How tech vendors can help finance leaders modernise, stay resilient, and meet regulations

Modernisation, compliance, and personalisation are reshaping financial services institutions. ADAPT outlines 5 key trends to guide tech vendors in secure, scalable transformation.

Australia and New Zealand’s financial services sector is modernising fast, driven by mounting regulatory demands, digital disruption, and rising customer expectations.

For technology vendors, the opportunity lies in enabling compliance-ready transformation that doesn’t compromise experience or agility.

Financial services institutions (FSIs) are racing to replace legacy systems, consolidate data, and embed AI to stay competitive.

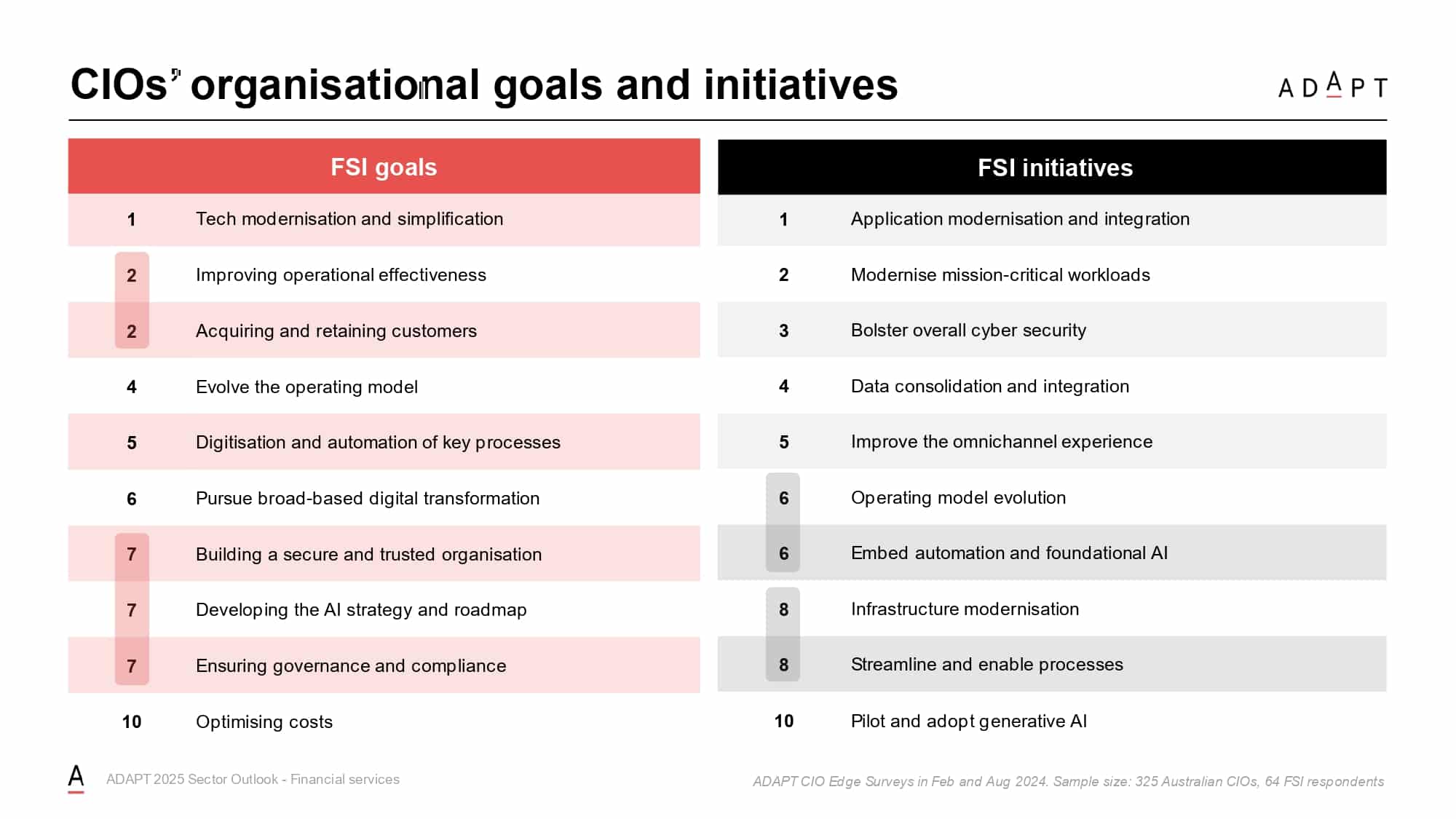

In 2024, tech modernisation was ranked as the #1 goal by CIOs, who are prioritising application upgrades, automation, and secure cloud adoption to boost scalability and reduce costs.

