60% of Australian CFOs now co-driving tech strategy

At CFO Edge, finance leaders explored how data discipline, AI governance, and people capability are reshaping the finance function.

At CFO Edge, finance leaders explored how data discipline, AI governance, and people capability are reshaping the finance function

ADAPT’s 16th CFO Edge at The Fullerton in Sydney gathered more than 150 senior finance leaders representing organisations responsible for about one fifth of Australia’s GDP gathered to define how their function will navigate AI disruption and modernisation.

CEO and Founder Jim Berry opened by describing how CFOs now operate at the centre of transformation, linking governance, data, and investment decisions that determine enterprise resilience.

He noted that technology now dictates how quickly organisations can achieve accuracy, compliance, and cost efficiency.

Across the day’s discussions and keynotes featuring financial, tech, and business leaders from Oracle, Westpac, Accenture, the Australian Red Cross, ResMed, Bendigo & Adelaide Bank, Imperative Advisory, and more, several consistent themes emerged.

Finance executives identified the need to evolve leadership for continuous transformation, strengthen data maturity to support AI, quantify value in technology investment, and develop people capable of sustaining long-term change.

Together, these priorities outlined how Australia’s CFO community is preparing for the next phase of digital finance maturity.

Evolve financial leadership for continuous transformation

The Hon Victor Dominello, former New South Wales Minister for Customer Service and a national advocate for digital governance, positioned evolution as the real test of leadership maturity.

He noted that while many organisations achieve bursts of digital progress, few embed adaptability into their operating models.

Drawing on his creation of the NSW Digital Restart Fund, he showed how agile funding and iterative delivery replaced the rigidity of multi-year projects, enabling faster testing, clearer feedback, and stronger accountability, which are principles CFOs can apply directly to investment governance.

He also introduced the idea of “Government 4.0,” where systems evolve like software versions, each upgrade improving transparency and responsiveness.

The model resonated with CFOs because it translates directly to enterprise modernisation, treating finance, data, and governance as living, adaptive platforms.

Dom Price, Work Futurist and ADAPT Advisor, extended this thinking from a corporate lens, warning that automating legacy processes risks embedding inefficiency at scale.

For him, efficiency without adaptability creates fragility, while iterative learning compounds performance over time.

ADAPT data supported their views.

In 2023, 59% of CFOs reported involvement in technology strategy, rising to 60% in 2025, a clear evidence that finance leaders are now co-architects of enterprise transformation.

Yet funding constraints remain the top barrier across all executive personas, according to Gabby Fredkin, ADAPT’s Head of Analytics and Insights.

This disconnect between ambition and resources requires new models of shared accountability.

Jim reflected that this evolution demands CFOs who can balance strategic foresight with operational realism.

The modern leader must manage cyclical budgets while fostering a culture that can evolve at the same pace as technology.

Build data maturity as the foundation for AI ready finance

Shilpa Bhale, Director of Strategy and Product Management at Oracle, explained that most organizations have reached a point where technology adoption outpaces data readiness.

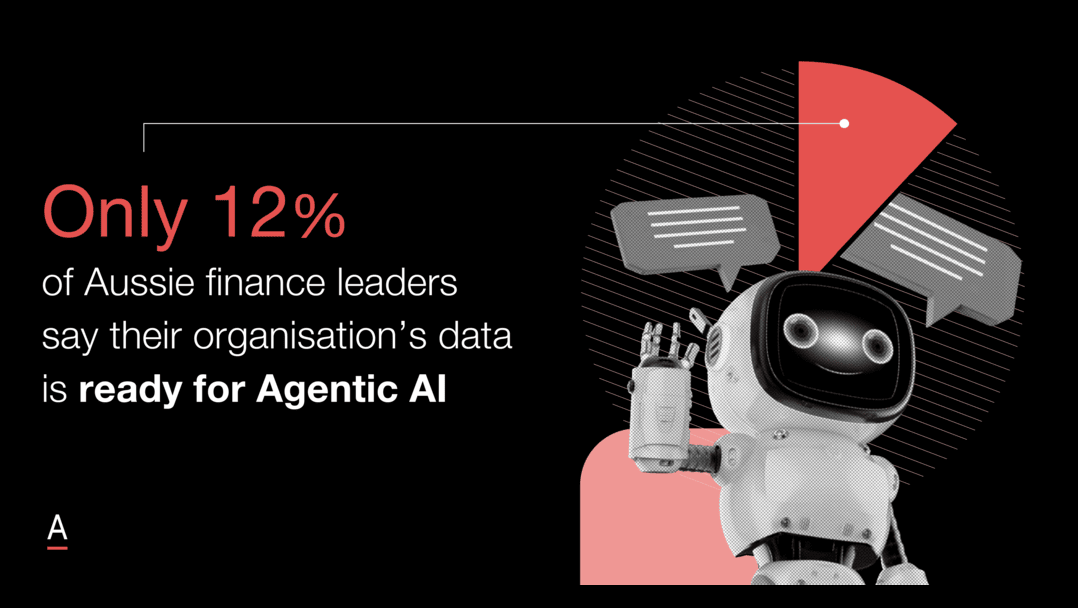

ADAPT benchmarking shows that only 12% of Australian finance leaders believe their data is prepared for agentic AI.

