3 Ways to Protect Your Business from Inflation

Amid rising global interest rates, CFOs play a key role in aligning businesses, assessing risks, and ensuring resilience in a changing financial landscape.

As interest rates are on the rise in Australia and globally, a diverse array of stakeholders, including investors, borrowers, retirees, and business leaders, are looking into digital transformation, adopting emerging technology, and upscaling the workforce to build new efficiencies

Businesses are tasked with the critical responsibility of reassessing their risk management strategies and enhancing their overall resilience during this period of heightened uncertainty.

This shift in the financial landscape follows a decade marked by the gradual decline or extended stability of official cash rates.

Consequently, it raises essential questions about its potential impact on the Australian economy.

Amid these ongoing financial uncertainties, the imperative for Chief Financial Officers (CFOs) to foster collaboration and establish robust organisational alignment is becoming increasingly crucial.

This collaborative effort is paramount as businesses grapple with a growing array of risks.

CFOs need access to tools and strategies that are advantageous and vital for success in this dynamic financial climate.

Challenge 1: Inflation

Australia’s economy is inching forward with a 0.4% growth in the June 2023 quarter, as reported by the Australian Bureau of Statistics (ABS).

However, beneath this façade lies a troubling trend for households. GDP per capita has fallen by 0.3%, marking the second consecutive quarter of decline and prompting some to label it a “per-capita recession.”

Household savings have reached their lowest point since 2008, with the saving-to-income ratio falling for seven consecutive quarters to 3.2%.

Rising interest payments on dwellings, increased income tax, and the growing cost of living are the culprits behind this decline.

Australians are also tightening their belts in response to inflationary pressures, with household spending seeing only a marginal increase of 0.1%, primarily on essential goods and services.

Businesses must heed these underlying economic challenges, which can significantly impact consumer behaviour and necessitate strategic adaptations.

Challenge 2: Rising Interest Rates

Since February 2002, Australia has seen an average official cash rate of 3.35%, peaking at 7.25%. This rate serves as the foundation for interest rates set by lending banks. In sharp contrast, it hit a historic low of 0.1% from November 2020 to April 2022, prompting economists to view it as an optimal borrowing window.

However, the financial landscape has shifted significantly since then, raising concerns about the repercussions of increasing interest rates.

Australians have grown accustomed to a prolonged period of low-interest rates but now face the prospect of their borrowing costs potentially doubling. This transformation has substantial business advantages, especially regarding investment, expansion strategies, and workforce management.

As interest rates gradually rise alongside the escalating cost of living, Australian businesses are compelled to seek efficiencies and reduce operational expenses.

It is crucial to acknowledge the increase in prices for goods and services, as such actions risk alienating clients and customers.

Furthermore, the recent decision by the Reserve Bank to raise interest rates by 25 basis points in early May, pushing the official cash rate to 0.35%, is expected to significantly impact business margins. This impact will be particularly felt by small to medium enterprises already dealing with substantial debt and limited capital resources.

In response, businesses must prudently navigate this evolving economic landscape to ensure sustainability and foster growth.

Challenge 3: Geopolitical Unrest and Supply Chain Disruption

In the face of unprecedented disruption and strain, businesses in Australia and Asia are confronted with the urgent need to fortify their supply chains for today’s and tomorrow’s challenges.

A recent study, presented by Asialink Business with generous support from Toll Group, meticulously examines the structural pressures affecting supply chains.

This research underscores the critical role of technology, innovation, and e-commerce in forging sustainable and resilient supply networks.

The study surveyed businesses across Australia and the broader region, bringing to light the disproportionate impact of supply chain uncertainty on small businesses.

Alarmingly, 32% of surveyed small businesses express concerns that business restrictions could significantly jeopardise their operational continuity.

In contrast, medium-sized and large corporations report substantially lower figures of 15% and 8%, respectively.

