How can technology vendors drive brand relevance and influence?

Australian marketing leaders explore how to prove value, engage executives, and build credibility in a market defined by AI, data, and consolidation.

Australian technology marketers are operating in a climate of cautious investment, shifting priorities, and increasing executive scrutiny.

With budgets tightening and AI transformation accelerating, buyers are demanding measurable returns from every engagement.

The competition for attention has intensified, and the gap between vendor messaging and executive expectations continues to widen.

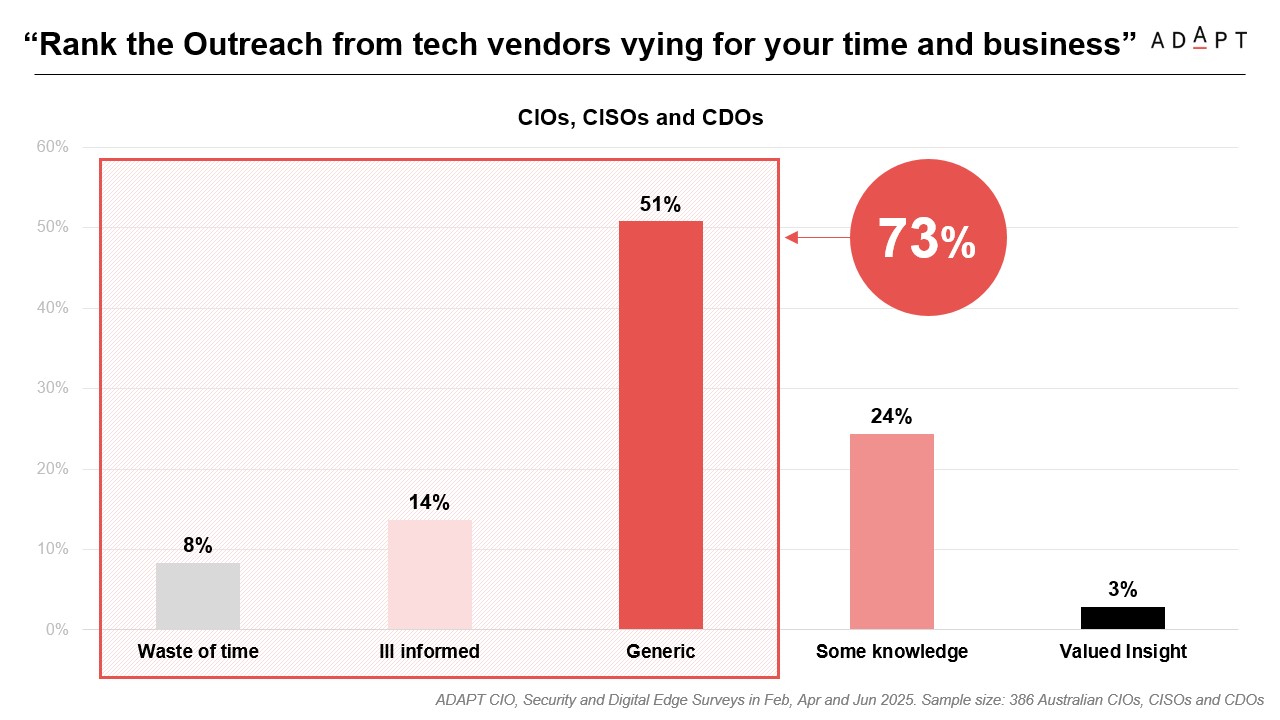

ADAPT research shows that 73% of CIOs, CISOs, and CDOs rate vendor outreach as irrelevant or low value, while 68% plan to consolidate their supplier base within the next year.

As enterprises aim to simplify their technology ecosystems, vendors are being judged not by visibility or volume but by clarity, credibility, and their ability to align with business priorities.

