Over 650 tech leaders reveal where AI, cyber, and modernisation strategies fall short. Reset your GTM for H2 with ADAPT’s latest insights.

In a crowded market competing for just 45 minutes of executive mindshare each month, every interaction matters.

The midpoint of 2025 offers a critical moment to reset GTM strategies, aligning more closely with enterprise buyer expectations and their internal realities.

At ADAPT’s recent Mid-Year GTM Checkpoint webinar, Matt Boon, Senior Research Director, and Gabby Fredkin, Head of Analytics and Insights, unpacked the biggest challenges shaping GTM strategy for H2 2025.

Their insights draw from surveys with over 650 enterprise technology leaders in H1, including CIOs, CISOs, Chief Data Officers, and Heads of Digital from Australia’s top private and public sector organisations.

The session revealed the disconnects slowing down enterprise innovation and identified where technology providers can better support traction in H2.

Despite continued investment, the second half of 2025 will demand sharper alignment between business value and delivery outcomes.

CISOs are blocked by legacy systems and competing priorities

Security leaders are under pressure to support business growth while controlling risk.

Their ambitions are increasingly aligned with enabling innovation and customer outcomes.

Yet three barriers continue to stall progress: insufficient resourcing, legacy technology, and limited business support.

Despite these constraints, 72% of CISOs are prioritising AI governance, and 62% are focused on identity and access management.

Both are seen as foundational for securing the broader tech stack, especially as more AI tools are introduced across the organisation.

However, resource constraints remain the top challenge, closely followed by competing business priorities.

These leaders are forced to make trade-offs between control and enablement.

Many report struggling to gain support from the business for compliance-led initiatives.

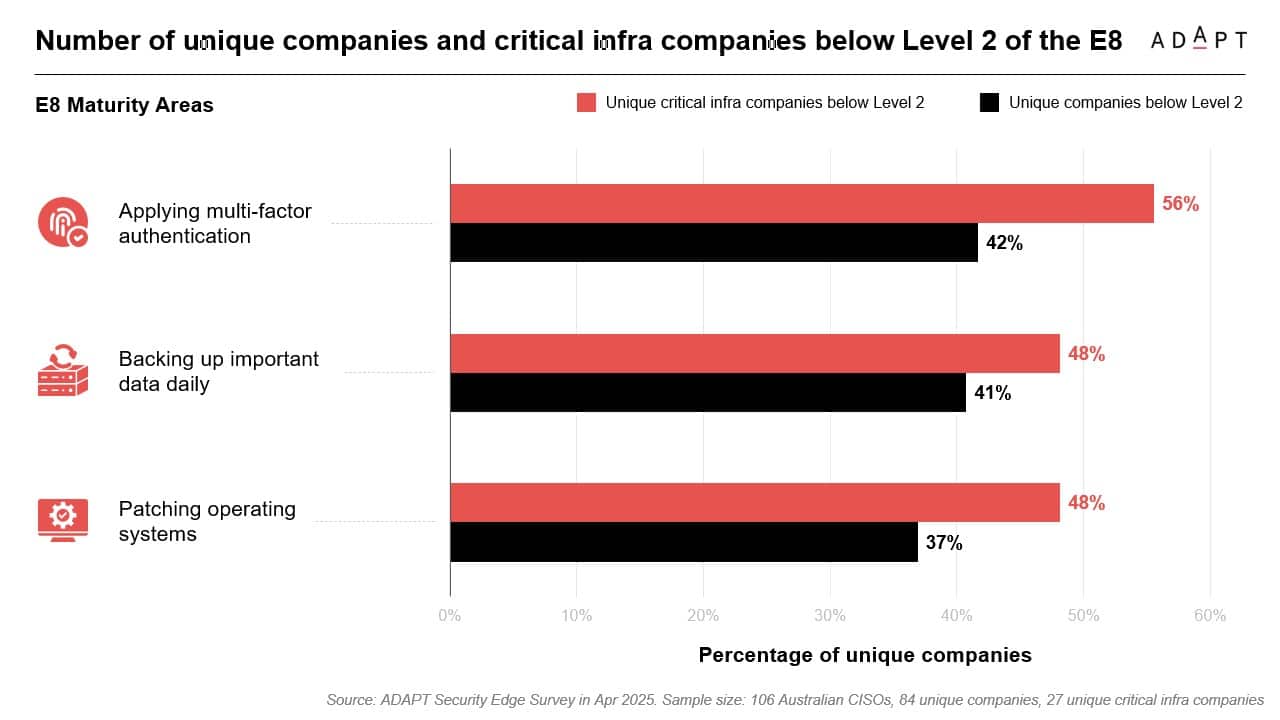

Across critical infrastructure sectors, maturity levels remain low.

Only 44% of surveyed organisations in this group meet Level 2 requirements for Essential Eight controls like MFA, daily data backups, and OS patching.

The result is a growing gap between public policy expectations and internal capability.

