Balancing art and economics: How the Sydney Opera House turns revenue into community impact

Jon Blackburn, CFO & Executive Director Corporate Services at Sydney Opera House, discusses how they transitioned to a data-driven model to adapt to changing audience behaviours and to boost marketing efficacy.Jon Blackburn, CFO & Executive Director Corporate Services at Sydney Opera House, discusses how they transitioned to a data-driven model to adapt to changing audience behaviours and to boost marketing efficacy in this CFO Edge interview.

Prior to the pandemic, ticket sales were stable, with resident companies and tourism reliably driving revenue.

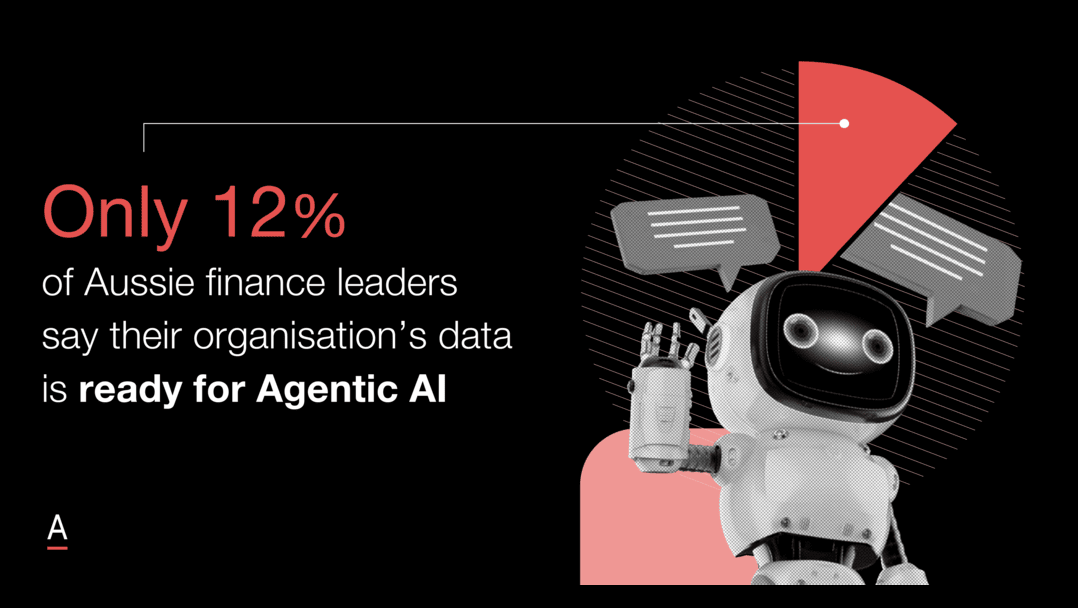

As revealed in ADAPT research, 79% of CFOs report difficulties in accessing reliable data for scenario modelling and risk mitigation.

For the Sydney Opera House, addressing these challenges was critical to adapting to post-lockdown uncertainties and identifying both risks and growth opportunities.

By tracking variables such as visitor origin, purchasing behaviours, and show preferences, they aim to tailor marketing efforts and identify both risks and growth opportunities.

This requires employing data to segment customers and implement predictive analytics for personalised recommendations—similar to models used by companies like Amazon.

In the journey to improve personalisation, data democratisation has been a key focus, with tools like Power BI empowering various departments to self-serve and analyse data without needing deep technical expertise.

This emphasis reflects an industry-wide trend, where data analytics and visualisation have emerged as top priorities for CFOs aiming to drive cost optimisation.

By empowering teams with accessible analytics tools, the Opera House enables faster, data-informed decisions that enhance both operational efficiency and customer experience.

The Opera House’s funding model also plays a significant role in shaping this strategy; as a government-owned, commercially-driven organisation, it must generate 90% of its own revenue to sustain operations.

The balanced approach combines commercial endeavours with community engagement.

This aims for inclusive programming that appeals to a wide audience while staying financially viable.

Technology and data analytics enable them to align with strategic goals, optimise operational costs, and enhance visitor engagement, all while maintaining compliance with government standards.

The Sydney Opera House follows a diversified revenue model that includes food, beverage, tourism, and events.

This allows for resilience and the ability to reinvest in community initiatives, like free events, educational programs, and supporting local artists.

Operating as a “not for profit, not for loss” entity, the Opera House maintains a circular economic model where revenue from commercial activities supports cultural and artistic endeavours.

They manage a balance between commercial success and artistic risk, much like an airline’s fixed cost structure—once a show is scheduled, the costs are incurred regardless of attendance.

The Opera House evaluates investment based on both cost-effectiveness and customer experience enhancements, such as improvements to their website and digital features like seat previews, to drive revenue and minimise customer friction.

Jon explains how they prioritise collaboration across IT, finance, and marketing to align technology spending with value creation for customers, emphasising a balanced, customer-driven approach in both operational and artistic investments.

This collaborative focus is especially pertinent as unclear responsibilities and collaboration issues between IT and finance have increased by 100% industry-wide.

By fostering synergy across these functions, the Opera House ensures that its investments are strategically aligned with its goals while avoiding inefficiencies that can arise from siloed operations.

Key takeaways:

- Circular, community-focused revenue model: The Opera House operates a self-sustaining, not-for-profit model that reinvests commercial revenue into community initiatives, education, and supporting local artists, balancing cultural impact with financial resilience.

- Operational risk similar to fixed-cost industries: With a fixed-cost structure like an airline, each event’s costs are incurred upfront. Success depends on ticket sales, so strategic decisions around attendance and break-even points are crucial to maintaining profitability and supporting artistic risks.

- Collaborative investment in customer experience: Cross-functional collaboration between finance, IT, and marketing enables the Opera House to prioritise customer-friendly digital features and cost-effective technology investments, driving both revenue and customer satisfaction by improving digital pathways, such as seat previews and frictionless ticket purchasing.