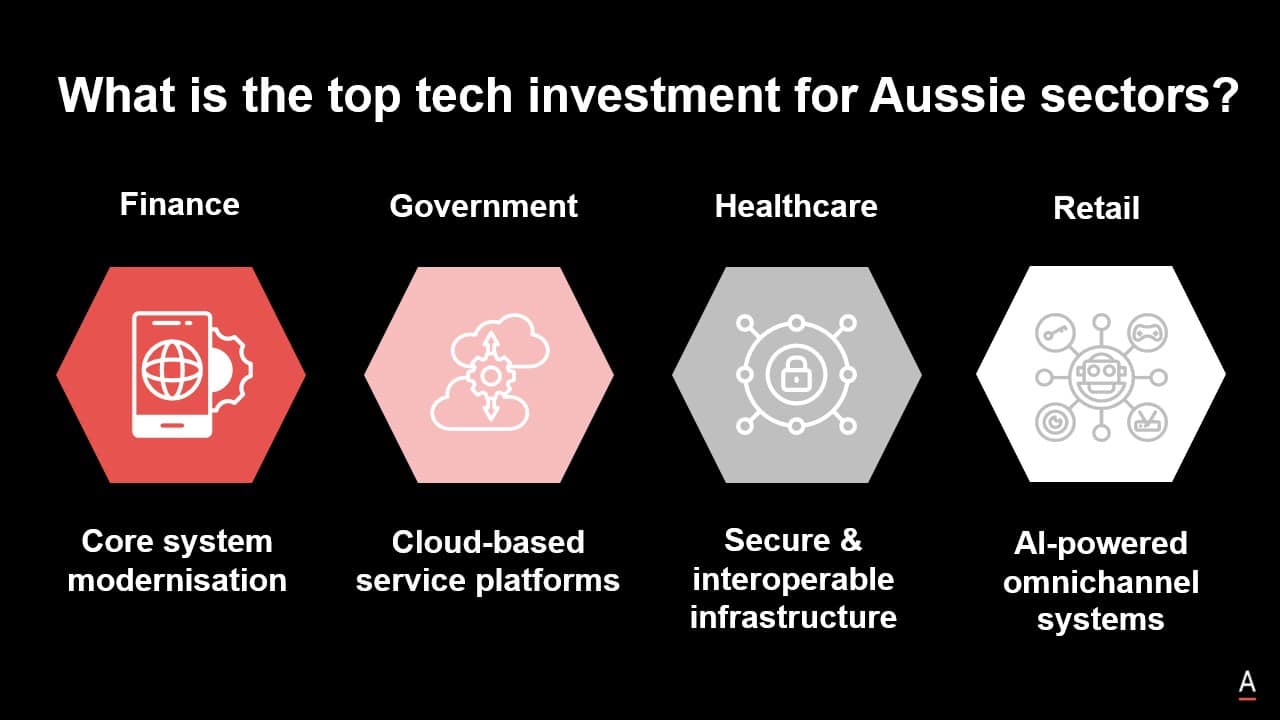

What’s driving tech investment across finance, healthcare, government, and retail?

How are Australia’s top industries investing in tech? Explore the trends shaping finance, healthcare, retail, and government—and where vendors fit in.

How are Australia’s top industries investing in tech? Explore the trends shaping finance, healthcare, retail, and government and where vendors fit in.

Modernisation is no longer a visionary goal.

It’s a live initiative, underway but uneven, across Australia’s public and private sectors.

From data fragmentation and compliance complexity to frontline fatigue and cyber security gaps, leaders are navigating real constraints in real time.

ADAPT’s latest research provides a front-row seat to what’s happening inside government departments, financial institutions, healthcare providers, and retail operations and what vendors must do to move beyond sales and into strategic alignment.

Finance institutions are modernising to stay compliant, customer-focused, and AI-ready

Financial services institutions are accelerating tech upgrades to meet regulatory obligations, reduce operational complexity, and build secure, data-driven platforms.

Application modernisation and cloud transformation remain top goals, with institutions like UniSuper, Tyro Payments, and Macquarie Bank driving phased upgrades and platform consolidation.

Fragmented customer data is hampering omnichannel strategies, with 95% of FSIs still lacking a unified view despite surging demand for AI-driven personalisation.

Compliance requirements under CPS 230 and APRA regulations are non-negotiable, while cyber threats and public trust issues further elevate security.

AI is being widely adopted, but trust, governance, and data quality gaps are slowing enterprise-wide rollouts.

Leaders from UniSuper, Tyro Payments, and Macquarie are aligning tech investment with business outcomes, focusing on resilient infrastructure and responsible AI.