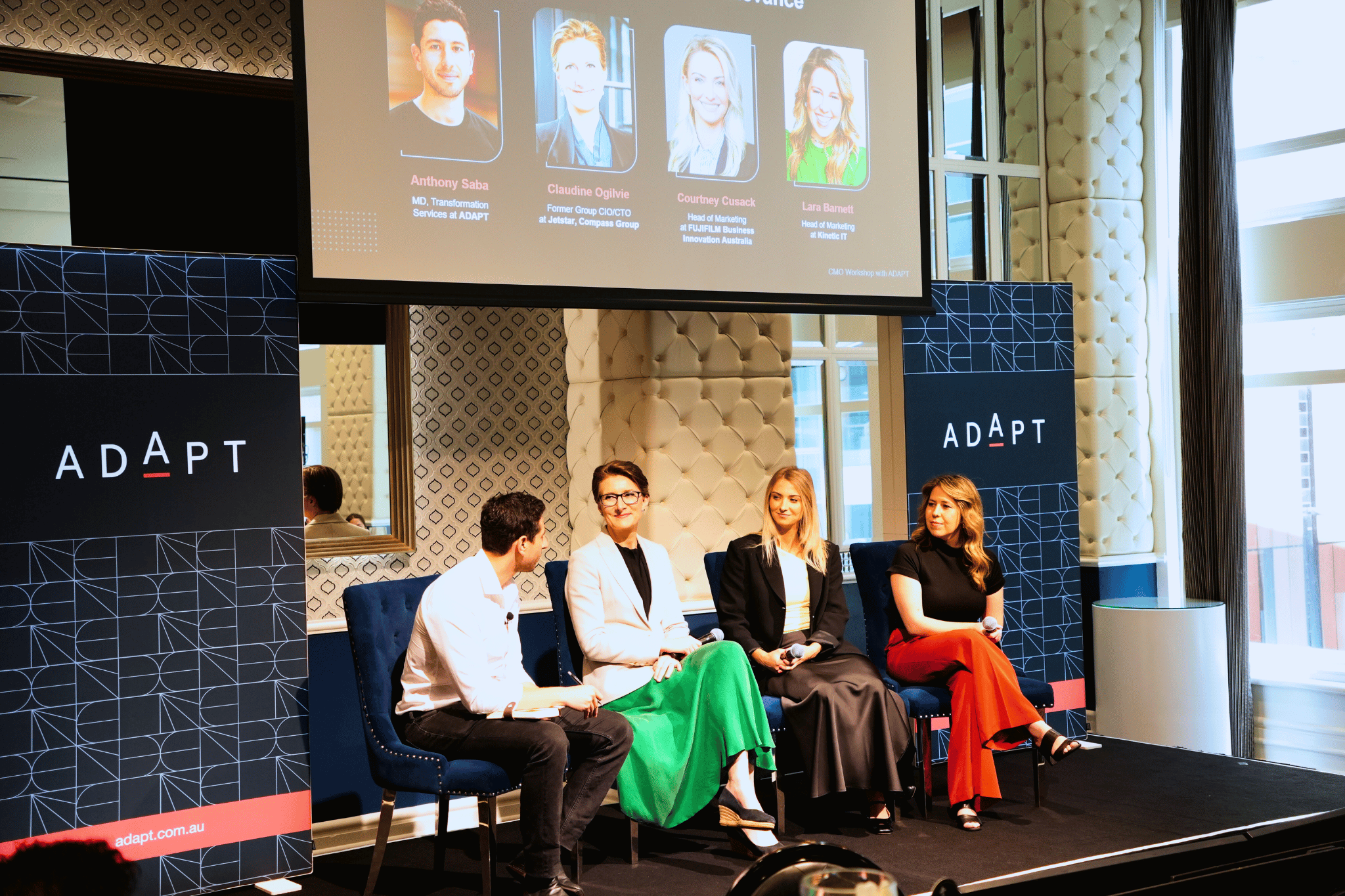

To unpack these shifts, ADAPT’s recent CMO Workshop gathered senior marketing leaders for an invitation-only discussion to explore how vendors can communicate value in ways that resonate with executive agendas and build partnerships grounded in measurable business outcomes.