CIOs need help justifying value, not expanding vision

CIOs are stuck in the middle of transformation programs that are outpacing their ability to measure and prove value.

Modernisation remains the top priority, with most CIOs investing in ERP, CRM, and HRIS refreshes.

But funding is tight, and the pressure to demonstrate ROI is escalating.

Many CIOs are shifting toward an agile approach that replaces long-term roadmaps with directional alignment and real-time reprioritisation.

But even with this pivot, friction remains.

Legacy systems still dominate, cost visibility is low, and most CIOs lack clarity on what is truly delivering business value.

The credibility gap is growing.

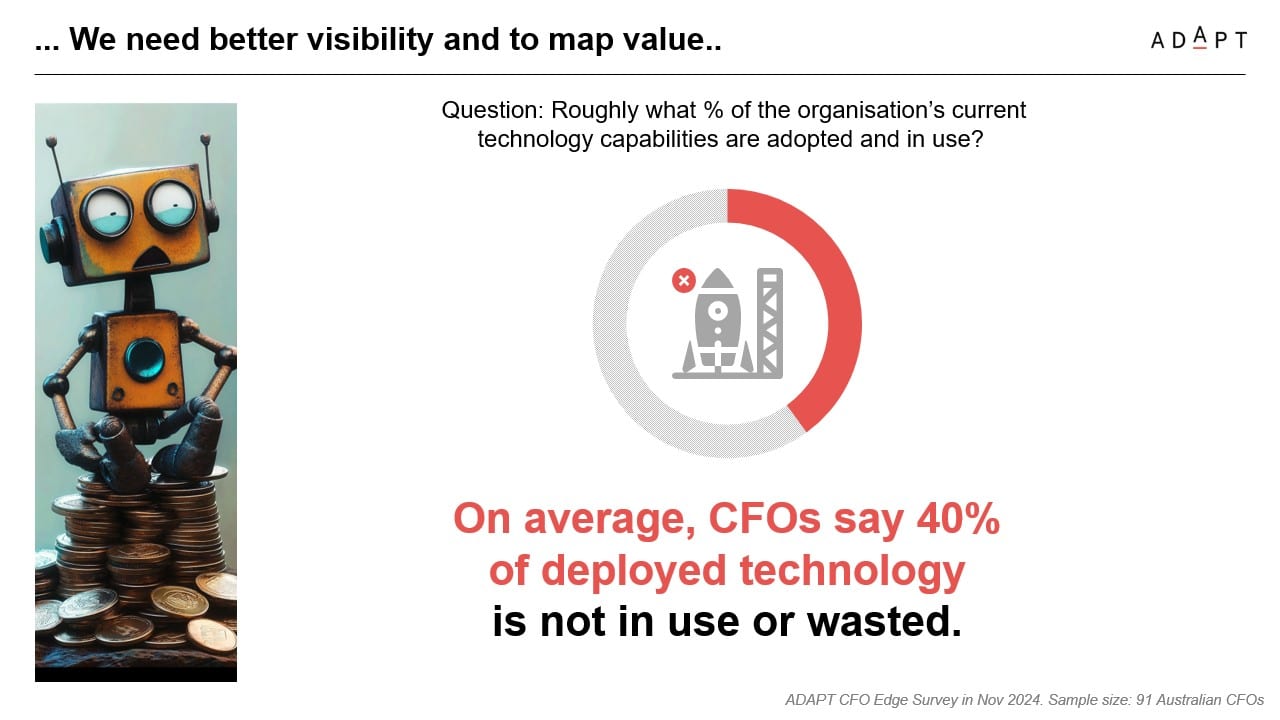

On average, CFOs estimate that 40% of deployed technology is unused or wasted.

Without clearer business alignment, CIOs are struggling to justify new investment, even when budgets are stable.

CIOs do not want more vision statements.

They want execution, transparency, and examples.

They want to see proven outcomes from peers in their sector and use that proof to navigate internal friction and finance scrutiny.

Digital and data leaders are hitting AI adoption walls

While GenAI pilots have surged, meaningful deployment remains narrow.

Administrative tasks and code generation are the most common use cases.

Adoption in decision-making and CX remains low.

Only 20% of CDOs say they are effective at using data to improve customer experience, and just 21% rate their organisational data quality as mature.

The core issue is foundational.

Only 23% of digital and data leaders report having formal AI training programs.

A further 38% say their organisation only has policy documents in place.

This is risk reduction by compliance, not enablement through capability.

Leaders are also under pressure to show value quickly.

45% percent of CDOs expect to see value from digital and automation initiatives within a year.

But with low maturity and weak adoption strategies, these expectations are rarely met.

Despite the appetite, AI value realisation is falling short.

Infrastructure leaders are rebalancing cloud strategy

Public cloud workloads have dropped from 46% in 2024 to 31% in 2025.