What tech vendors should do:

- Offer modular, phased modernisation that supports core system transformation with minimal disruption.

- Provide secure cloud and integration-ready platforms that simplify compliance with APRA, CDR, and CPS 230.

- Support AI adoption with embedded governance, auditability, and data readiness frameworks.

- Build trust through customer-centric tools that unify data, personalise experiences, and boost omnichannel performance.

Healthcare organisations are modernising under pressure from cyber risk, legacy systems, and workforce demands

CIOs across healthcare are modernising digital foundations to enhance patient care, comply with regulation, and manage cyber threats.

Security is not only a technical requirement but a core component of trust and compliance.

Incidents have prompted renewed urgency around risk management, data protection, and privacy law alignment.

At the same time, infrastructure modernisation is top of mind.

CIOs are upgrading core systems to support telehealth, hospital automation, and cloud adoption while ensuring interoperability through standards like HL7 and FHIR.

Security is being embedded into every stage of modernisation, including frontline systems and clinical workflows.

CIOs are also evolving operating models to improve workforce efficiency and care continuity, with digital workplace investments targeting regional and aged care needs.

Meanwhile, advanced analytics and data governance are essential to unify records, drive reporting, and support real-time care decisions.

Organisations such as Cochlear, Bupa ANZ, Estia Health, Virtus Health, and Bolton Clarke are scaling secure infrastructure while building trust in data-led transformation.

What tech vendors should do:

- Provide secure-by-design infrastructure that meets privacy regulations and Essential Eight maturity

- Support interoperable cloud migration aligned with healthcare standards like FHIR

- Deliver modular platforms that improve care coordination, back-office automation, and workforce enablement

- Offer advanced analytics and data governance tools to unify data and enable real-time, insight-driven care

Government agencies are rebuilding from the core to meet rising citizen expectations

Australian government agencies are delivering more digital services, but legacy systems, cloud cost uncertainty, and data silos are slowing transformation.

CIOs are prioritising mission-critical application upgrades, cloud-first strategies, and secure platform interoperability.

Data-driven decision-making is gaining traction, but gaps in governance, analytics capability, and talent persist.

Agencies are also focused on integrating mobile-first public services and unifying digital identities across fragmented systems.

Cyber security and operational resilience are top priorities, with demand for stronger recovery capabilities and citizen data safeguards.

Organisations including the Department of Defence, Commonwealth Superannuation Corporation, Australian Bureau of Statistics, South East Water, Ipswich City Council, and Sydney Opera House are advancing cloud efficiency, data governance, and cross-agency collaboration.

What tech vendors should do:

- Deliver secure, modular systems that support phased modernisation of core government services

- Provide cloud platforms with built-in compliance, usage monitoring, and cost transparency

- Enable real-time, secure data sharing using standardised integration and analytics frameworks

- Support mobile-first and multi-channel government service platforms with authentication and accessibility tools

- Build resilient systems with embedded risk management, incident response, and business continuity features

Retailers are investing in CX, AI, and security while managing legacy systems and integration fatigue

Australian retailers are funnelling investment into modernisation, customer experience, and intelligent automation to stay competitive.

Budgets are shifting toward back-office and infrastructure upgrades to optimise cost and performance.

Omnichannel engagement is the top priority, with retailers striving to unify digital and physical experiences across platforms.

However, integration challenges persist.

Legacy applications remain common, and real-time data visibility is still a work in progress.

Cyber security is climbing the agenda, driven by increased attack volumes and consumer expectations for privacy and trust.

At the same time, AI adoption is expanding rapidly, with generative AI seen as a lever for both personalisation and operational efficiency.

Coles, Woolworths, and the broader Australian Retailers Association highlight a focus on agile deployment, demand forecasting, and connected experiences. Platforms that simplify integration and support real-time decisions are increasingly essential.

What tech vendors should do:

- Support application integration with robust APIs, prebuilt connectors, and real-time data synchronisation

- Deliver scalable AI tools with embedded governance and data readiness support

- Offer omnichannel platforms that link inventory, fulfilment, and customer engagement

- Strengthen security posture with solutions tailored to retail transaction environments and data privacy needs

Across all four sectors, the message is clear: leaders are asking for partners, not just providers.

They want vendors who understand the local constraints, connect their solutions to boardroom priorities, and support incremental, low-risk modernisation.

Whether it’s enabling AI-ready data in finance, secure CX in retail, interoperable care in health, or whole-of-government agility, vendors that tailor to sector-specific needs will build trust and unlock long-term growth.

For deeper insights, explore the full articles on each sector via ADAPT’s resource centre.