95% of FSIs still struggle with fragmented customer data, hindering efforts to deliver seamless omnichannel experiences.

Unifying this data is now a strategic priority, alongside AI integration, fraud detection, and real-time compliance reporting.

Meanwhile, cyber security and regulatory compliance are non-negotiable.

In the wake of major breaches and a 13% rise in cyber crime, FSIs are under pressure to demonstrate resilience and meet new APRA and ASIC mandates.

To help vendors align with these shifting priorities, ADAPT has identified five key trends shaping the financial services landscape in Australia and New Zealand.

Trend 1: Tech modernisation and infrastructure transformation

Outdated, siloed systems continue to limit operational efficiency, compliance, and customer experience across the financial services sector.

Modernisation has become the top priority for FSI CIOs in 2024, with ADAPT’s survey highlighting application upgrades and simplification of legacy infrastructure as key initiatives.

According to Publicis Sapient, 58% of Australian banks struggle with outdated IT, driving up costs and slowing digital innovation.

Adding further complexity, recent waves of sector consolidation—such as acquisitions by Westpac and Commonwealth Bank—have led to fragmented technology stacks across the BFSI landscape.

This fragmentation weakens internal efficiency and hampers seamless customer service.

PayPal’s EVP & CTO, Sri Shivananda, reinforced this shift during ADAPT’s Cloud & Infrastructure Edge, outlining a “dream blueprint” for modular, secure, and scalable architecture designed to integrate emerging technologies and fast-track transformation goals.

At UniSuper, transformation is prioritised annually based on risk reduction, cost, and impact.

Head of Enterprise Delivery Praveen Miranda highlighting how financial institutions are modernising core systems while aligning IT initiatives to broader strategic outcomes.

Tyro Payments also exemplifies this trend, choosing to own its tech stack to deliver tailored SME services while enabling faster cloud migration and modernisation, as shared by CTO Dave Coombes.

Recommended actions for technology vendors

- Offer modular solutions that enable FSIs to modernise in phases, reducing risk and minimising disruption.

- Provide scalable, compliance-ready cloud platforms with hybrid options and migration support to ease legacy transitions.

- Promote API-first and microservices-based architectures to improve integration, agility, and support for open banking.

Trend 2: Enhancing omnichannel experience through personalisation

Fintechs are raising the bar for seamless, personalised customer experiences, pushing FSIs to accelerate omnichannel and data-driven strategies.

ADAPT’s 2024 CIO Survey shows “acquiring and retaining customers” and “improving omnichannel experience” among the top sector priorities, signalling a strong shift toward customer-centric engagement.

Yet despite 89% of FSIs using data for personalisation, 95% face retention challenges due to fragmented data, and 34% still lack a 360-degree customer view (InterSystems).

With 99% of banking interactions now digital and chatbot usage up over 1200% since 2019, FSIs must unify data and deliver personalised, secure experiences to stay relevant in a digital-first market.

Westpac’s transformation team, as shared at Digital Edge by GM Vincent Pierce, is improving service delivery by embedding microservices and journey mapping, enabling continuous, customer-led improvement.

Executives from Xero, Slack, and CBA echoed the need for data and automation to scale personalisation, with CBA’s then Executive Manager for PreTrade, Debt Markets & Risk and Regulatory Technology Martin Anderson specifically calling out the challenge of educating the “frozen middle” to adopt customer-centric innovation.

Recommended actions for technology vendors

- Provide AI-driven predictive analytics to help FSIs personalise interactions and anticipate customer needs.

- Enable real-time, cross-channel data integration to support seamless omnichannel experiences.

- Design scalable, agile personalisation solutions that adapt to rapid digital growth without major system changes.

Trend 3: Automation and AI are streamlining operations, but trust gaps remain

Financial services are rapidly adopting automation and AI to boost efficiency, reduce risk, and improve compliance—especially across customer service, transaction monitoring, and fraud detection.

ADAPT’s 2024 CIO Survey ranks digitisation and automation of key processes among the top priorities, with AI playing a central role in driving these efforts.

A recent INFORM Australia and YouGov study found that 83% of banking executives have adopted AI for tasks like transaction analysis and customer support, and 85% see clear value in doing so.

However, adoption challenges persist: 83% report internal resistance from staff, 46% cite siloed data, and 29% face pushback from leadership.

At the same time, public trust in AI remains a concern.