Reading the customer: AI maturity and emerging technology priorities

Opening the session, ADAPT Founder & CEO Jim Berry presented findings from ADAPT’s research with over 1,400 Australian executives.

He described a market defined by enthusiasm for AI but limited readiness to scale it responsibly.

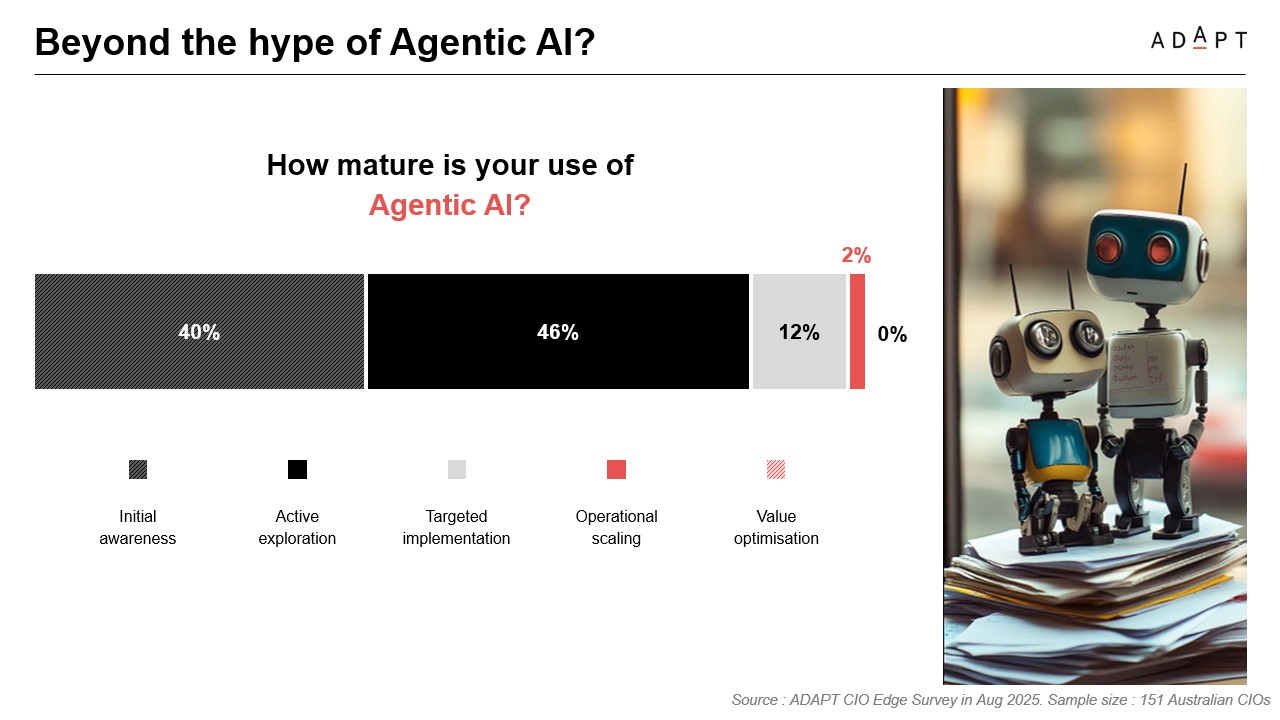

While 46% of organisations are still piloting agentic AI initiatives and 40% remain at early exploration stages, only 2% have reached enterprise-wide deployment.

The maturity gap reflects deep issues in data quality, governance, and accountability.

Executives ranked AI-driven productivity and cost efficiency among their top short-term objectives, yet most remain cautious about deeper automation.

The rise of Agentic AI, capable of independent decision-making, has sparked interest but also concern.

Many leaders are reluctant to delegate critical choices to systems without clear oversight or safeguards.

