What are the Australian C-Suite investing in?

Enterprise tech budgets in H2 2025 focus on AI, governance, efficiency, and cyber security. ADAPT reveals how vendors can align to real execution gaps.

By mid-2025, budget shifts across Australian enterprises have become impossible to ignore.

Leaders are making sharper trade-offs, backing priorities with real funding, and reassessing what belongs in the portfolio.

Confidence is moving toward outcomes, not aspirations.

Vendors are being judged by their alignment to these evolving decisions.

ADAPT’s survey of more than 650 c-suite technology decision-makers, including CIOs, CISOs, Chief Data & Analytics Officers, and Heads of Digital from leading enterprise and government organisations, reveals five investment signals that define the current moment.

These signals show where budget is flowing, what pressures leaders are responding to, and where opportunity sits for those who can deliver value today.

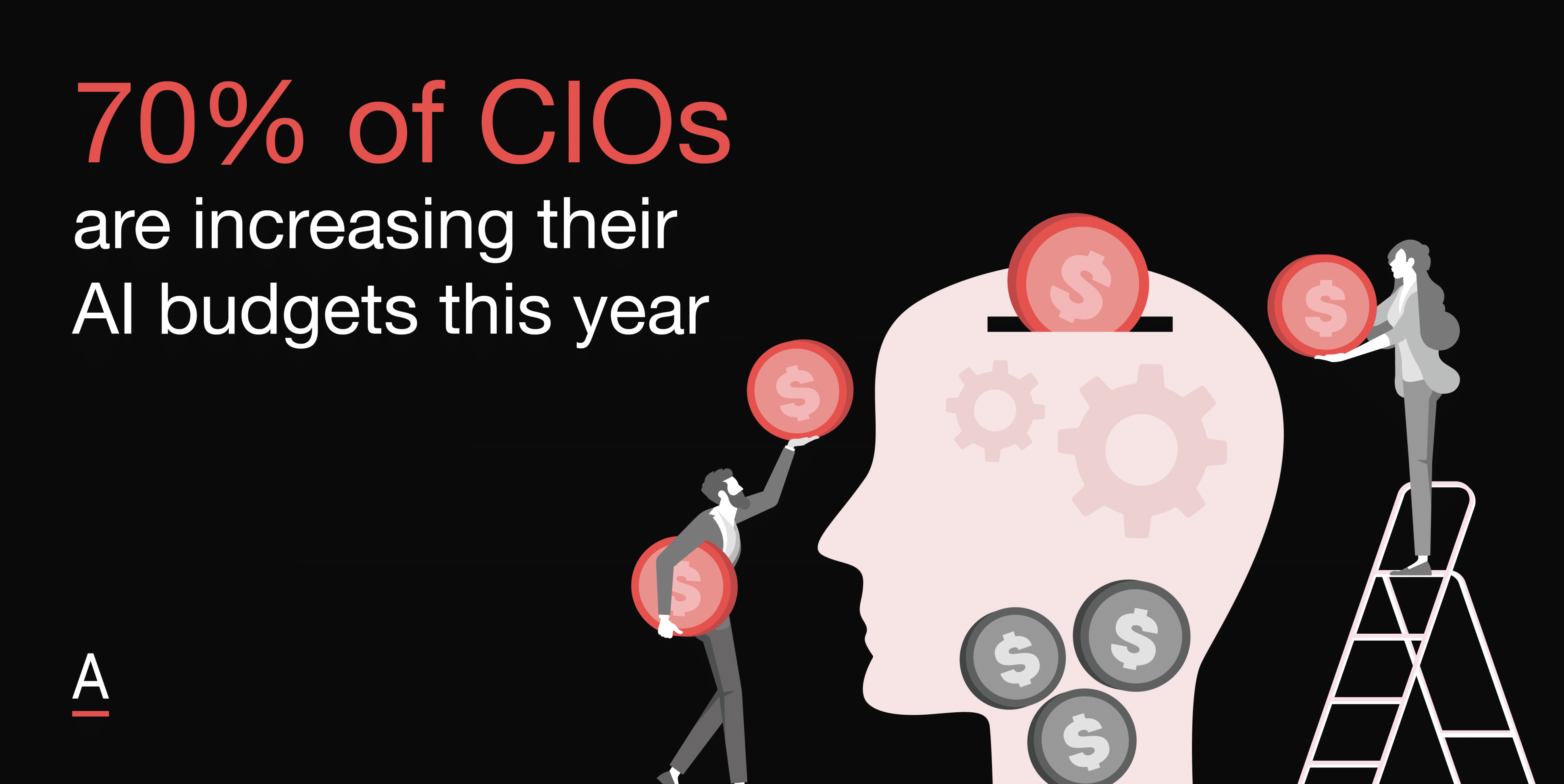

AI budgets grow as CIOs rewire around capability, not maintenance

Among CIOs, 70% have increased investment in artificial intelligence this year.

This expansion has come through internal reprioritisation.

Core IT services have become a source of funding for emerging capability.

1 in 5 CIOs confirmed a reduction in traditional service spend to support new AI programs.

CIOs are shifting their portfolios away from run-costs and toward tools that speed up time-to-insight, reduce dependency on manual input, or enable competitive delivery.

Vendors that continue to frame their value around technical uptime or feature sets will miss.

Those who align AI capability to measurable improvements such as cost avoidance, forecasting accuracy, staff productivity will hold the room.

Governance investment signals rising CDAO accountability

Among CDAOs, 70% have already allocated budget to responsible AI, compliance, and data governance for the next 12 months.

This shift reflects direct accountability to internal risk functions and growing visibility at the board level.

CDAOs are being asked to translate AI ambition into structured control.

This means clear data lineage, decision traceability, and tools that can stand up under regulatory review.

Vendors who deprioritise governance or treat it as an overlay to core functionality will find barriers.

Those who help CDAO teams embed audit readiness, define roles across federated environments, and operationalise compliance within live workflows will stand apart.

