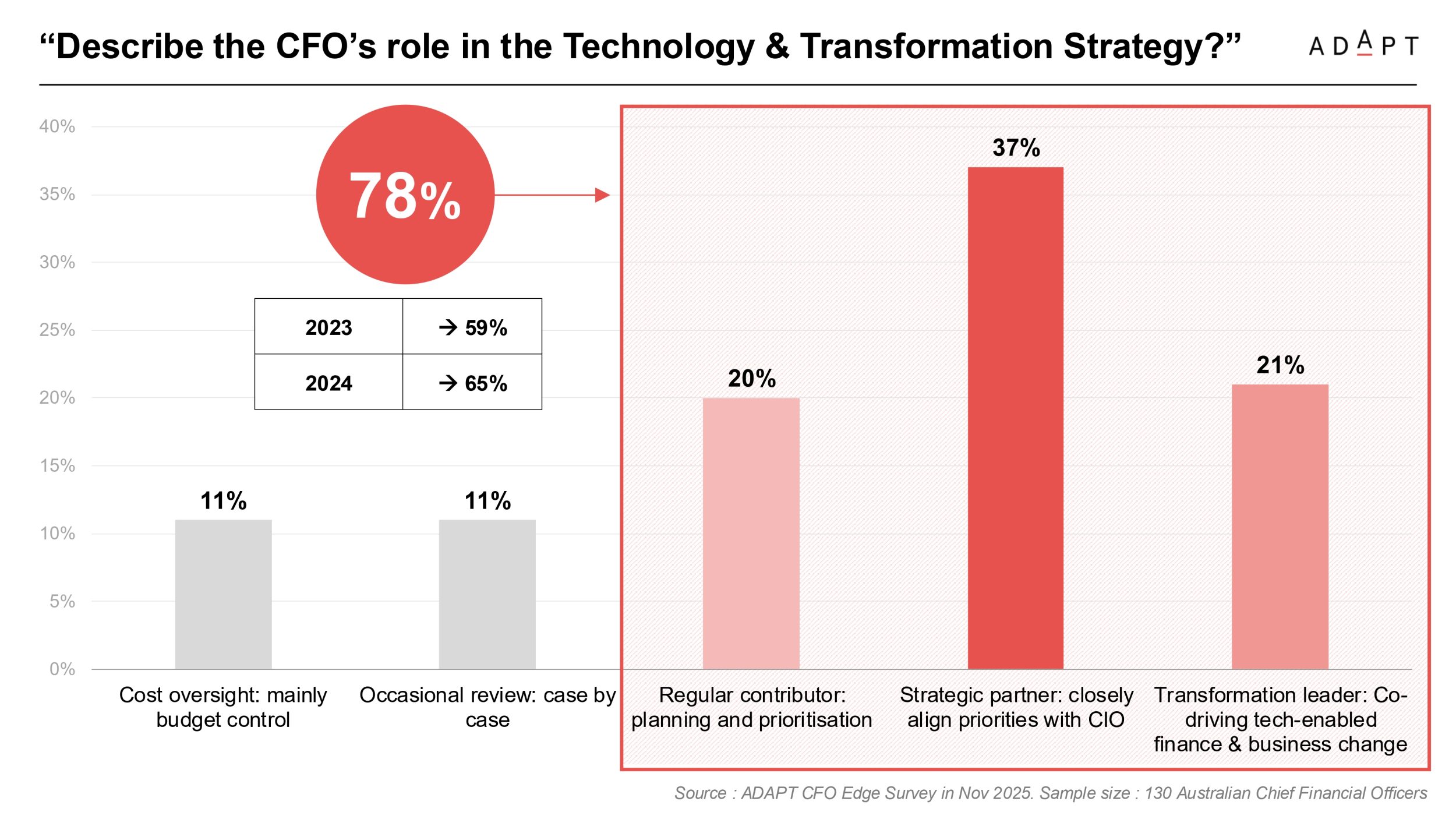

CFOs are moving deeper into transformation strategy.

According to ADAPT’s CFO Edge survey, 78% of finance leaders now describe their role as either strategic partners or transformation leaders, closely aligning with CIOs or co-driving tech-enabled business change.

Yet this growing accountability is not matched with confidence.

CFOs report that 39% of deployed technologies end up underused or wasted.