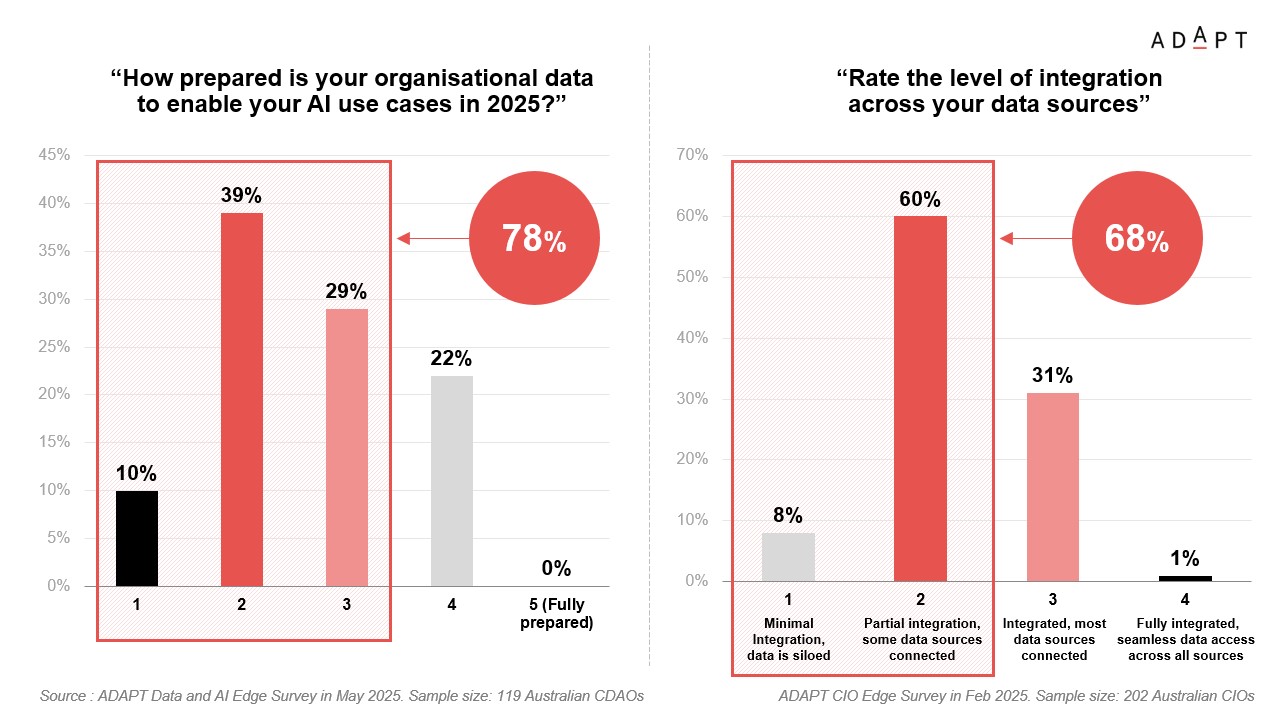

Jim explained that 80% of chief data officers rate their data maturity as average or worse, and two-thirds still manage fragmented architectures.

78% of CDAOs admit their organisational data is not yet ready for AI use cases, and 68% report fragmented integration across data sources.

The lack of readiness underscores why so many leaders are still struggling to convert AI ambition into measurable business impact.

This limits AI’s potential and reinforces why buyers are prioritising vendors who can simplify complexity and create dependable foundations for innovation.