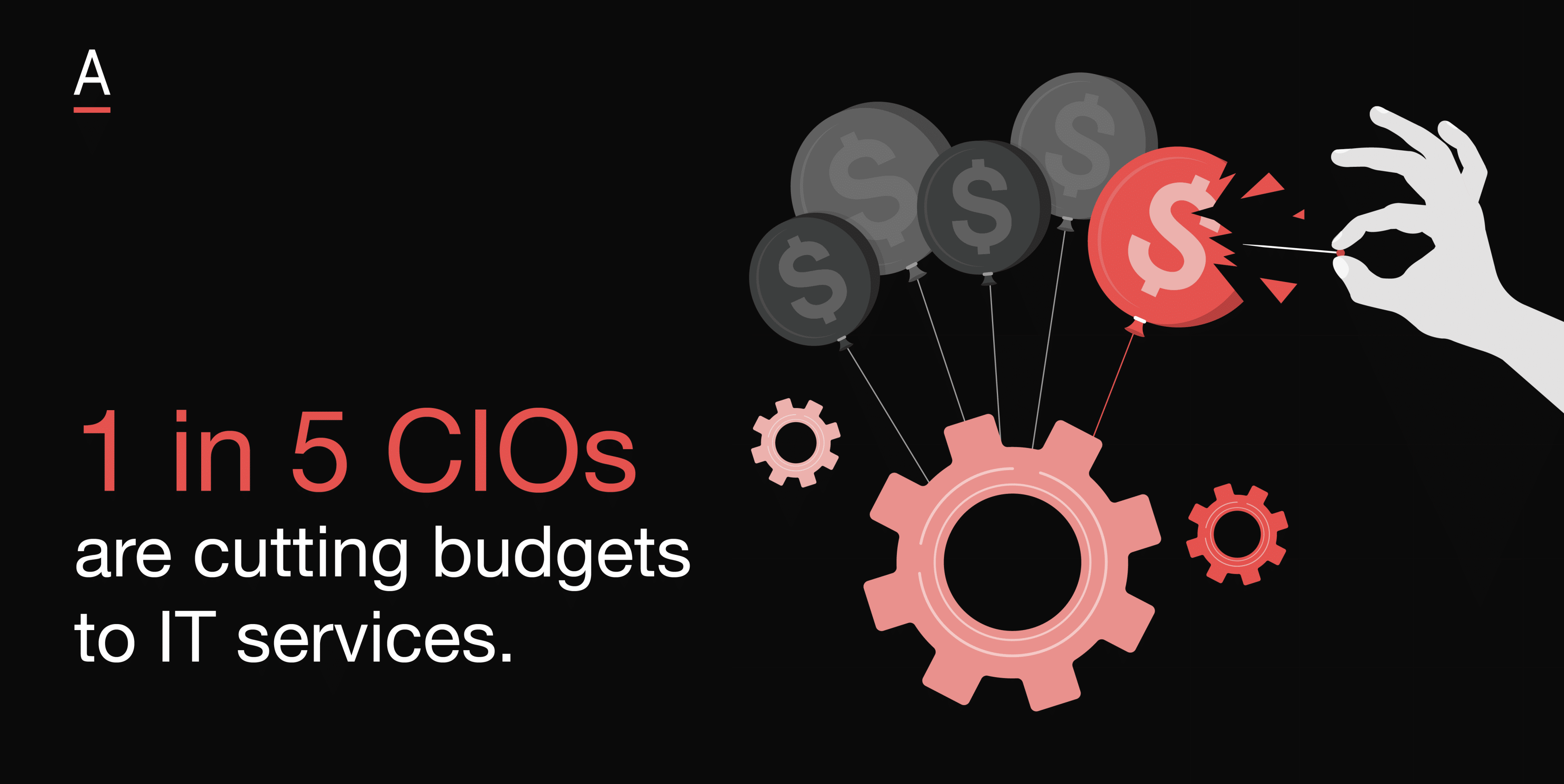

Transformation-aligned tools earn budget while support services fall away

Spending has started flowing toward platforms that support modernisation.

At the same time, 1 in 5 CIOs have cut investment in traditional IT services.

This reflects a broader shift away from tools built to sustain the past and toward those positioned to support measurable transformation.

Buyers are now scanning for solutions that collapse processes, automate handoffs, and shorten the path from strategy to execution.

Transformation is no longer a program of change.

It is a condition for continued investment.

Vendors that enable fast, focused delivery inside current teams will take priority over those that require large, sequential deployments.

