How CFOs are driving tech buying and enterprise transformation

Australia’s CFOs are stepping up as transformation leaders. Discover how they are reshaping finance, tech ROI, and AI adoption in 2025.

CFOs across Australia are stepping into expanded roles, moving closer to the centre of enterprise decision making.

They are being asked to steer transformation agendas while solving for cost control, AI integration, data governance, and operational agility.

The challenge is whether they can translate that influence into measurable impact.

ADAPT’s CFO Edge findings, roundtable discussions, and leadership persona research confirm that the finance function has reached a strategic tipping point.

CFOs are being held accountable for outcomes beyond finance, and success depends on how clearly they link capital to capability.

CFOs are acting on a mandate to deliver clarity at speed

Enterprise demands are accelerating.

Decisions that once played out in quarters are now made in days.

CFOs are responding by pushing finance teams toward real time operations.

At ADAPT and Workday’s private CFO roundtable, many shared that critical decisions like pricing and capital allocation are still being made with lagging or incomplete data.

Dr Peter Weill, Chairman of MIT CISR and Senior Advisor at ADAPT, asked finance leaders to identify one decision that, if made in real time, would materially shift business performance.

The responses varied, but the friction points were consistent.

Current planning cycles are too slow, and fragmented systems block execution.

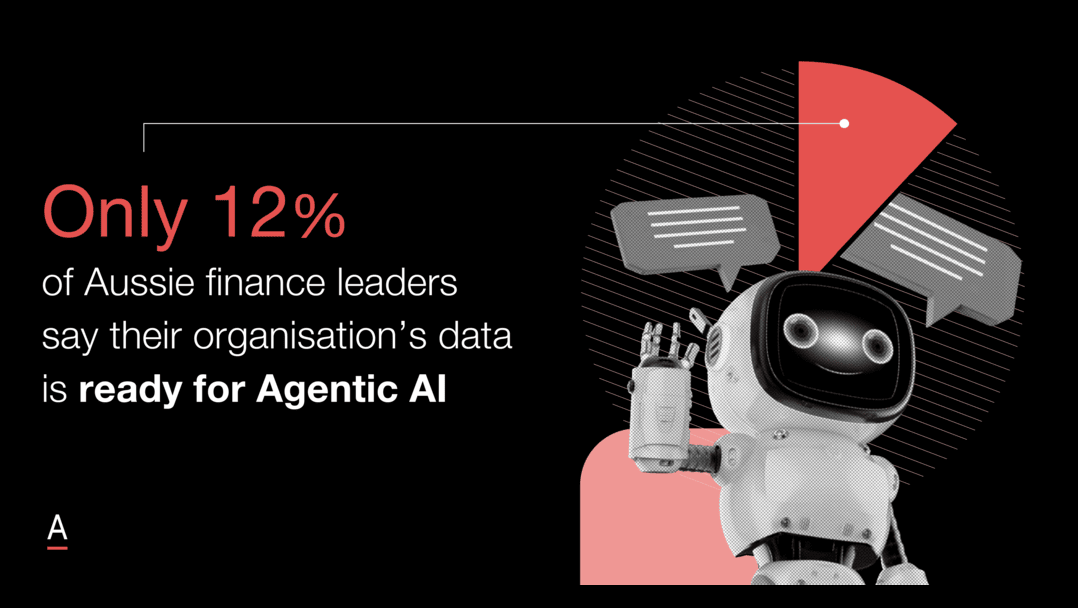

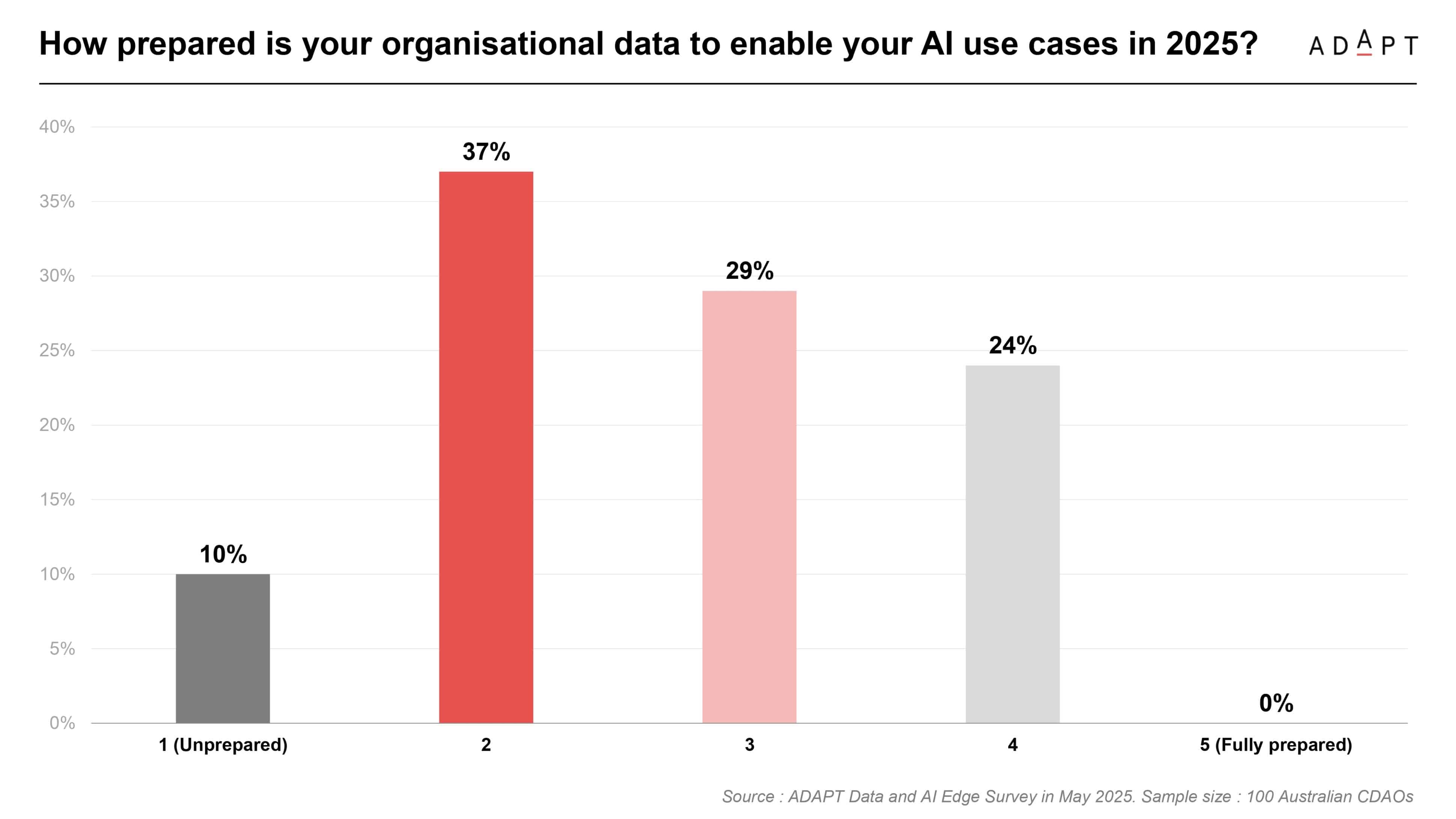

Only 29% of organisations say their data is even partially ready for AI, and 0% report being fully prepared.

The technology exists, but the foundations are not in place.

This is a structural challenge rooted in process gaps and lack of readiness.

CFOs must redesign processes and reporting flows before aiming for speed.

Vendor takeaway: Position your solution as a mechanism to remove friction in decision workflows, not just accelerate them.

Data quality and governance are defining financial effectiveness

CFOs cannot deliver fast decisions without trusted data.

