Only 20% of CFOs can track tech ROI—how can B2B marketers help tech execs build stronger business cases in 2025?

At the recent ADAPT CMO Workshop, 40+ B2B technology marketing leaders in Melbourne gathered to explore the evolving dynamics of customer engagement, technology adoption, and the role of AI in reshaping sales and marketing strategies.

At the recent ADAPT CMO Workshop, 40+ B2B technology marketing leaders in Melbourne gathered to explore the evolving dynamics of customer engagement, technology adoption, and the role of AI in reshaping sales and marketing strategies.

As businesses look ahead to 2025, achieving strategic success hinges on a deep understanding of customers, aligning messaging with their priorities, and addressing organisational challenges with actionable insights.

Drawing on insights from over 1,000 executive surveys across Australia’s top 400 organisations—representing 60% of the nation’s GDP and employing nearly a quarter of the workforce—ADAPT presented a roadmap for CMOs to thrive in an increasingly complex environment.

AI investments surge, but execution barriers persist

Jim Berry, Founder & CEO of ADAPT, set the stage by outlining the broader challenges businesses face in 2025—tight budgets, complex IT environments, and an urgent need for transformation.

“Most of your customers are being asked to do more with less while navigating increasing complexity in their IT environments,” Jim stated.

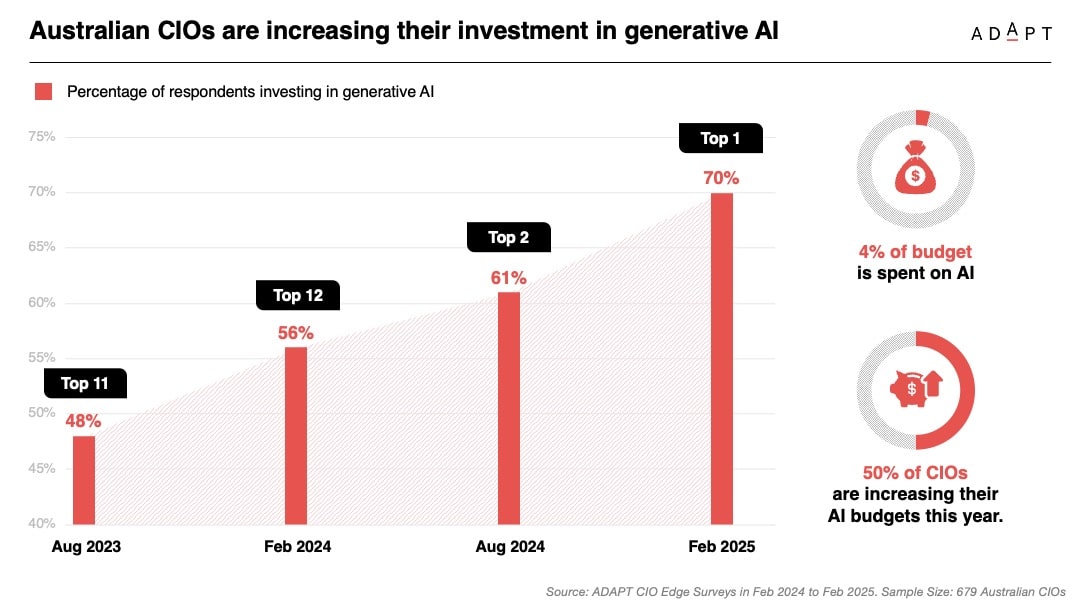

AI investment is accelerating, with 70% of Australian CIOs increasing their budgets for 2025.

However, enthusiasm alone won’t drive transformation.

“The biggest challenge isn’t whether companies want AI—it’s whether they can make it work at scale.”

CFOs, meanwhile, remain sceptical about AI’s value. ADAPT’s research shows that 77% of CFOs are unconvinced about AI’s return on investment.

Many finance leaders struggle with visibility into AI-driven productivity gains, making it difficult to justify continued investment until new metrics are established and, bluntly, headcount reductions are factored in.

Beyond funding, legacy IT systems remain a major roadblock.

Many enterprises struggle with outdated infrastructure that complicates innovation and increases operational risk.

Additionally, while AI promises efficiency, poor data quality and lack of skilled talent are slowing implementation.

For organisations to see real ROI from AI, they must first modernise their IT environments and invest in execution strategies that address workforce and infrastructure gaps.