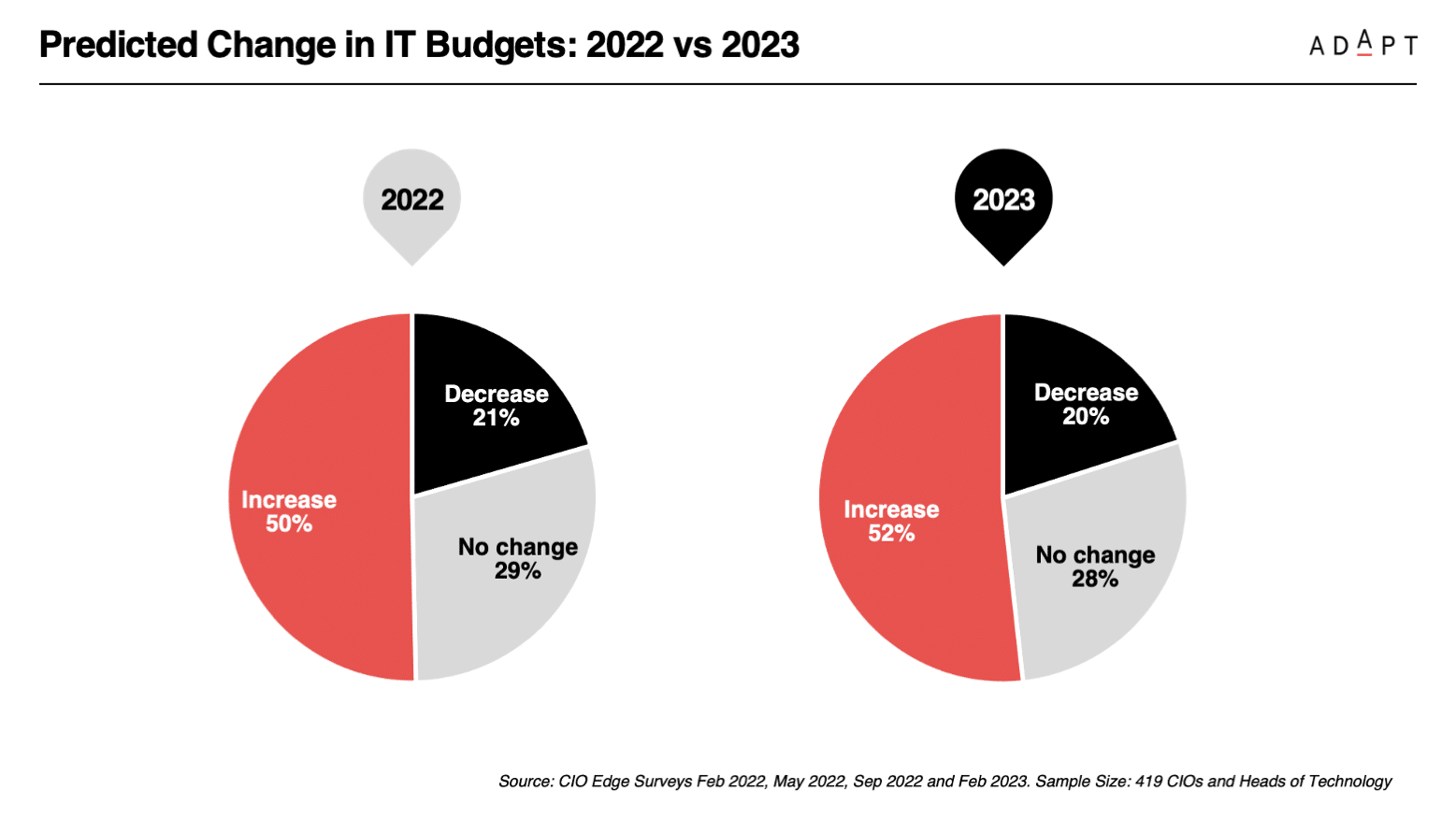

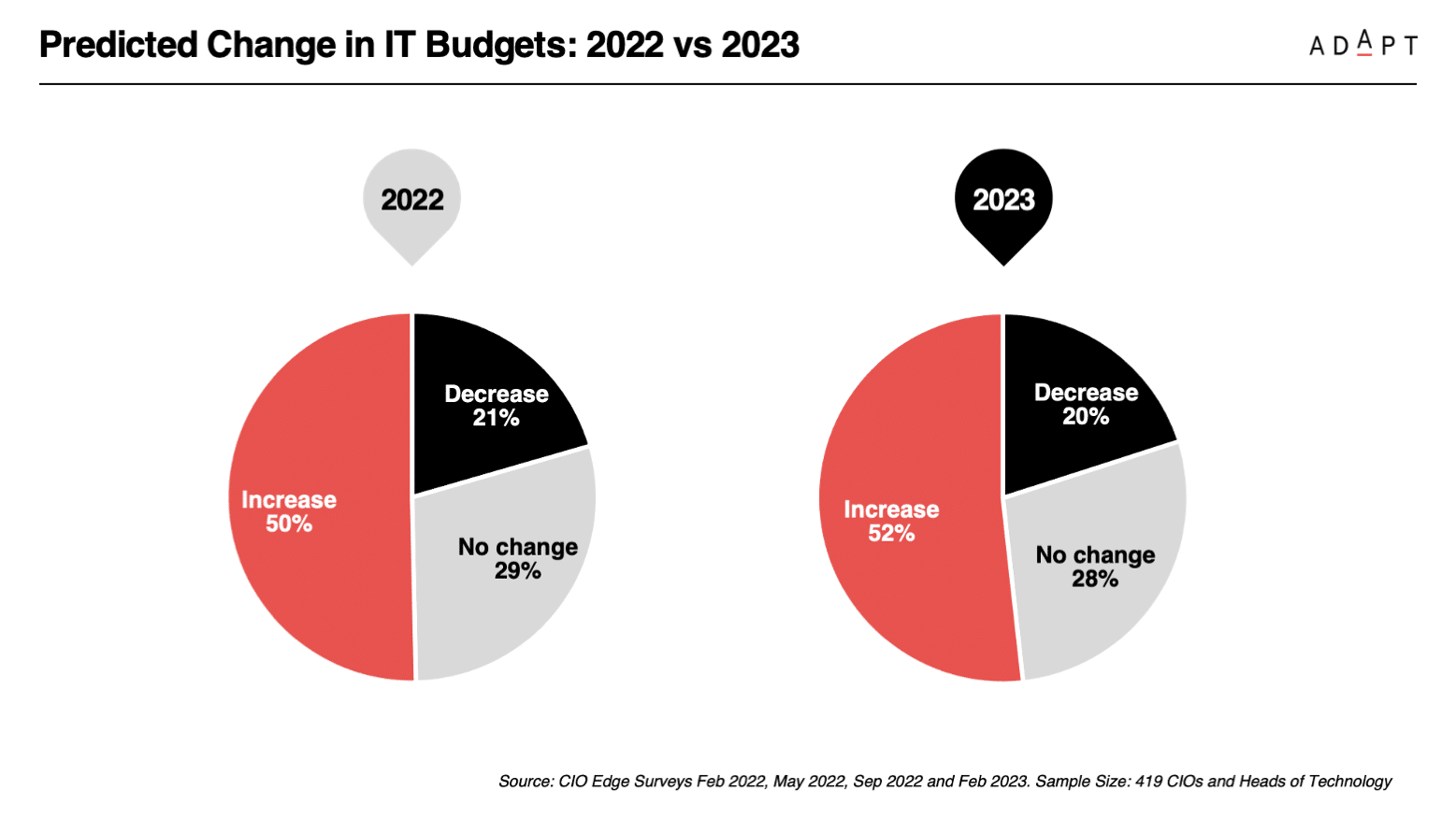

As the 2022/23 financial year draws to a close, 52% of corporate leaders anticipate an increase in their IT budgets.

This expectation follows a period of interest rate hikes and ongoing economic uncertainties.

Remarkably, this budget increase aligns IT spending with an appropriate percentage of annual revenue, suggesting that rising interest rates may not impede funding initiatives in the same way as the COVID-19 pandemic did.

However, alongside the optimism for budget increases, a significant portion of respondents anticipate either a decrease or no change in their budgets.