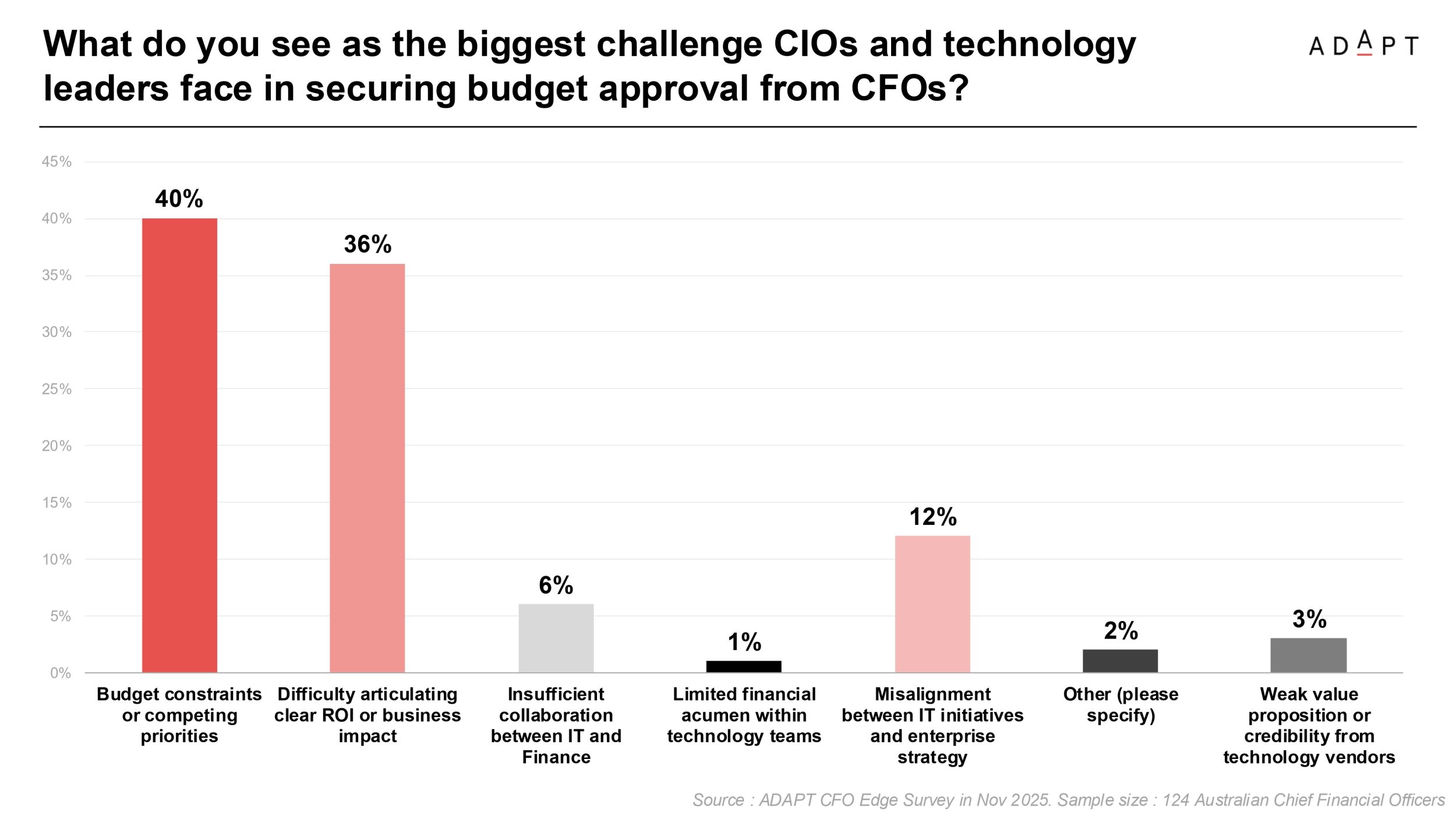

And when CIOs seek budget for new initiatives, 40% of CFOs cite budget constraints or competing priorities, while 36% say it’s difficult to articulate clear ROI or business impact.

Gabby Fredkin, ADAPT’s Head of Analytics and Insights, explained that this creates a fundamental disconnect.

Despite increasing collaboration, 59% now co-drive transformation alongside CIOs, only 12% of CFOs believe current IT strategies are well-aligned to enterprise goals.