Shilpa argued that without structured data, AI amplifies inconsistencies rather than solving them.

She emphasised that embedded AI agents can automate payables, ledger reconciliations, and financial reporting, but they only succeed when supported by reliable metadata, unified processes, and strong governance frameworks.

In an interview at CFO Edge, Ali Mehfooz, Group Financial Controller at Bendigo and Adelaide Bank, offered a financial institution’s view of that reality.

He described how legacy systems fragment information, limiting visibility and creating duplication in reporting.

His focus has been on building unified data models that allow faster and more confident decision making.

Meanwhile, Chris Merjane, Head of Finance for Corporate Functions at ResMed, shared how his team has integrated operational and financial data to shorten forecasting cycles and strengthen accountability.

For him, automation is valuable only when it sharpens human insight and removes manual noise.

Gabby’s data across industries supported their experiences.

Even as AI funding rises, the absence of consistent, clean data continues to delay measurable return on investment.

CFOs must therefore treat data governance as a financial control equal in importance to statutory compliance.

Translate technology investment into measurable value

In the CFO Edge panel, David Walker, Group Chief Technology Officer at Westpac and DBS Bank, described how finance and technology teams can jointly quantify complexity to justify investment decisions.

His team discovered that duplicated technology environments inflated project costs by more than half, leading to a measurable case for rationalisation and governance.

Samantha Randall, Chief Financial Officer for Australia and New Zealand at Accenture, showed that measurable outcomes depend on shared accountability.

By aligning program leads across finance and technology, her teams ensure that each transformation initiative ties directly to defined value metrics.

For his part Jean-Baptiste Naudet, Chief Financial Officer at the Australian Red Cross, connected efficiency to impact, explaining that in mission driven organisations, improved productivity expands community reach.

According to him, transformation value includes social outcomes as well as financial gains.