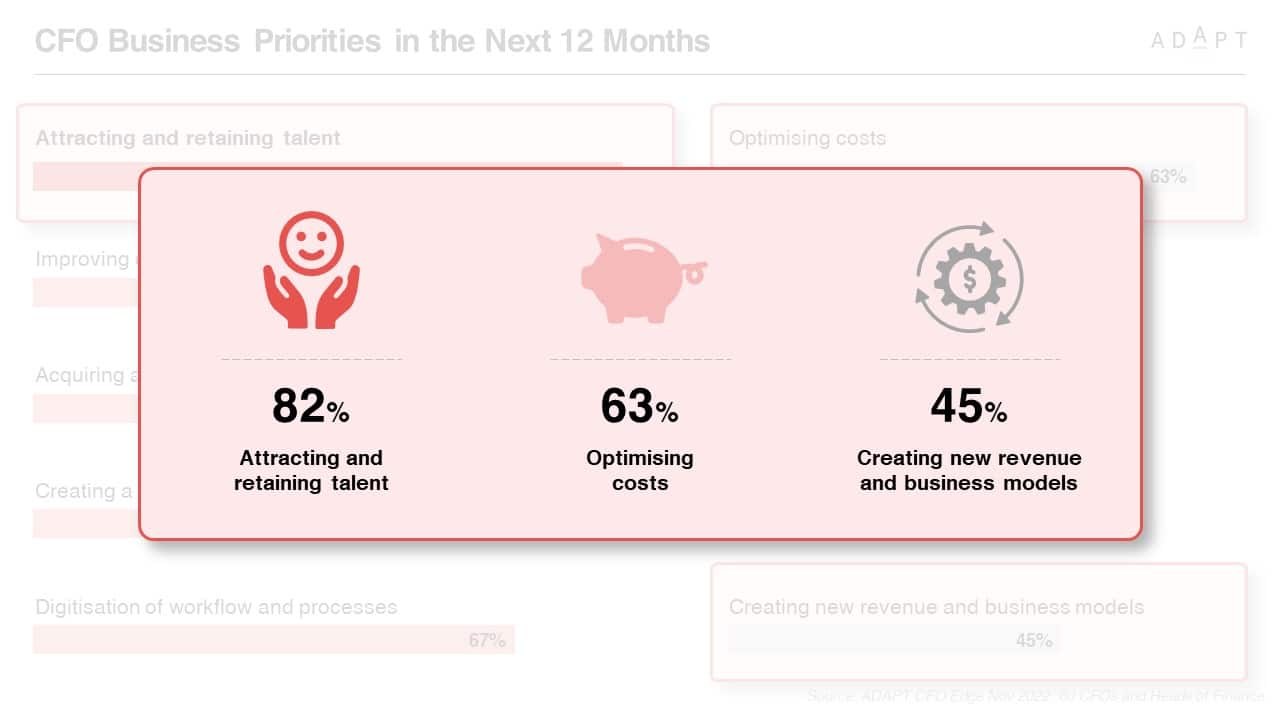

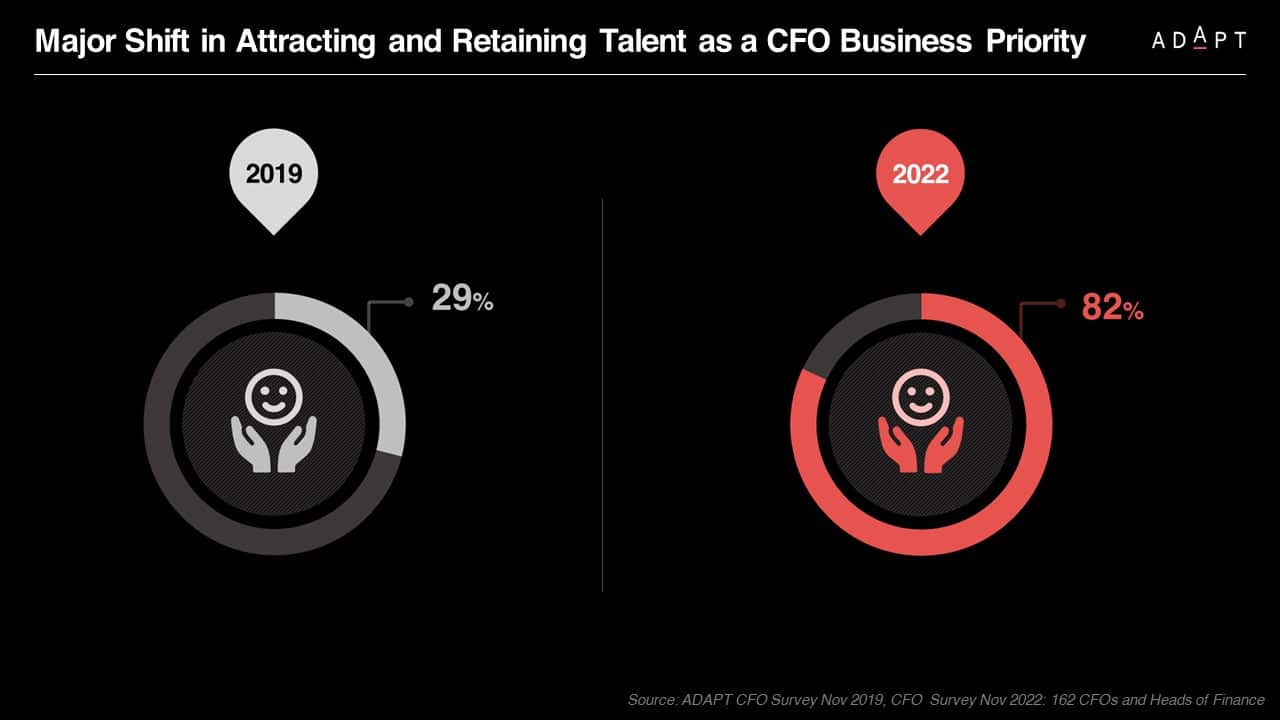

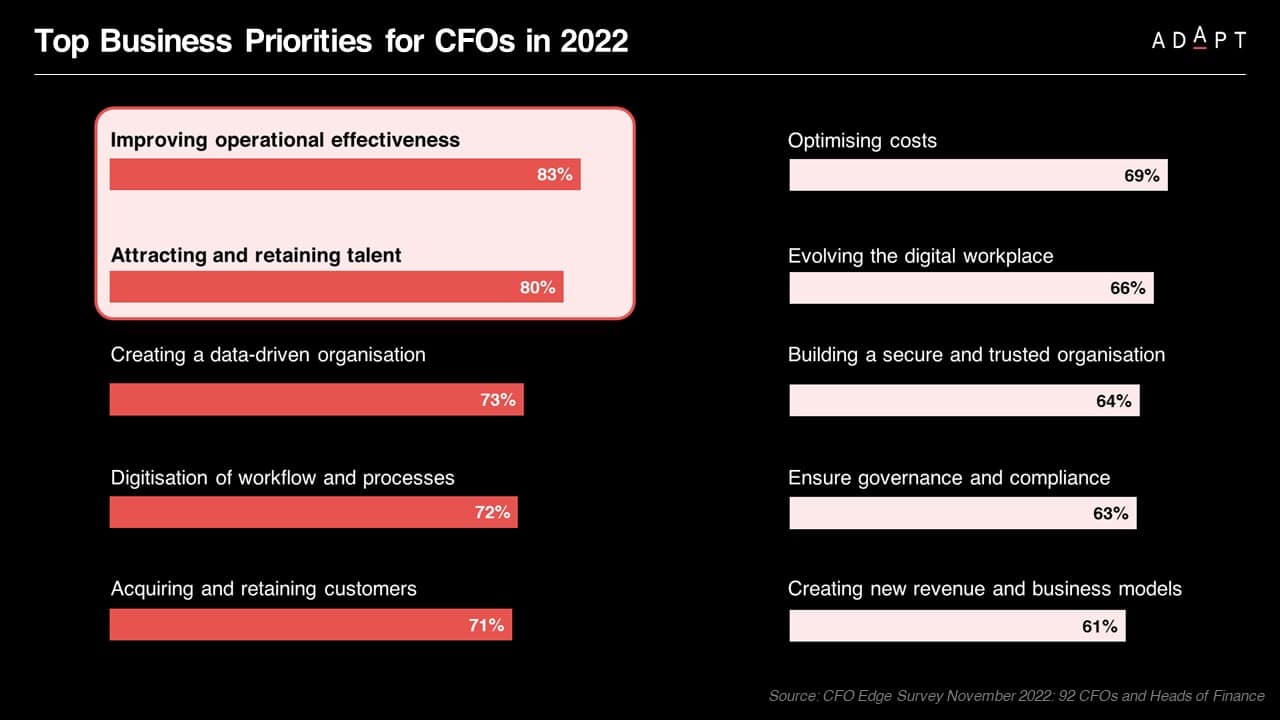

In light of this, an ADAPT in Nov 2022, outlines the priorities of CFOs moving into 2023.

These priorities centre around enhancing operational effectiveness, fostering a data-driven organisation, and digitising processes.

For corporate executives, aligning IT budgets with these business priorities becomes paramount, ensuring that investments add value and contribute to building a future-proof organisation.

Amidst this landscape, corporate executives navigate a distinctive set of challenges from geopolitical unrest and supply chain disruptions.

The world is undergoing a remarkable transformation marked by geopolitical uncertainty, with a departure from globalisation principles and a surge in protectionist policies.

This shift has far-reaching implications, affecting international trade agreements, data privacy regulations, and global technology partnerships.

