How can CFOs lead the shift to real-time finance to create competitive advantage?

At ADAPT and Workday’s private roundtable, 50 CFOs explored how real-time finance and agentic AI can drive smarter decisions and lasting business value.

Across Australia, finance leaders are facing rising pressure to enable faster decisions, greater control and more visible value.

Static planning cycles are falling out of step with business demands.

As AI advances and data expectations grow, finance teams are being asked to shift from backward-looking functions to real-time operators.

To explore this evolution, ADAPT hosted a private executive roundtable in partnership with Workday, during Vivid Sydney.

Held at the Museum of Contemporary Art, the event gathered 50 CFOs and senior finance leaders for a working dinner and peer discussion focused on how intelligent systems, real-time data, and AI adoption are reshaping the finance agenda.

Reposition finance to meet the demand for speed and simplification

ADAPT CEO Jim Berry opened the session with survey insights pointing to a meaningful shift in finance’s influence.

44% of CFOs now play a strategic role in tech-enabled decision making, while 14% describe their role as agile.

Both figures have grown year on year, indicating rising confidence in finance as a partner to enterprise transformation.

However, data and capability gaps remain.

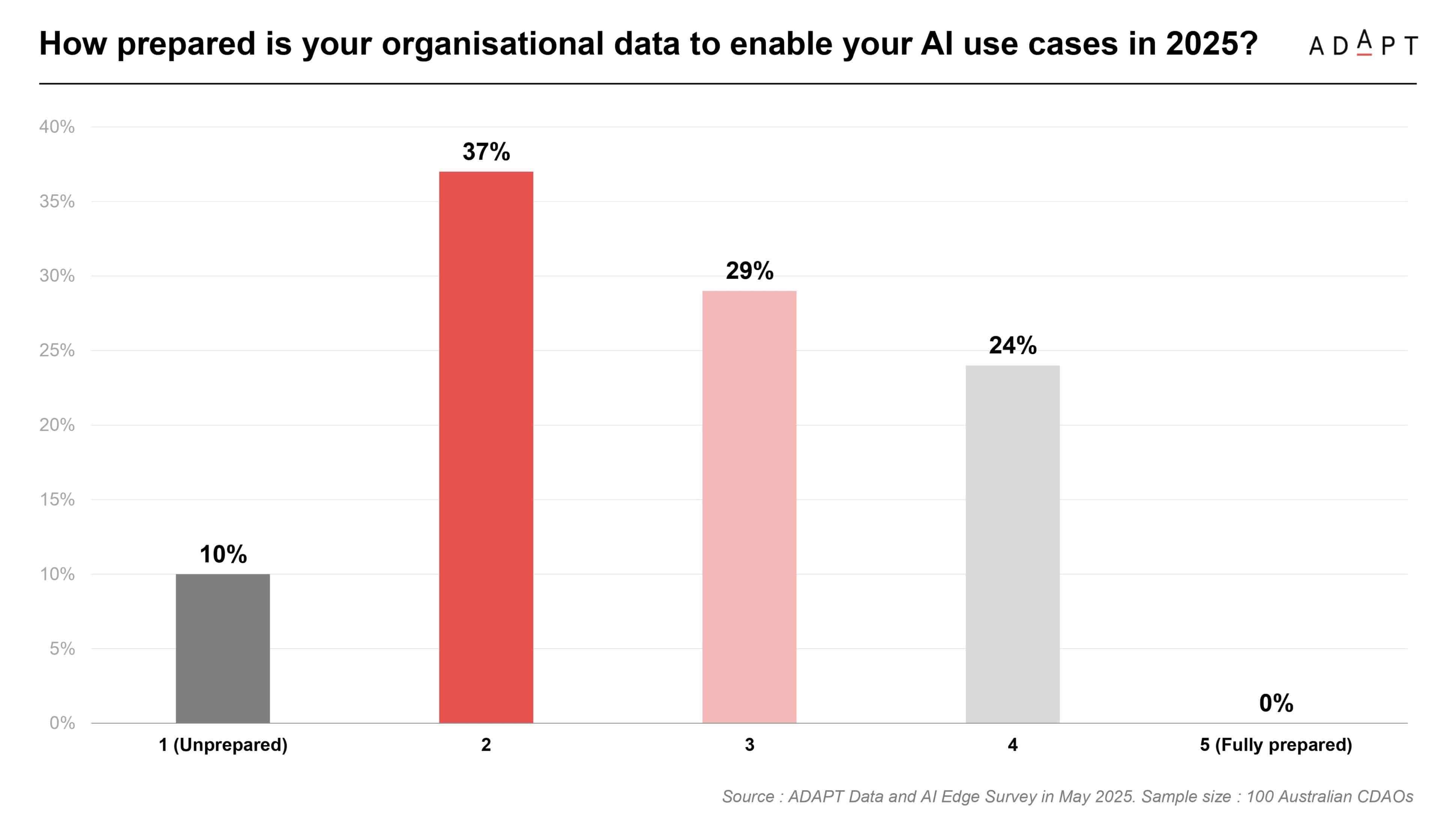

According to ADAPT’s latest research, only 29% of organisations say their data is partially prepared to support AI use cases, and 0% consider themselves fully prepared.

The majority sit between unprepared and immature, with 37% rating their data readiness at level 2 out of 5.

These numbers point to a broader readiness challenge.

CFOs may understand the opportunity, but most are still working through fragmented systems, unclear process ownership, and limited cross-functional visibility.

Simplifying operations and integrating data are now prerequisites to progress.

Adopt agentic AI to elevate roles and improve resilience

In conversation with Jo-Anne Ruhl, Managing Director at Workday, Jim Berry explored the expanding role of agentic AI.

These systems do more than automate.

They interpret goals, execute multi-step tasks and adapt to changing inputs, acting as digital collaborators that support decision-making across the finance function.

Jim noted that agentic AI is already showing impact in high-value areas like variance detection, dynamic reporting and month-end acceleration.

Yet too many organisations are still experimenting without clear structure.