Yet 79% report challenges accessing reliable data for scenario modelling and risk planning.

This directly impacts capital allocation, cost forecasting, and risk coverage.

Michelle Dennedy, Chief Data Strategy Officer at Abaxx Technologies, described privacy and data governance as strategic levers, not compliance exercises.

She advised CFOs to treat data quality with the same discipline as financial reporting, using frameworks to measure maturity, track ethical risks, and increase transparency.

The real risk is quiet misalignment.

If underlying data is inaccurate, CFOs lose credibility with boards and executive peers.

They may still hit reporting deadlines, but the business will be operating with assumptions that do not hold up under pressure.

Vendor takeaway: Demonstrate how your platform improves data accuracy, structure, and accessibility across finance, risk, and transformation use cases.

AI expectations are high but outcomes remain limited

AI investment is ramping up, but the results are lagging.

While AI adoption is accelerating, 72% of organisations say it has under-delivered or remains in early evaluation, and 58% are stalled at that stage.

In fact, 63% of organisations that are “all in” on AI admit they’ve seen limited success..

Gabby Fredkin, Head of Analytics and Insights at ADAPT, introduced the technology impact to value ratio as a way to evaluate AI maturity.

Many AI initiatives are misaligned with finance goals, with CFOs citing poor readiness, unclear ROI, and data gaps as the biggest blockers.

Jo-Anne Ruhl, Managing Director at Workday, argued that CFOs are well placed to lead AI, because they own the control frameworks and process design.

But most teams are still running pilots without clear business cases or success metrics.

The organisations that are moving fastest are those using AI for high value use cases like month end acceleration, fraud detection, and workforce enablement.

These are measurable and defensible, which gives CFOs confidence to expand further.

Vendor takeaway: Show how AI tools link to specific, auditable use cases that help CFOs eliminate waste and improve speed to insight.

Poor ROI tracking is creating friction between finance and technology

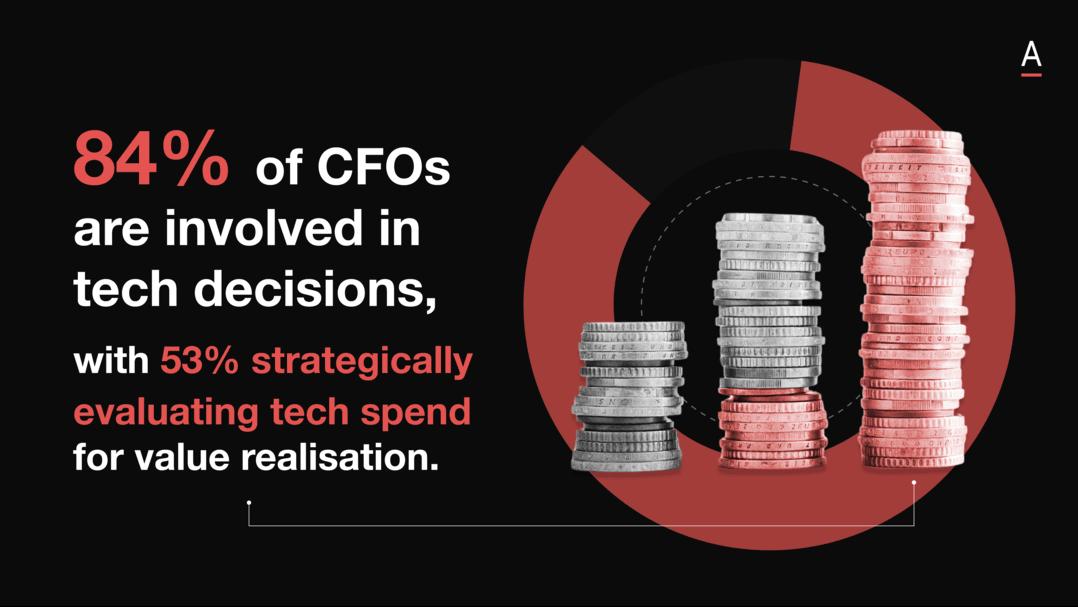

Finance is more involved in tech buying than ever, with 84% of CFOs participating in decision making.