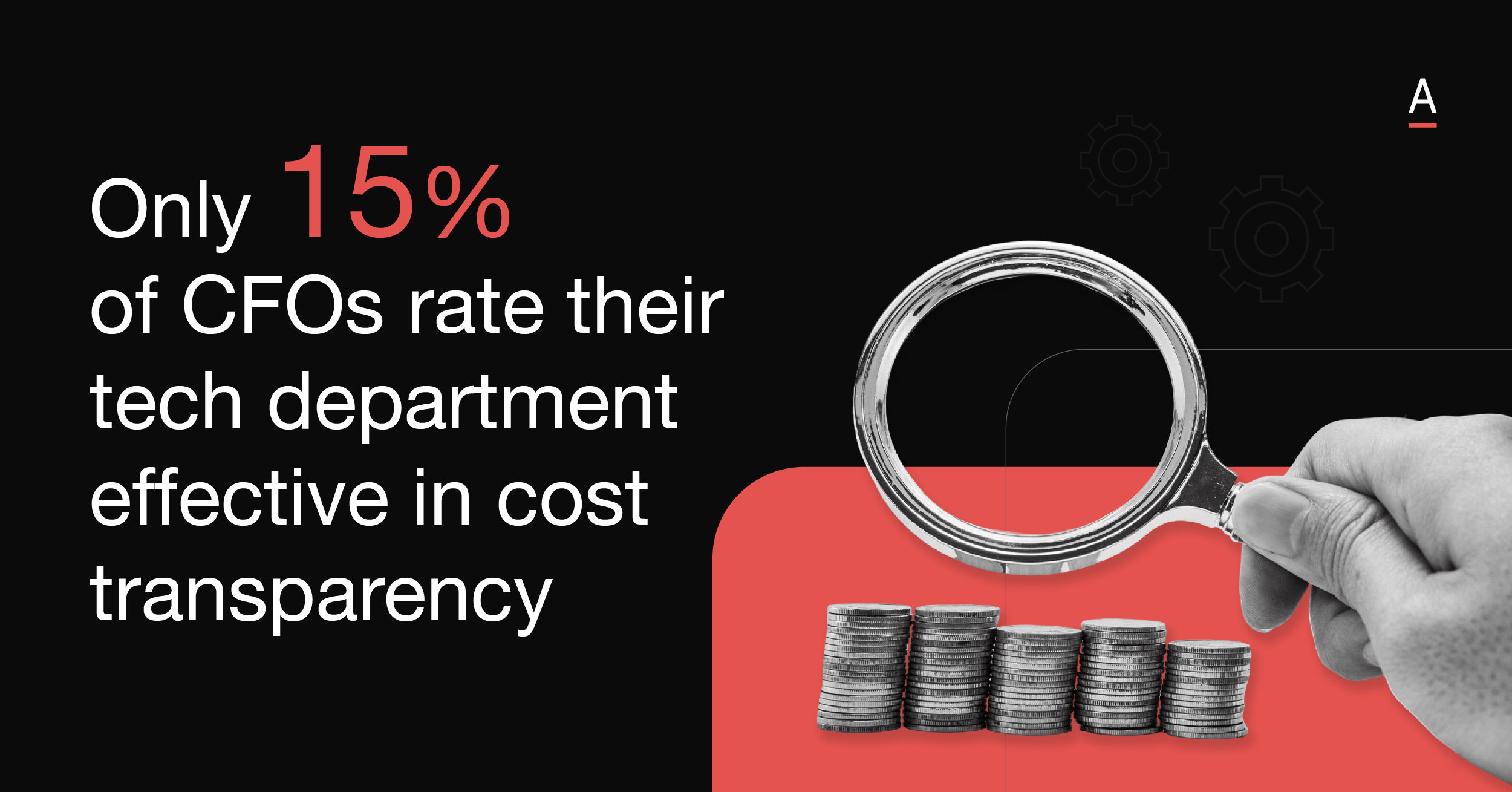

ADAPT’s research found out that only 15% of CFOs rate their technology departments effective in cost transparency.

The gap underscores why CFOs must lead with quantitative insight, translating technology adoption into metrics that boards can understand.

Gabby added that co building initiatives with the CIO has become one of the top ten strategic priorities for finance in 2025, up from twentieth last year.

This rise confirms that financial rigor and technical execution are converging into a single performance system.

Empower people to sustain transformation and culture

Florian Pecher, CFO Performance Coach at Imperative Advisory, explained that successful transformation depends on leadership self awareness and team psychology as much as data or technology.

His research with executive teams shows that personality traits such as drive, adaptability, and empathy directly influence execution quality.

Leaders who remain composed under pressure and encourage reflection create conditions for sustained change.

Samantha Randall echoed that transformation only endures when people see their role in it.

Accenture now positions modernisation programs as career advancing opportunities, ensuring that key staff invest in outcomes rather than view transformation as a temporary assignment.

Chris Merjane described a similar approach at ResMed, where close collaboration between finance and product teams builds mutual ownership of digital improvement.

JB Naudet also noted that linking efficiency to purpose motivates engagement across the humanitarian workforce.

Culture and capability remain among the top five barriers to execution, ranking just behind funding and legacy systems.

Addressing those gaps requires measurable leadership development, not one off training.

Florian’s framework of competing, collaborating, and innovating provided a language for assessing that maturity.

For finance leaders, human adaptability is becoming the most reliable predictor of transformation success.

Recommended actions for CFOs

The discussions and data from CFO Edge revealed seven practical actions that finance leaders can take to strengthen execution, improve data maturity, and accelerate measurable value across their organisations.

- Establish data governance as a finance owned control before expanding automation

- Quantify complexity costs and set clear reduction targets with technology teams

- Link every AI or transformation initiative to adoption and outcome metrics

- Design funding models that support continuous, iterative investment cycles

- Make transformation roles career defining and reward leaders on impact delivered

- Track trust, collaboration, and adaptability as leadership performance indicators

- Use finance as the connector between technology, operations, and culture

CFO Edge 2025 marked a clear evolution in how Australia’s finance leaders define transformation.

Lasting progress depends on three interconnected capabilities: disciplined data foundations, measurable value creation, and human adaptability.

Leaders agreed that transformation can no longer be managed as a series of projects.

It must operate as a continuous cycle of learning, investment, and governance.

The conversations highlighted that data readiness is inseparable from financial integrity, that technology investment requires transparent measures of complexity and value, and that people capability now determines how effectively innovation endures.

Across every discussion, one message stood out.

The finance function is becoming the connective system of the enterprise, linking digital strategy, operational control, and organisational culture.

The next generation of CFOs will be defined by their ability to manage these intersections, building financial architectures that learn, adapt, and sustain growth as technology and market forces evolve.