Back-office modernisation and cyber security dominate IT agendas

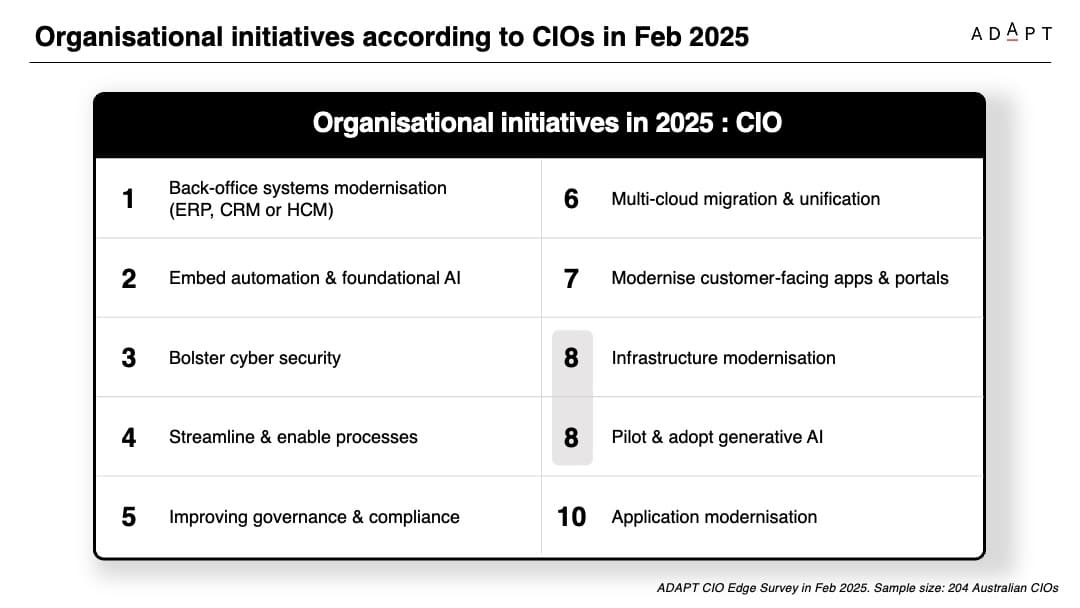

When asked about their 2025 organisational initiatives, CIOs overwhelmingly pointed to back-office system modernisation (ERP, CRM, HCM) and embedding foundational AI.

Meanwhile, cyber security remains a top-three priority as businesses continue to face heightened threats.

Infrastructure modernisation, multi-cloud unification, and generative AI adoption round out the top areas of focus.

CFOs take a bigger role in tech decision-making

CFOs’ strategic influence in evaluating technology investments has surged, with a 29% increase in strategic involvement over the past year.