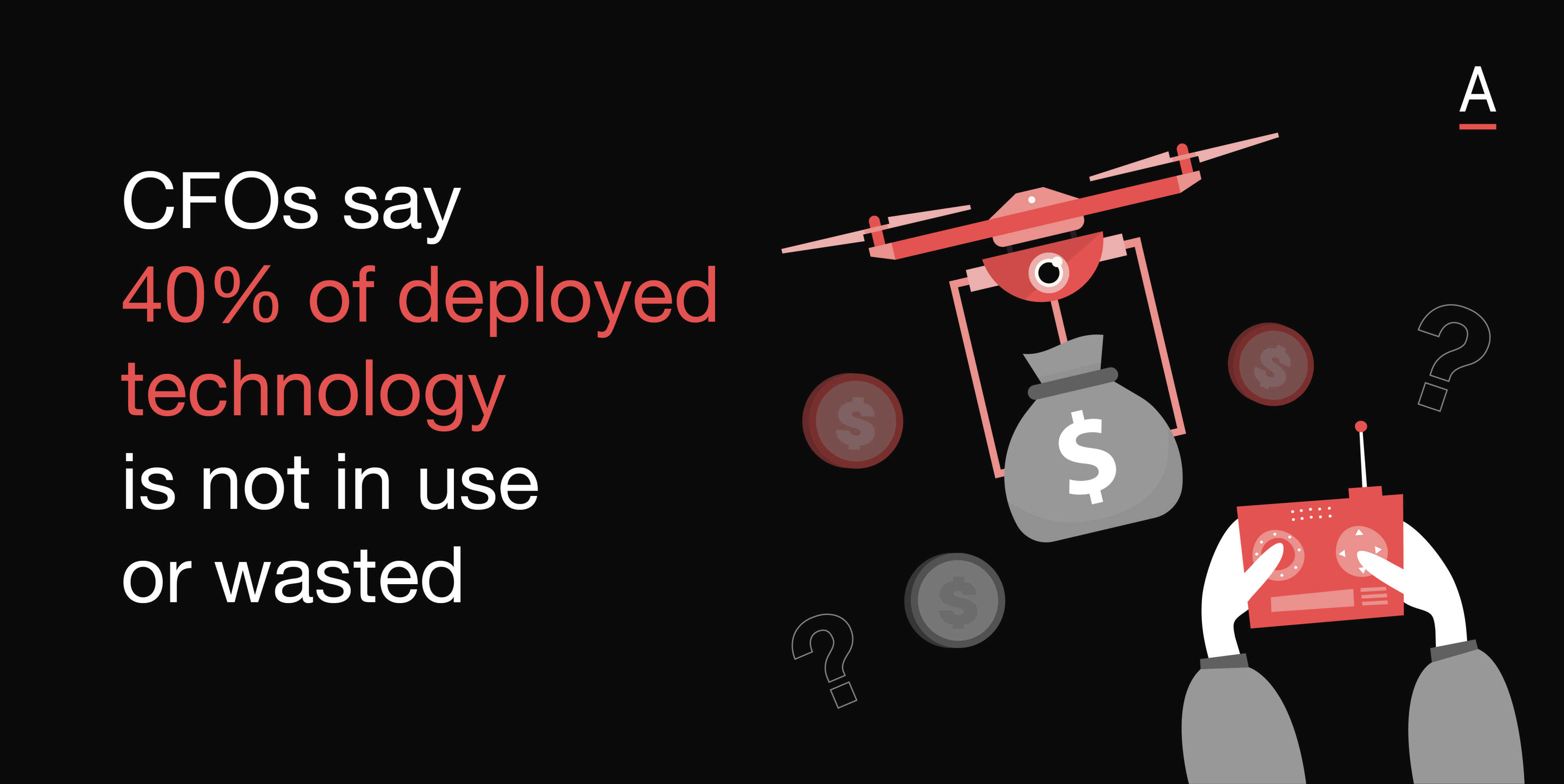

CFOs push for value recovery across the tech stack

Technology leaders are not the only ones tightening investment criteria.

40% of CFOs believe that deployed software is currently underused or delivering poor return.

This insight is shaping how finance leaders engage with IT and how they assess every new request for spend.

Recovery of wasted value now matters as much as generating new value.

Proposals that clean up overlapping capability, eliminate shelfware, or improve internal adoption will resonate more clearly than expansion-oriented pitches.

Vendors that demonstrate how they replace cost without reducing output, or streamline platforms without burdening operations, will support the agenda emerging inside finance.

CISOs stretch capability against static resources

Cyber security continues to rise in strategic importance, but resourcing has failed to scale at the same pace.

Lack of funding and people ranked as the top challenge among CISOs.

Teams are navigating third-party risk, expanded attack surfaces, and GenAI-fuelled threat volume without the uplift they need.

This context shifts the definition of vendor value. Offers that assume high headcount availability or multi-phase deployment programs will stall.

Tools that extend visibility without adding complexity, or automate prioritisation to reduce manual analysis, align with the actual working conditions of security leaders in 2025.

Closing the gap between strategy and spend

C-suite investment is being directed toward performance pressure points: AI execution, internal compliance, platform simplification, and security reach.

The organisations winning that spend are those with clear answers to operational gaps and the credibility to deliver outcomes inside limited conditions.

This 17 July, ADAPT’s Mid-Year GTM Checkpoint: What Enterprise Buyers are Prioritising in H2 2025 virtual workshop will break down where budgets are flowing next, and how vendors can align with live enterprise demand.