How PayPal tackled a large-scale transformation of their infrastructure, platforms, and applications

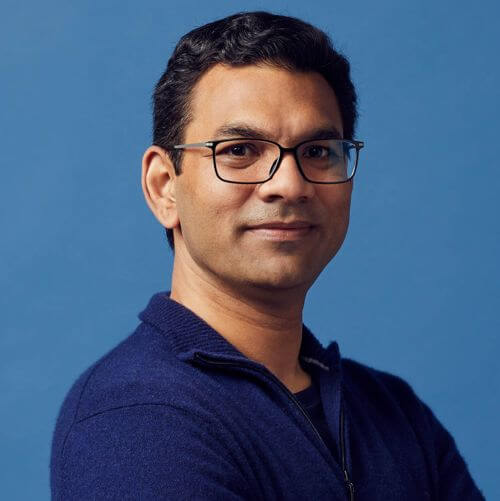

Sri Shivananda plays a critical role in shaping their technology strategy in his role as Executive Vice President, Chief Technology Officer (CTO).

In this presentation, at ADAPT’s CCDC Edge, Sri shares how to navigate an organisation through a future of financial services that will increasingly rely on algorithms and predicting customers’ needs.

To do this, infrastructure executives must ensure the platform can integrate with emerging technologies. Organisations will position themselves to withstand any disruption, bolstered by the infrastructure to support innovation from their employees as hybrid operations continue.

To unlock the full video and access ADAPT’s comprehensive catalogue of expert presentations, localised research, case studies and community interviews, talk to a Senior Consultant about becoming a Research & Advisory client.

Transcript:

When we split from eBay in 2015, that allowed us to first stabilise as a new company. We started to create what we call a dream blueprint of what we wanted our infrastructure and what our technology landscape needed to look like.

It is based on three main things that we were trying to optimise.

Given that we’re in the business of trust, security was number one. It has always been at the top of mind.”

The second was scale. This was about fuelling growth in transactions every single year. We needed to support that growth as it comes in our direction, sometimes in unexpected ways.

The last one was speed. This was about the nimbleness and the agility for us to take ideas and deliver them to our customers as fast as possible.

Between security, scale and speed, we created that dream blueprint and started to work towards that over the years.

We’ve done a lot of work in terms of completely building a brand-new network backbone, building new edge locations around the world, starting to migrate first into a private cloud setup, and now into a public cloud set up and while doing so, upgrading everything in terms of our security infrastructure and moving into zero trust architectures.

The vision is a continuously evolving one, based on the realities of today, the experience from history, but also the aspirations of the future.

Today we are at 400 million active customers. In a five-year timeframe, we want to grow to 750 million active customers.

We will go from a little less than a trillion dollars in total payment volume to about $2.7 trillion in total payment volume in the next five years with an agile architecture.

Having a vision, understanding how transformations work, and executing on that with discipline is what puts us ahead of that scale.

That intensity makes us able to serve our customers when they are the way they deserve to be and the way they desire to be.

Agile architecture is not a new concept. If you go back and look at automobile manufacturing, the best automobile manufacturing units, even in how they build their buildings, and their manufacturing pipelines, with the right separation of concerns, they have done it for a long time.

A Boeing 777, when it first was launched, had 2.4 million parts that were manufactured in 5400 different factories that had to come together to create one airplane. Today’s software enterprise is no different.“

You must make sure that you build for modularity and scalability.

When you go back to the first principles, consider the right design approaches you take to be agile on many different fronts.

Agile in terms of customer expectations and the products we need to build agile in terms of the number of transactions.

We will get agile in terms of the number of employees and engineers we will have at the company and what their throughput will look like agile in terms of the regulations that are coming at us and the constraints that may apply.

When you do processing, take a platform mindset. Build it once, and you can leverage it multiple times.

Take an approach of one company, one platform where no matter how many acquisitions you make, you build one common platform to serve the brain of the company or the skeletal, nervous infrastructure of the company through infrastructure and platforms like identity payments, compliance, risk, and credit.

To unlock the full video and access ADAPT’s comprehensive catalogue of expert presentations, localised research, case studies and community interviews, talk to a Senior Consultant about becoming a Research & Advisory client.