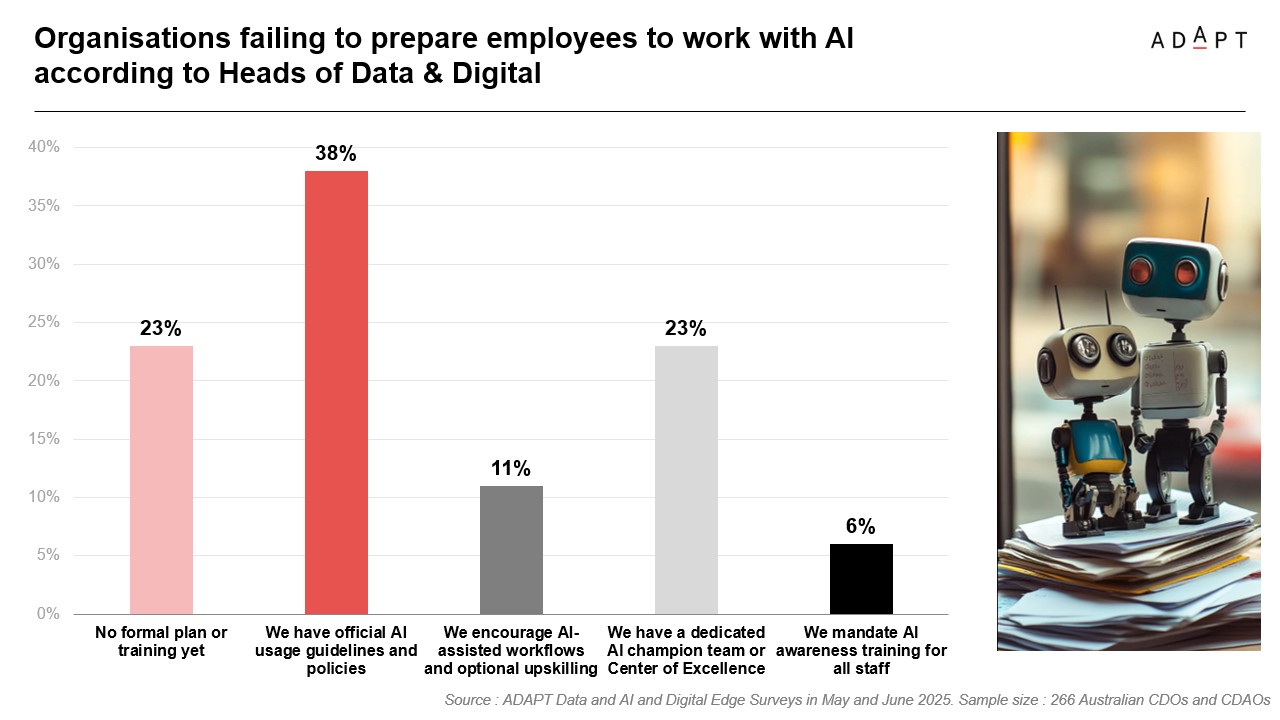

He also shared that 23% of organisations lack formal AI training and 38% have only minimal internal guidelines, often stored in unstructured documents rather than formal governance frameworks.

The result is a widening gap between aspiration and execution, leaving significant value unrealised across industries.

These realities are shaping how executives evaluate technology partners.

Vendors that help organisations modernise responsibly, improve data readiness, and guide ethical AI adoption earn trust as long-term partners in sustainable transformation.

Translating business priorities into meaningful engagement

Building on these insights, Courtney Cusack, Head of Marketing at FUJIFILM Business Innovation Australia described how marketers are adapting to this new environment.

She said that relevance now begins with understanding what matters most to executives, from AI adoption and efficiency to long-term growth.

When marketers speak to business impact rather than product features, they position their brands as partners in transformation.