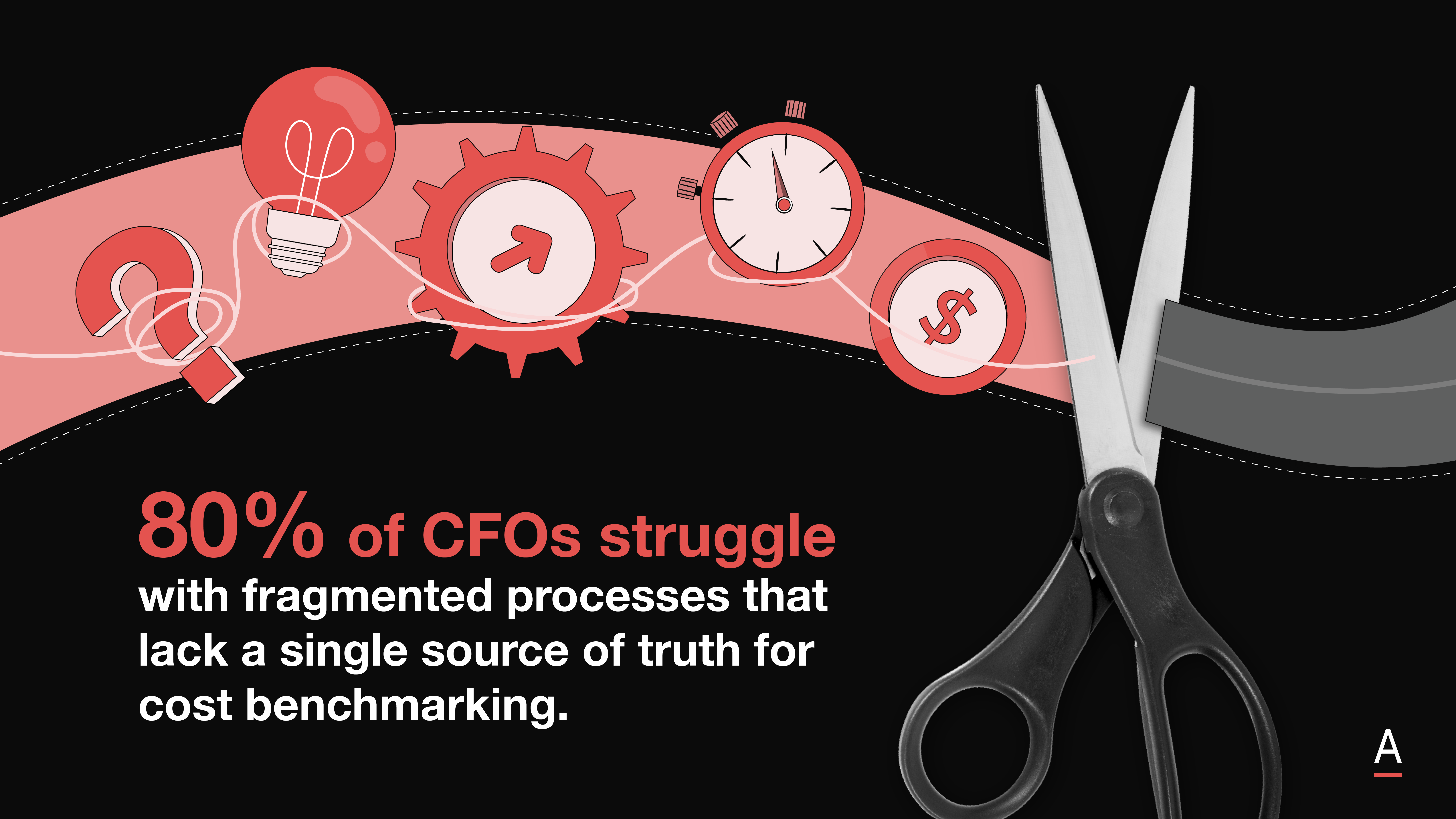

But 80% still struggle to measure value from those investments.