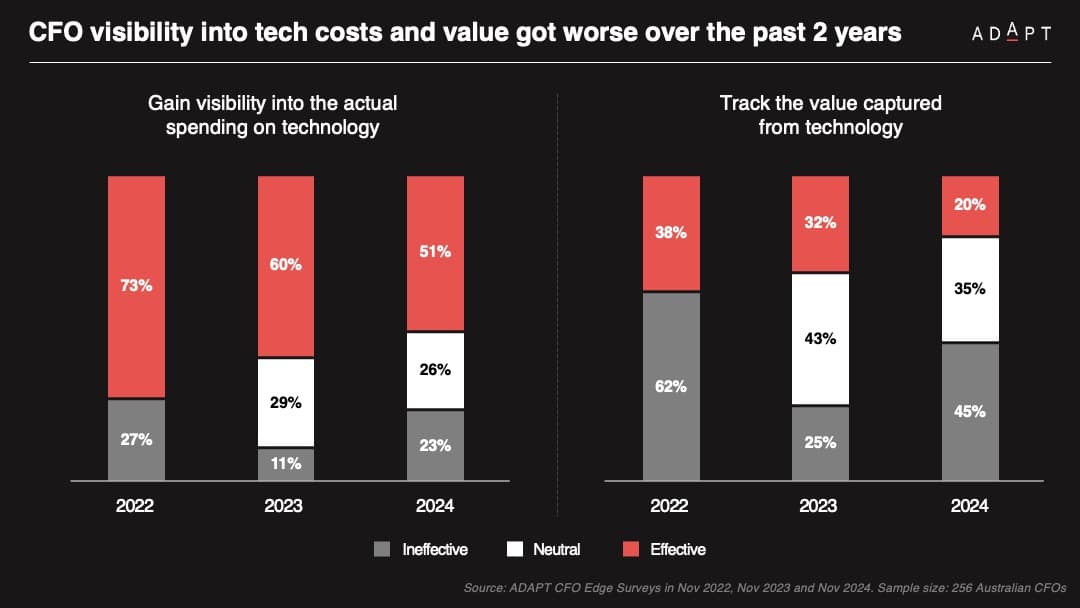

However, despite their growing role, many finance leaders still struggle to track value from technology investments effectively.

CIOs, too, report difficulties in building a strong business case for technology investments, with many struggling to gain visibility into actual tech spending or measure the value captured from their investments.

The proportion of CFOs who can accurately track tech ROI has dropped significantly—from 38% in 2022 to just 20% in 2024.

CFOs are also questioning the effectiveness of broader tech investments, with nearly half indicating that much of their organisation’s technology remains underutilised.

Many leaders cite a lack of adoption and integration as key reasons why their current tech stacks are failing to deliver expected outcomes, further increasing scrutiny on new investments.

Vendor consolidation: the battle of the platforms

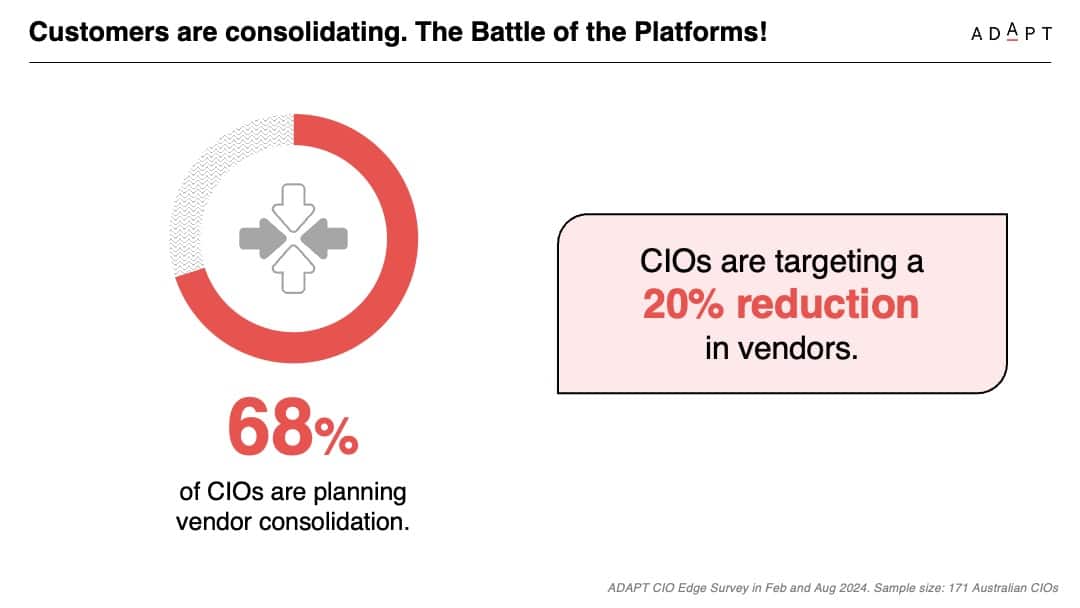

Australian CIOs are streamlining their vendor ecosystems, with 68% actively planning vendor consolidation and targeting a 20% reduction in suppliers.

As budgets tighten and the need for interoperability grows, technology providers must demonstrate clear ROI and differentiation to remain competitive.