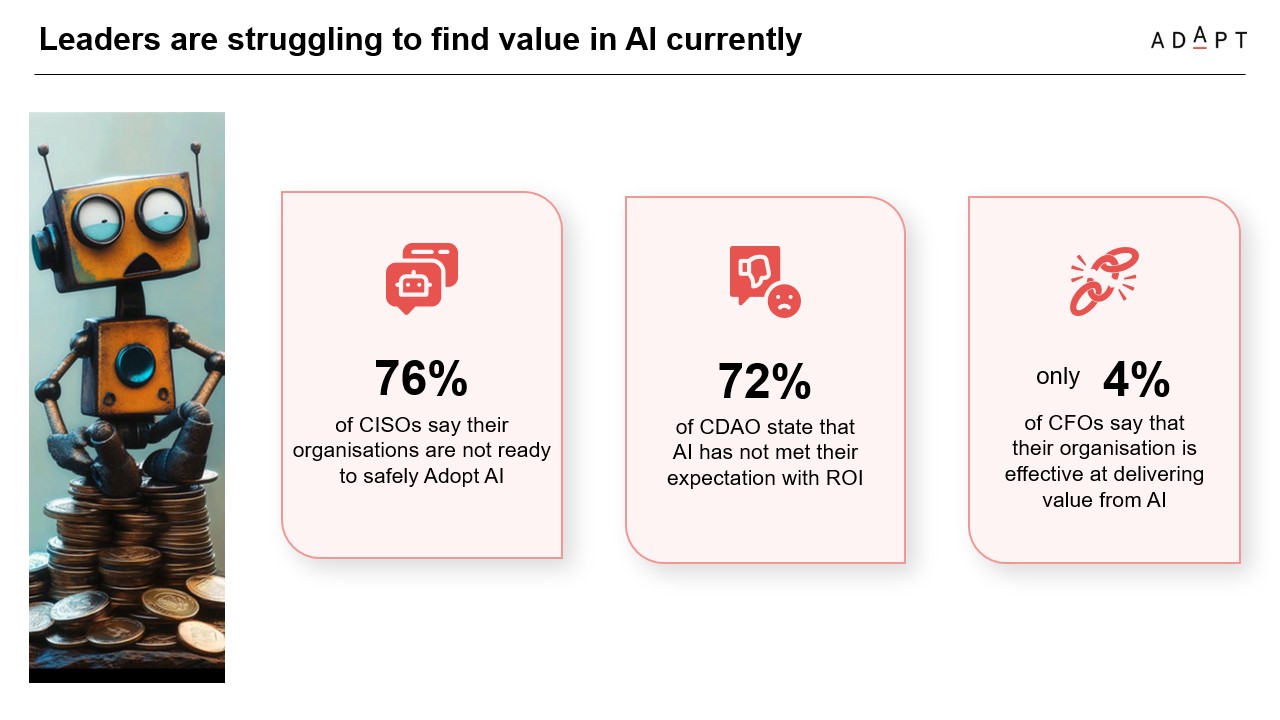

ADAPT data reinforces this shift in focus. 76% of CISOs say their organisations are not ready to safely adopt AI, and 72% of CDAOs report that AI has not met expectations on ROI.

At the same time, only 4% of CFOs believe their organisations are effective at delivering value from AI.

These numbers show that while leaders are excited about AI’s potential, most are still struggling to translate ambition into measurable outcomes.

Anthony Saba, Executive Director, Research & Advisory at ADAPT, added that too many marketing strategies still mirror internal objectives rather than validated customer priorities.

As growth surpasses modernisation as the dominant focus for Australian executives, marketers must demonstrate how technology drives tangible business results rather than theoretical innovation.

Lara Barnett, Head of Marketing at Kinetic IT, explained that consistency remains central to credibility. Brands that maintain a unified voice across every channel earn greater trust and stay top of mind across extended buying cycles.

From the buyer’s perspective, Claudine Ogilvie, former Group CIO/CTO at Jetstar, shared that CIOs pay close attention to which vendors help them articulate business value within their organisations.

Those who provide clarity and confidence throughout the investment process are more likely to be invited back to the table.

The discussion established that marketing leadership now depends on empathy, focus, and discipline.

The ability to communicate in a way that connects technology to outcomes is what distinguishes relevant vendors from forgettable ones.

Proving value through data and storytelling

The panel then turned to the question of how vendors can demonstrate value beyond the initial engagement.