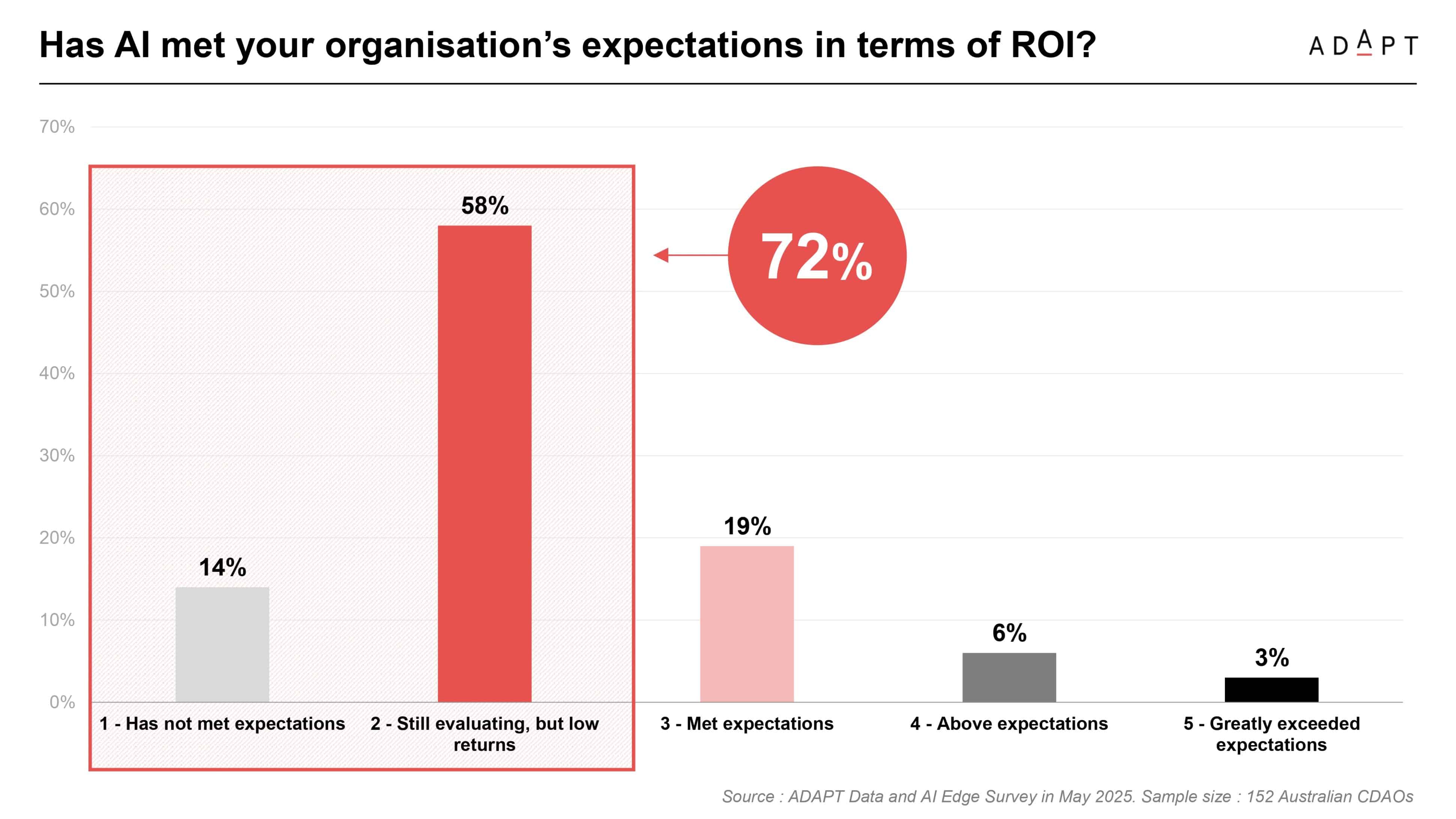

72% say AI has under-delivered or remains in early evaluation, and 58% are stalled in that evaluation phase.

This gap is not due to lack of potential, but lack of preparation.