Without shared dashboards or time-to-value metrics, finance leaders are left interpreting platform deployments through a commercial lens—and often with limited clarity.

CFOs recalibrate GenAI expectations amid governance and data gaps

CFOs are leaning into AI with intent, but they are also applying sharper scrutiny.

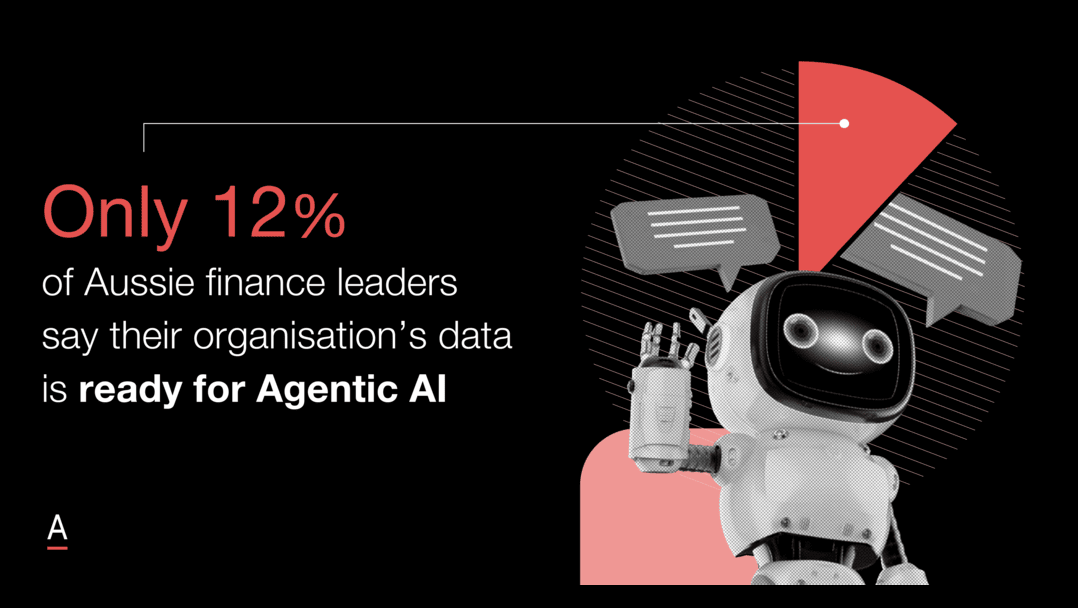

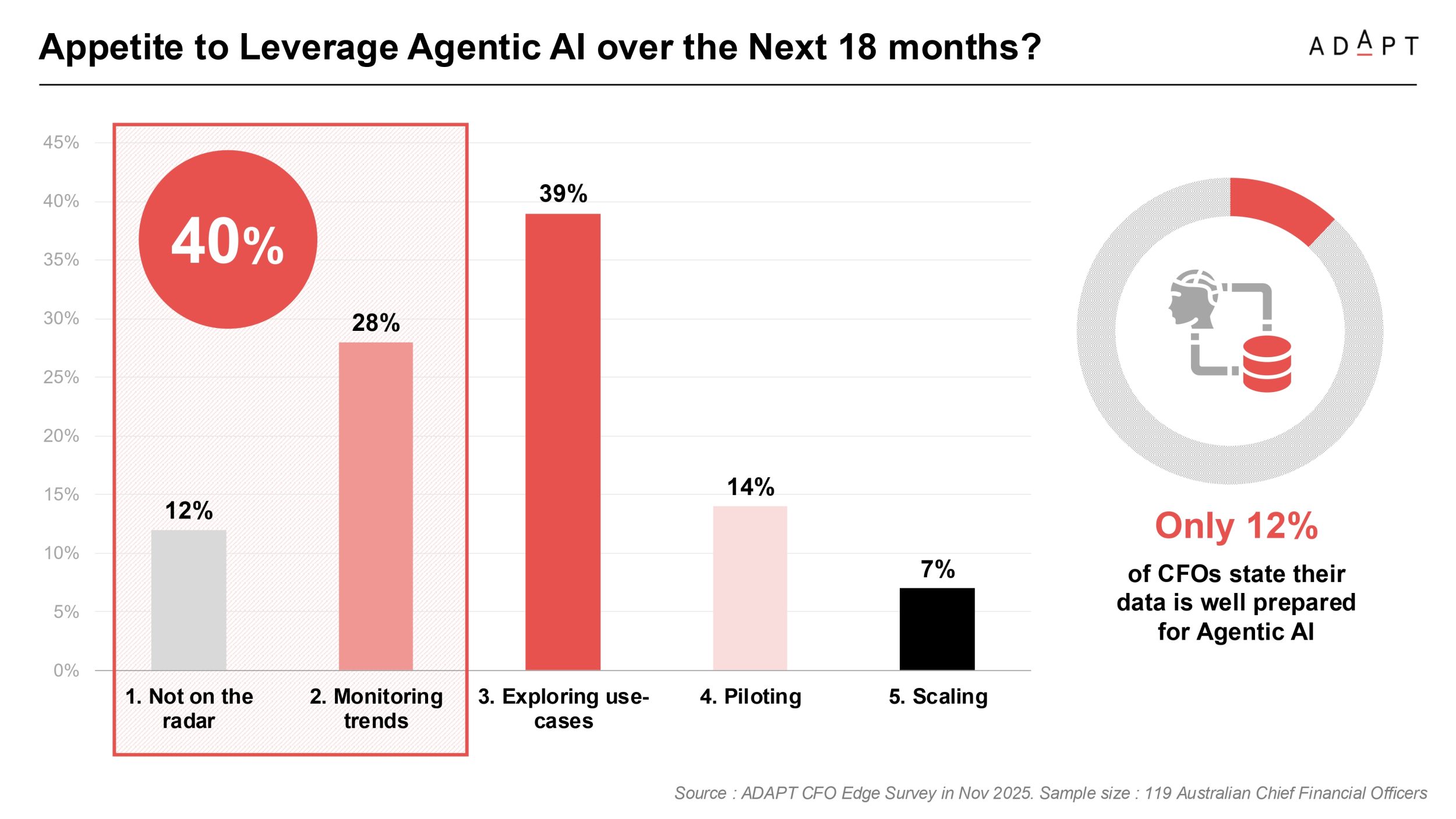

While 39% are already exploring GenAI use cases, just 12% believe their data is well-prepared to support agentic AI adoption.

At the same time, 80% of CFOs say their expectations around GenAI have either not been met or are still under evaluation.

Governance is quickly becoming the focus.

Risk and compliance now rank as the most critical consideration when allocating AI budgets, more so than ROI, strategic alignment, or implementation readiness.

Business impact and ROI follow closely, with 65% rating it as either “very important” or “critical” when assessing AI initiatives.

This commercial lens is also shaping the kinds of use cases CFOs pursue.

Rather than speculative innovation, most are prioritising deployed, value-generating applications.

Expense and invoice management, fraud detection, and internal knowledge retrieval lead as the most mature finance use cases in market.

The shift reflects a growing maturity curve.

CFOs are rebalancing optimism with operational reality, favouring governance frameworks, data readiness, and tangible business outcomes over hype-driven experimentation.

CFOs expect commercial clarity and early engagement

As finance teams gain influence over transformation success, vendors must also rethink their timing and approach.