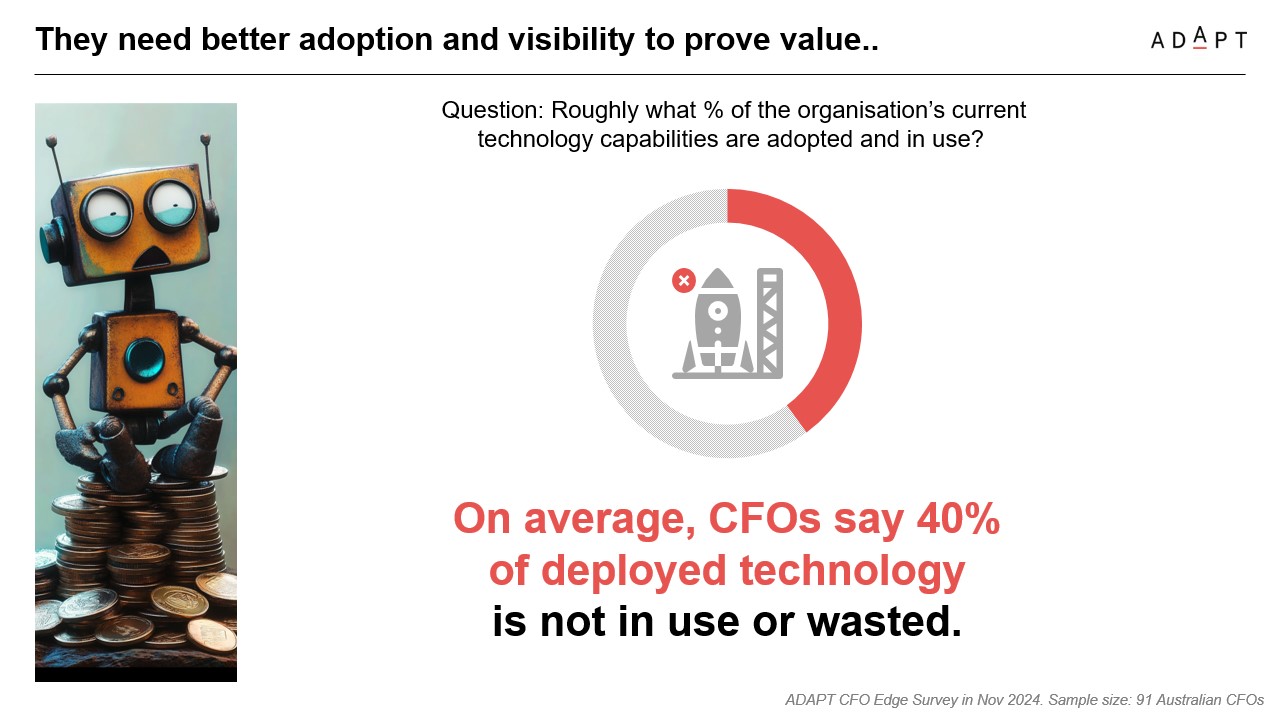

Jim shared further data showing that 40% of deployed technology within Australian enterprises remains underused, while only 39% of CIOs feel confident building business cases for new initiatives.

He pointed out that this underutilisation signals both a financial inefficiency and an opportunity for marketers to guide customers in capturing missed value.