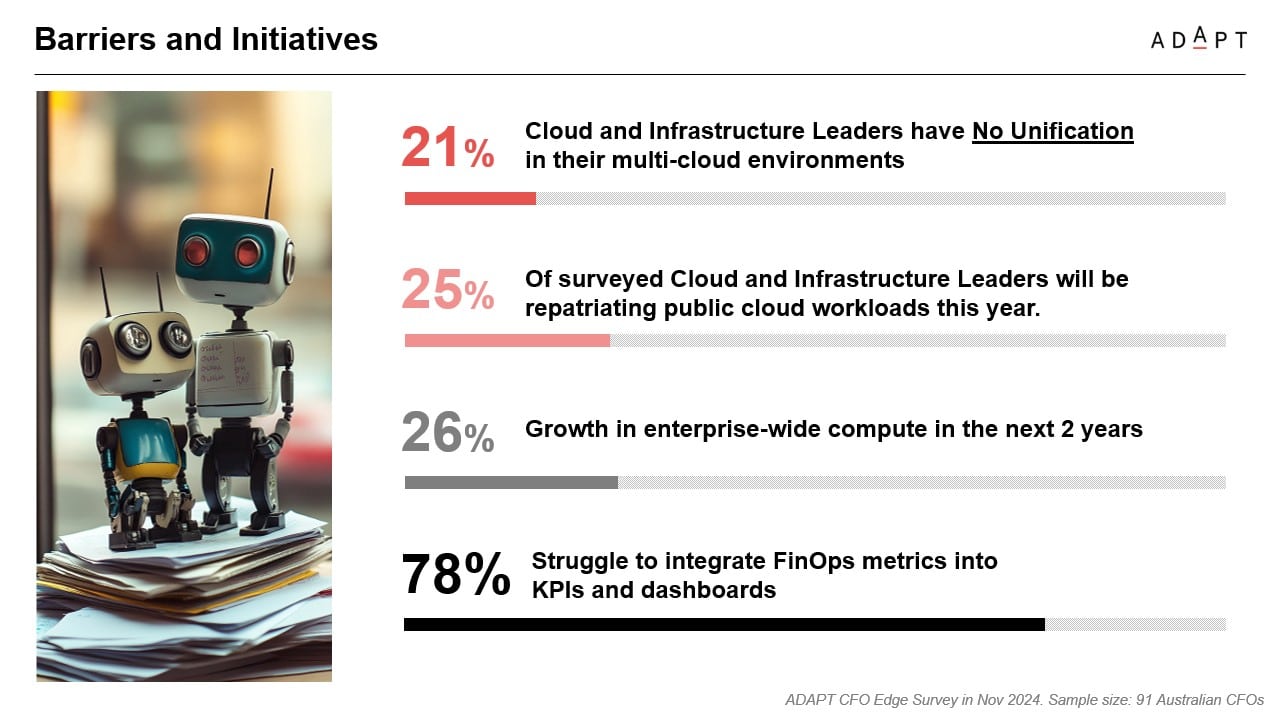

Hybrid environments are on the rise, and 25% of leaders plan to repatriate workloads this year.

The shift marks the end of cloud-first thinking.

This is a cloud correction era driven by escalating costs, rising governance concerns, and AI-fuelled data volumes.

By 2026, public cloud is expected to represent just 52% of workloads, with hybrid increasing to 24% and private to 16%.

By 2027, hybrid is forecast to rise again to 24%, while public cloud slips to 36% and private rises slightly to 17%.

Infrastructure leaders are under pressure to support compute growth without blowing out costs.

Enterprise-wide compute needs are projected to grow 26% over the next year.

At the same time, 78% of leaders report struggling to integrate FinOps metrics into their KPIs.

Cloud maturity gaps are now stalling ERP migrations and inflating cost overruns.

Observability and cloud cost optimisation are the top investment areas, as leaders scramble to restore control.

Recommended actions for tech vendors

To stand out in H2 2025, vendors must be enablers of outcomes.

- Target the friction and the ambition – Buyers know what they want to achieve. What they need is help overcoming the execution gaps caused by poor data quality, underused platforms, and legacy drag.

- Lead with sector-specific proof – Enterprise buyers want local benchmarks and relatable examples. Generic capability decks will not land. Relevance now depends on understanding the constraints and language of each vertical.

- Map outcomes to internal realities – CFOs are gatekeepers. CIOs need help linking platforms to business results. Avoid feature-led pitches and start with clear use case value mapping.

- Shift from tactical to embedded – One-off tools will be deprioritised in favour of embedded capabilities that align with workflows. Vendors must show how their solution integrates, scales, and sustains over time.

Enterprise leaders are under pressure to scale transformation, adopt AI safely, and deliver value faster.

But execution is constrained by complexity, disconnected teams, and capability gaps.

Every proposal must help buyers clear blockers, accelerate outcomes, and reduce uncertainty.

The most valuable partners will be those who embed deeply, solve decisively, and contribute to lasting impact across the business.

Watch the full webinar recording to learn what Australia’s C-suite are prioritising for FY25–26 investment.