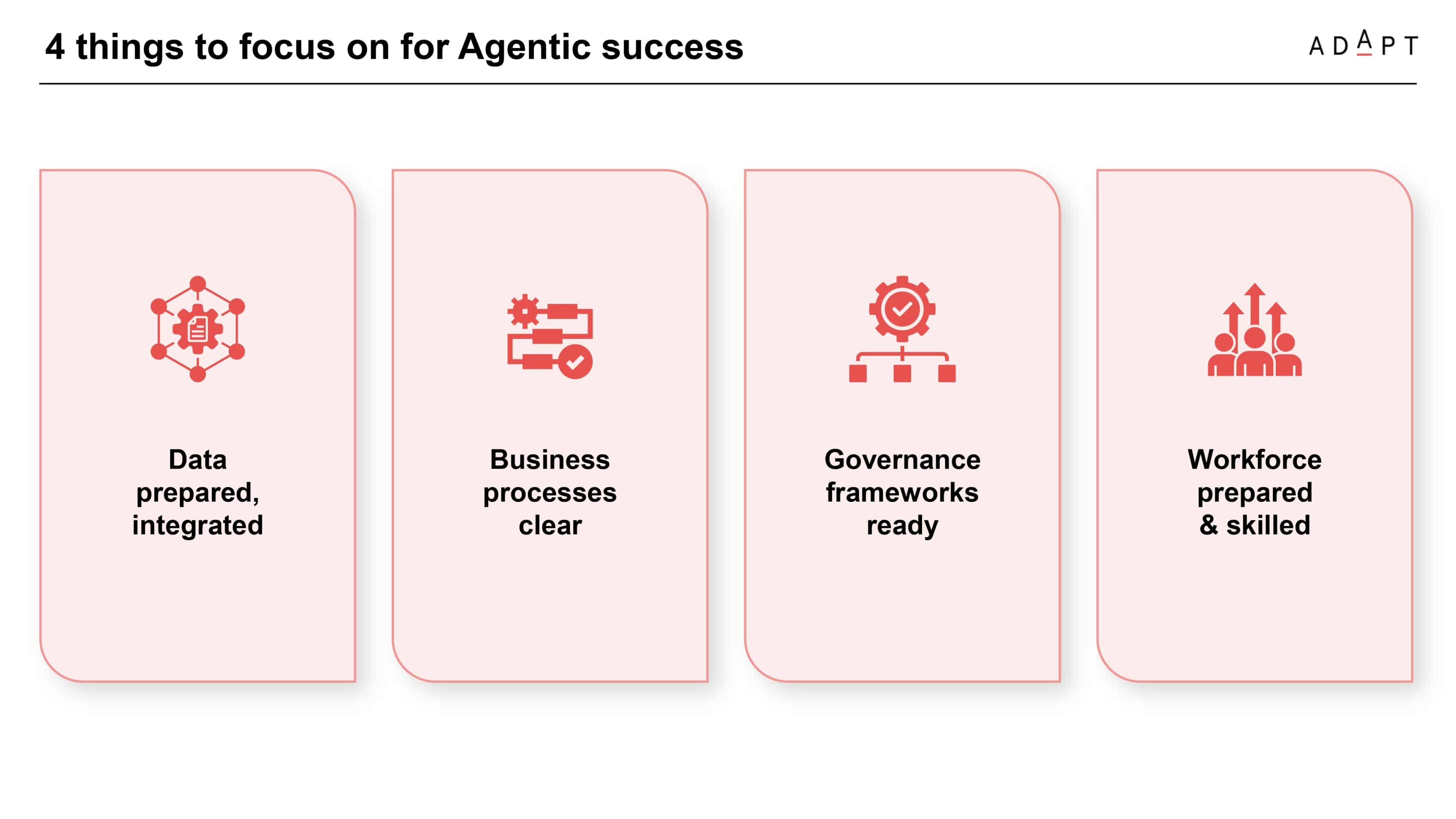

Agentic AI depends on four core enablers: prepared data, simplified processes, active governance, and a skilled workforce.

Most organisations are still building toward this maturity.

Jo-Anne reinforced that progress begins with simplification.

CFOs must strip out unnecessary complexity from core processes before embedding intelligent automation.

She described finance as uniquely positioned to lead adoption—able to define clear outcomes, shape control frameworks and guide teams through change with clarity.

Rather than waiting for ideal conditions, Jo-Anne urged leaders to identify practical, measurable use cases and build momentum through early success.

The strength of finance platforms and data structures already in place means finance is well equipped to move from pilots to scaled AI-enabled performance.

When approached with ownership and intent, agentic systems can remove manual burden, strengthen accuracy and give finance teams greater capacity to act as strategic partners to the business.

Build the capabilities of a real-time enterprise

MIT CISR Chairman and ADAPT Senior Advisor Dr Peter Weill introduced the concept of the real-time business.

These organisations operate with consistent speed and intelligence across customer, employee and partner interactions.

They are defined by clarity, not complexity, and they outperform peers on both growth and margin.

Peter asked attendees to consider one decision in their business that, if made in real time, would shift performance.

For finance leaders, responses ranged from dynamic pricing to instant capital allocation.

The pattern was clear: current decision-making cycles are too slow, often reliant on stale data or delayed inputs.

Creating a real-time finance function means more than faster reporting.

It requires redesigning how decisions are made, who makes them, and what data they are based on.

The closer finance operates to the frontlines of the business, the more impact it can deliver.

A practical roadmap for CFOs to activate real-time finance

To accelerate real-time decision making, CFOs must shape finance into a more integrated, responsive and AI-ready function. Based on insights from ADAPT and Workday’s roundtable, the following actions offer a clear starting point:

- Fund the integration of core data to support timely, cross-functional decisions

- Establish AI governance that ensures transparent and responsible automation

- Redesign key processes before layering in intelligent systems

- Equip teams with the skills to work alongside AI and interpret its outputs

- Lead enterprise AI conversations with clarity around value and readiness

- Sponsor practical use cases and identify internal champions to guide adoption

- Link finance KPIs with outcomes like responsiveness, accuracy and speed

- Embed decision clarity into day-to-day finance workflows and culture

The roundtable made clear that finance now holds the tools and the mandate to lead transformation.

What matters is how that mandate is activated.

Real-time finance does not begin with new systems. It begins with strategic ownership and operational readiness.

CFOs who lead on data integration, workforce capability and process clarity are already positioning finance as a driver of growth.

The shift is underway, and those who move first will define how fast, and how far, their organisations go.