While over half of Australians believe AI can improve banking, 96% have concerns around data privacy, job loss, and transparency.

Despite appreciating AI-driven personalisation, 58% of consumers still prefer human interactions.

At Macquarie Bank, Executive Director & Chief Data Officer Ashwin Sinha is addressing these issues by aligning data and digital strategies, modernising platforms, and embedding responsible AI practices with transparency and ethics frameworks.

Data leaders from NAB, Telstra, and HivePix also emphasised that AI success depends on cross-functional collaboration, data quality, and governance, underpinning business-led innovation.

Recommended actions for technology vendors

- Develop automation tools for routine tasks like transaction monitoring and reporting to boost speed, accuracy, and compliance.

- Provide AI-powered chatbots and sentiment analysis to personalise interactions and proactively address customer concerns.

- Enable dynamic content creation using LLMs to deliver tailored marketing, reports, and product information.

- Offer scalable AI platforms with integrated data capabilities to support organisation-wide adoption and insights.

Trend 4: Cyber security and compliance are non-negotiable

With the high sensitivity of financial data, cyber security has become a core focus for FSIs, essential to avoid financial loss, reputational damage, and regulatory penalties.

ADAPT’s 2024 CIO Survey ranks “building a secure and trusted organisation” as a top-five goal, with cyber security and compliance cited as critical priorities and persistent operational barriers.

FSIs must also navigate strict regulations like APRA, GDPR, and PCI DSS while addressing growing customer concerns around data privacy.

Despite $1.5 billion invested in Consumer Data Right (CDR) capabilities, the Australian Banking Association reports low customer participation, highlighting trust as a key issue.

To drive personalisation and data-driven innovation, FSIs must build secure, compliant platforms that enable customer-consented data sharing and reinforce trust.

David Gee, former cyber risk lead at Macquarie, amplified the need for stronger collaboration between CIOs and CISOs to ensure transformation aligns with cyber resilience and third-party risk management.

Meanwhile, Bendigo & Adelaide Bank is using AI for fraud detection while integrating open banking APIs and cloud infrastructure to future-proof compliance and customer trust.

Recommended actions for technology vendors

- Provide compliance-ready security platforms with encryption, access controls, and support for APRA, GDPR, PCI DSS, and CDR standards.

- Offer AI-powered tools for real-time threat detection and rapid incident response to minimise security risks and ensure compliance.

- Enable secure, consent-based data-sharing platforms aligned with CDR, with audit trails and transparent data practices to build trust.

Trend 5: Data resilience is essential for agility, compliance, and growth

In a highly regulated and competitive sector, FSIs are prioritising data resilience to ensure continuity, security, and strategic decision-making.

ADAPT’s 2024 CIO Survey shows strong FSI investment in platforming, virtualisation, and scalable architectures to streamline compliance and support strategic growth.

Resilient platforms go beyond uptime, enabling real-time insights, fraud detection, and regulatory agility while maintaining data privacy and security.

Centralised Customer Data Platforms (CDPs) help unify fragmented data, improve governance, and power hyper-personalisation, yet 95% of FSIs still face data management challenges (InterSystems).

By integrating with legacy systems and offering audit trails and controlled access, modern data platforms position FSIs for scalable, secure innovation and improved customer retention.

CTO of Banking and Financial Services at Macquarie Group Jason O’Conell shared how a shift to 96% public cloud adoption, Kubernetes, and a no-ops model is enabling real-time insight, platform agility, and AI-readiness across the bank’s digital environment.

Meanwhile, Auswide Bank’s CFO William Schafer described how the organisation is also using data insights to align board-level decisions with customer outcomes, proving that data resilience fuels both compliance and business growth.

Recommended actions for technology vendors

- Provide scalable, compliance-ready data platforms with encryption and audit trails to support resilient, future-proof operations.

- Enable real-time data integration and virtualisation to unify insights and support faster, data-driven decisions.

- Prioritise secure data sharing and privacy controls to build customer trust and meet regulatory obligations.

- Offer centralised governance tools to streamline compliance, manage access, and maintain secure audit trails.

FSIs are ramping up investment in cloud infrastructure, AI-driven personalisation, and compliance-ready platforms to boost agility and meet rising regulatory demands.

With market consolidation and fintech disruption reshaping the landscape, vendors offering secure, scalable, and interoperable solutions will be key to driving transformation.

Emerging technologies like generative AI and quantum computing are opening new frontiers in fraud detection, automation, and customer engagement.

For deeper insights and data-backed strategies, access the full ADAPT 2025 Sector Outlook: Financial Services Insights for Technology Vendors.