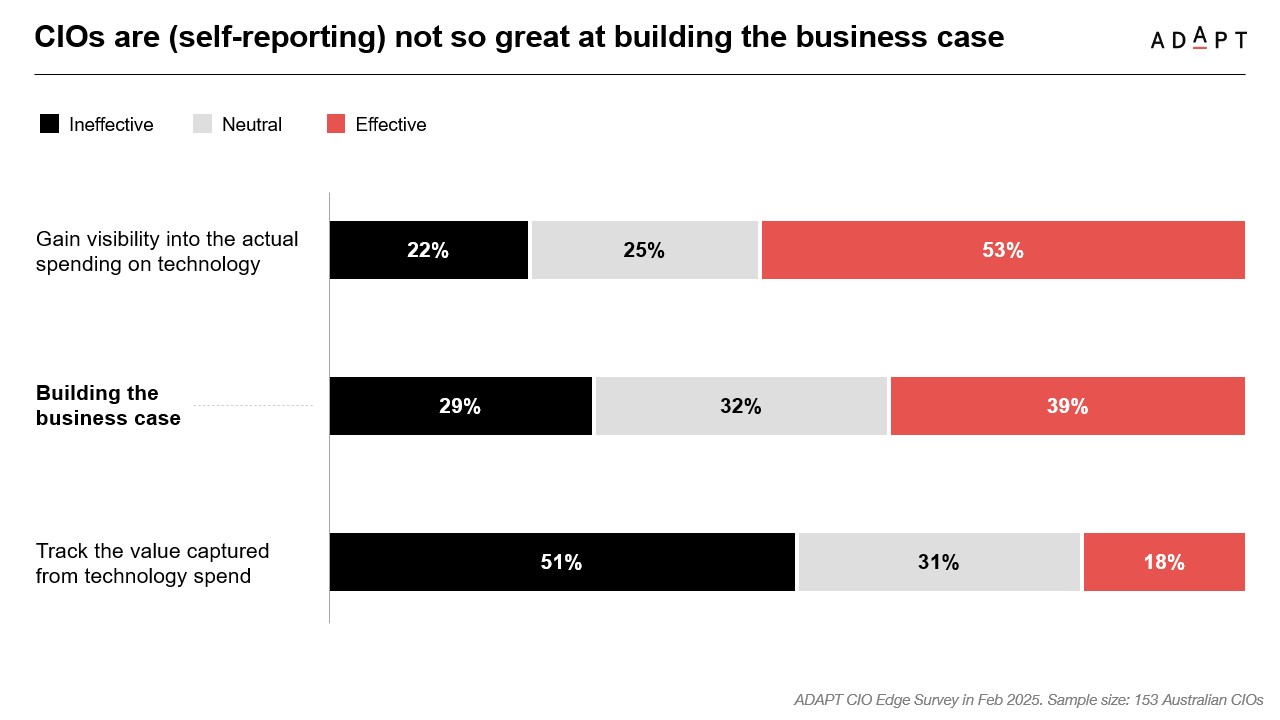

ADAPT’s CIO Edge Survey also showed that just 18% of CIOs effectively track the value captured from technology spend, and only 39% feel confident building the business case.

Most are struggling to gain visibility over technology costs, with more than half rating their processes as ineffective.

Courtney described how marketing teams can act as enablers of executive success by equipping customers with business justification materials, ROI frameworks, and adoption metrics.

These resources help technology leaders validate outcomes internally and sustain confidence in their chosen solutions.

Anthony explained that maintaining communication after implementation strengthens perception of reliability.

Regularly reporting on adoption rates, time savings, and business impact demonstrates accountability and differentiates vendors who deliver on promises.

Lara reflected that while data builds credibility, storytelling turns that credibility into connection.

When marketers translate results into narratives of progress and shared success, they engage both rational and emotional decision drivers within leadership teams.

Claudine closed the discussion by noting that authenticity defines the line between influence and intrusion.

Executives respond to vendors who understand their operational constraints and culture, not those who overwhelm them with generalised claims.

Audience discussion reinforced this principle, including a case where a gamified cyber security program achieved 90% staff participation.

It illustrated how creative approaches, backed by measurable outcomes, can educate, engage, and inspire action across complex organisations.

Recommended actions for technology vendors

- Anchor messaging in executive priorities – Build narratives around growth, AI adoption, and efficiency, reflecting what matters most to the Australian C-suite.

- Simplify complexity – Position your offering as an enabler of integration, compliance, and responsible AI governance.

- Support the business case – Provide quantifiable outcomes, ROI frameworks, and ongoing measurement to help customers demonstrate value internally.

- Localise and contextualise – Reference Australian market examples and benchmarks to establish authenticity and trust.

- Stay engaged beyond deployment – Continue sharing insights, data, and success metrics to reinforce partnership and long-term relevance.