Only 25% feel confident in tracking impact, and just 16% say they can adjust spend based on performance.

This is creating tension across the enterprise.

Cost visibility is low, roles are unclear, and collaboration between IT and finance has deteriorated.

Cloud in particular is a pain point.

Cloud cost accountability has risen 150% in 12 months, but ownership remains fragmented.

Gabby Fredkin noted that cloud spend often falls into a grey zone where no single team can explain total cost of ownership or track cost to serve.

Without clear tracking, CFOs hesitate to fund future investments.

The real need is for integrated metrics that bridge finance and IT.

CFOs want to know how tools perform, what they cost, and how quickly they return value.

Vendor takeaway: Equip CFOs with real time cost, usage, and ROI tracking tools that support defensible investment decisions.

Successful CFOs are building capability while stripping complexity

CFOs are being asked to deliver more with fewer resources.

The top three blockers to transformation are funding constraints, legacy systems, and skills shortages.

But high performing finance teams are responding by reducing internal complexity, upskilling teams, and prioritising projects that enable operational lift.

Jessica Eyes, Digital Leader at McKinsey and Company, outlined how finance-led ERP transformations deliver more value when they avoid “like for like” replacements.

She stressed the importance of involving finance from the outset and aligning transformations with measurable KPIs like capital efficiency and planning accuracy.

Jean-Baptiste Naudet, Chief Financial Officer at Australian Red Cross, shared how the organisation is using AI to verify claims and prevent fraud, ensuring funds reach those in genuine need.

This digital approach has enabled the finance team to scale during crises, streamline operations, and maximise impact across its humanitarian programs.

The CFO’s role in workforce and process enablement is now central to AI success.

Vendor takeaway: Deliver platforms that reduce complexity, improve finance process automation, and support team adoption with low learning curves.

Recommended actions for technology vendors

ADAPT research shows CFOs are open to partnership, but they expect value to be proven.

To build credibility with the finance function:

- Align with finance metrics – Frame your product’s value in terms CFOs care about, including cost to serve, capital efficiency, time to value, and scenario agility.

- Support defensible ROI tracking – Provide dashboards, ROI calculators, and FinOps reporting tools that improve visibility into both spend and outcomes.

- Simplify the deployment path – Offer modular delivery, quick start programs, and embedded change support to help finance teams overcome internal execution gaps.

- Link AI to workforce productivity – Focus AI messaging on measurable tasks like automation, variance analysis, and reporting acceleration, rather than innovation themes.

- Help build stronger business cases – Supply benchmarks, local references, and data points to strengthen value messaging across finance and technology stakeholders.

- Close the feedback loop – Enable course correction with real time metrics so CFOs can adjust investments and report outcomes with confidence.

CFOs are being asked to lead through ambiguity.

They are accountable for turning technology into value, for making real time decisions with incomplete data, and for proving outcomes before the business loses confidence.

That pressure is real, but the path forward is becoming clearer.

CFOs who focus on readiness, clarity, and collaboration will emerge as enterprise architects.

They will fund what matters, scale what works, and earn the trust to lead beyond finance.

Technology vendors must equip them with the tools to act, streamlining execution, strengthening visibility, and enabling outcomes that speak in financial terms.

At CFO Edge, 130 of Australia’s CFOs and senior finance leaders from the region’s largest enterprise and government organisations will come together to accelerate finance transformation, unlock ROI, and modernise for growth.

As a sponsor, you will access exclusive 1:1 meetings, detailed delegation profiles, and opportunities to showcase your expertise through keynotes and strategic sessions.

Register your interest or explore tailored sponsorship options for CFO Edge.