Execution barriers: funding, skills gaps, and governance hurdles

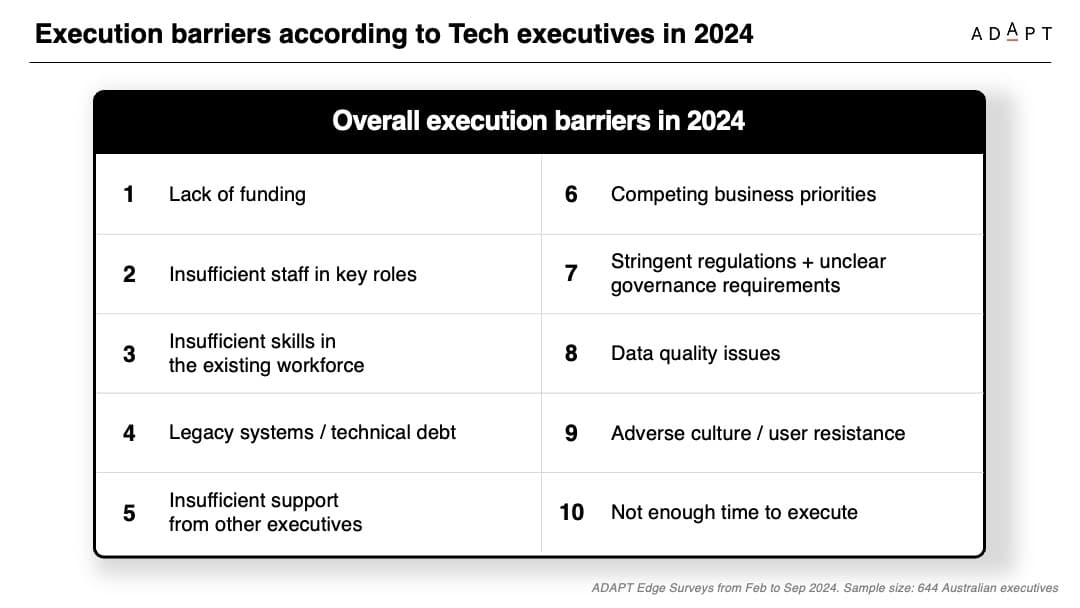

Despite strong investment intentions, CIOs cite execution challenges as a major roadblock.

Lack of funding, insufficient skilled staff, and stringent governance requirements are among the top barriers preventing organisations from executing their strategies.

Similarly, users’ resistance to new technologies, unclear adoption strategies, and limited training further hinder digital transformation efforts.

When asked if they have enough resources to execute on their goals, the answer from technology leaders was overwhelmingly clear—they don’t.

Two-thirds of CIOs and CISOs, along with nearly half of data leaders, report needing more resources to meet their mandates.

Even CTOs and CFOs cite lack of funding as their top barrier to execution.

With cost-cutting measures already in place, organisations are now at a crossroads.

If resources are stretched thin just to maintain operations, how will they tackle future-facing initiatives like IT estate modernisation and operating model redesign?

The importance of local insights

Anthony Saba, Executive Director of Research & Advisory at ADAPT, emphasised the significance of local insights in shaping effective go-to-market strategies.

He highlighted that while global trends provide a broad view, they often fail to reflect the nuances of the Australian market.

Saba pointed out that the Australian tech ecosystem is uniquely shaped by government-driven spending, varied levels of digital maturity, and a highly competitive yet relatively small market.

Leaders must navigate an environment where vendor messaging often sounds identical, making differentiation a challenge.

He stressed that while AI, security, and vendor consolidation remain priorities, the underlying motivations and execution challenges vary significantly from those seen in the US or Europe.

Furthermore, he pointed out that the rapid evolution of business needs, noting that insights from six months ago may already be outdated.

How B2B sales and marketing leaders can stand out in 2025

To navigate these challenges and capitalise on emerging opportunities, B2B sales and marketing leaders must:

- Differentiate with hyper-local insights – Leverage real-world Australian case studies rather than generic global references to ensure relevance and credibility.

- Equip CIOs and CFOs with the tools to articulate ROI – Provide measurable business outcomes that help technology leaders secure executive buy-in for investments.

- Strengthen partnerships by reducing friction in vendor relationships – Offer streamlined procurement, integration support, and consultative sales approaches to align with evolving business priorities.

- Help CIOs build stronger business cases – Support IT leaders with clear frameworks, adoption strategies, and benchmarks to justify technology investments and demonstrate long-term value.

- Shift outreach from generic to insight-led engagement – Tailor messaging and solutions to the specific pain points and priorities of Australian executives, focusing on real business impact.

With AI adoption accelerating, security challenges mounting, and vendor ecosystems consolidating, 2025 is set to be a defining year.

Sales and marketing leaders who align with these priorities and proactively support executive decision-makers will be best positioned to thrive in this evolving landscape.