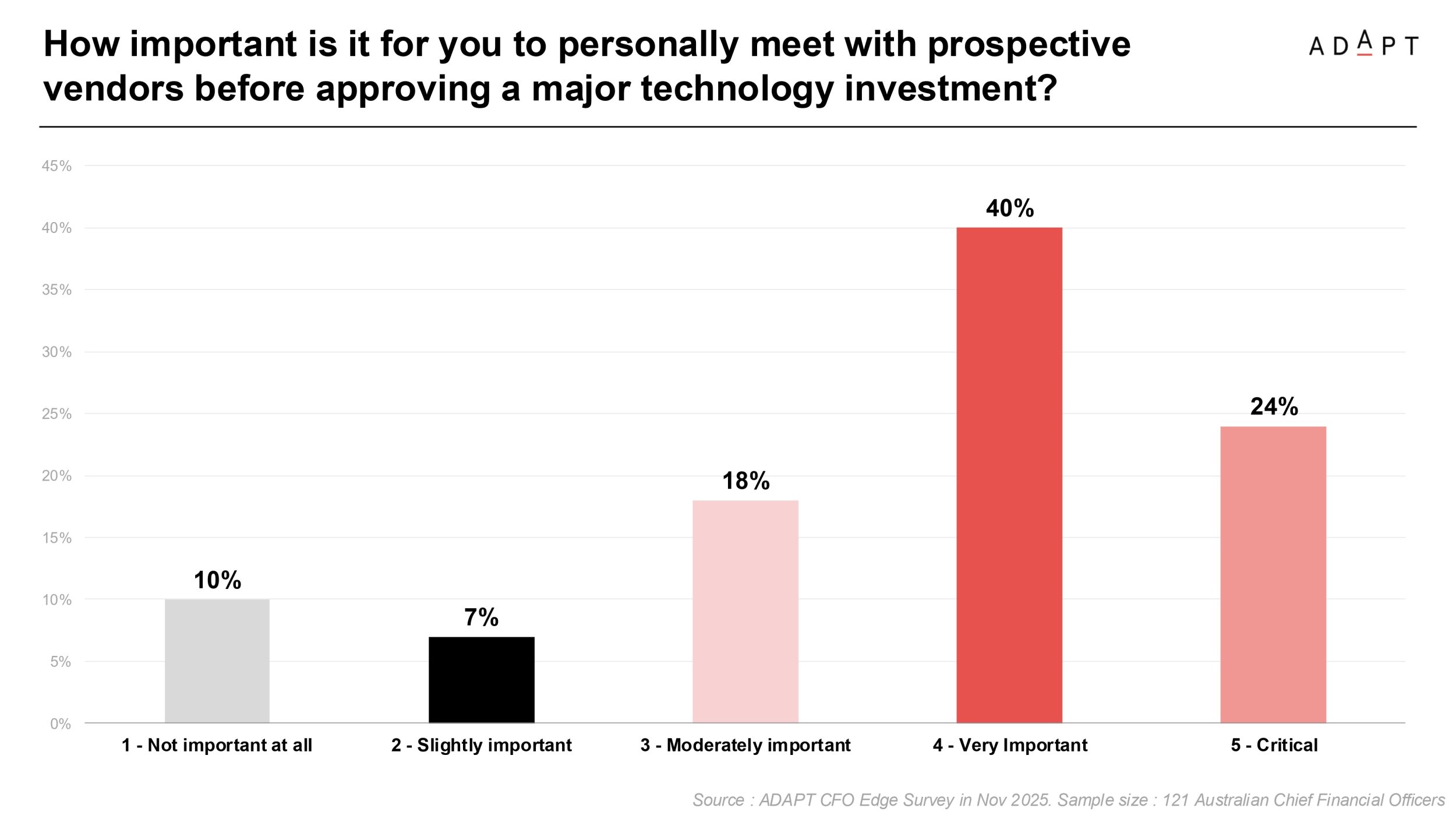

64% of CFOs say face-to-face engagement is still the most effective way to connect with providers before final budgets are locked in.

Gabby explained that CFOs are applying a commercial lens earlier in the decision cycle.

They are not just gatekeepers but co-owners of transformation success, and they expect vendor conversations to reflect that.

Recommended actions for tech vendors based on the insights

CFOs are now central to transformation decisions.

They are demanding transparency, commercial clarity, and direct links between technology and business value. Vendors must evolve their engagement approach to reflect this shift.

- Demonstrate productivity impact. Move beyond platform features to show business throughput gains.

- Quantify value in commercial terms. Offer CFO-ready proof points: margin improvement, cost reduction, or operational lift.

- Reduce complexity, not just cost. Show how your solution removes duplication and simplifies integration.

- Align with shared definitions of value. Help clients create or align around a common value realisation framework.

- Support the visibility gap. Equip CFOs with dashboards or KPIs that track adoption, value capture, and outcome delivery.

- Be realistic about GenAI. CFOs are skeptical. Avoid inflated claims and connect your AI narrative to actual efficiency benchmarks, use-case ROI, or cycle-time reductions.

CFOs are no longer passive approvers of IT budgets.

They are shaping the digital agenda and bringing financial discipline to transformation.

To stay relevant, tech providers must meet the expectations of a commercially minded audience.

Value must be visible, measurable, and mapped to business outcomes.

Features and functionality matter less than the answer to one question: how does this improve performance?

The above video is only an excerpt.

ADAPT’s Research and Advisory Advantage clients can access the full webinar and slides.

Register to access the full webinar recording: Engaging the Modern CFO – Positioning Tech Investments for Business Outcomes