Simultaneously, supply chain disruptions, catalysed by events such as Russia’s invasion of Ukraine, have skyrocketed commodity prices—including oil, natural gas, and coal.

This disruption reverberates throughout the supply chain, impacting the procurement of critical hardware components, data centre operations, and overall technology costs.

In a nutshell, corporate executives are at the intersection of geopolitical turbulence and supply chain volatility. Their role in ensuring business continuity and resilience is pivotal.

By embracing the strategies below and staying attuned to geopolitical developments, IT leaders can proactively navigate these challenges and harness technology-driven solutions to thrive in an uncertain world.

Solution 1: Digital Transformation and Technology Adoption

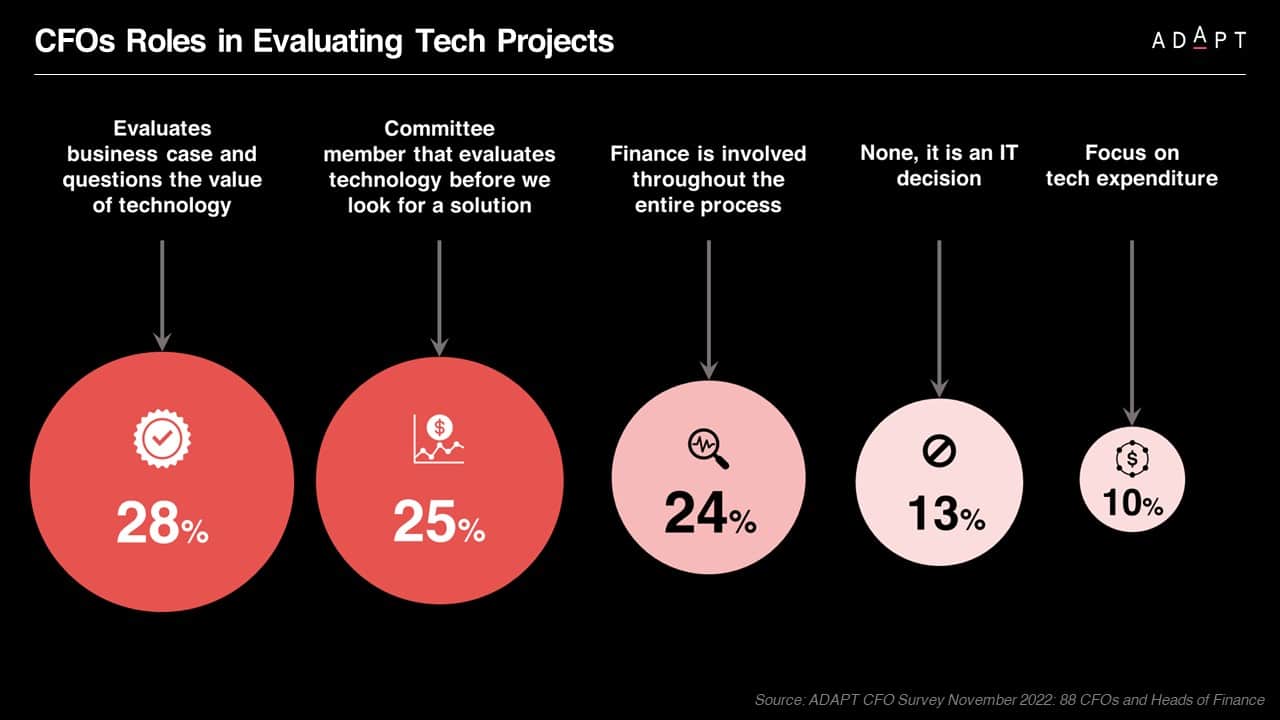

In a survey conducted by ADAPT in 2022, 96 CFOs from Australian-based organisations shed light on evaluating technology initiatives and the top expected transformations for finance.

Of the survey respondents, 52% are affiliated with companies employing over 2,500 people. These respondents collectively represent organisations that comprise 5% of the Australian workforce and contribute 15% to Australia’s $1.9 trillion Gross Domestic Product (GDP).

Australian CFOs are at the forefront of driving digital transformation and technology adoption within their organisations.

By leading financial transformations, quantifying technology’s value, and aligning financial strategies with tech adoption, CFOs can catalyse successful digital journeys that position their organisations for long-term growth and resilience.

- Embracing Financial Transformation in 2023

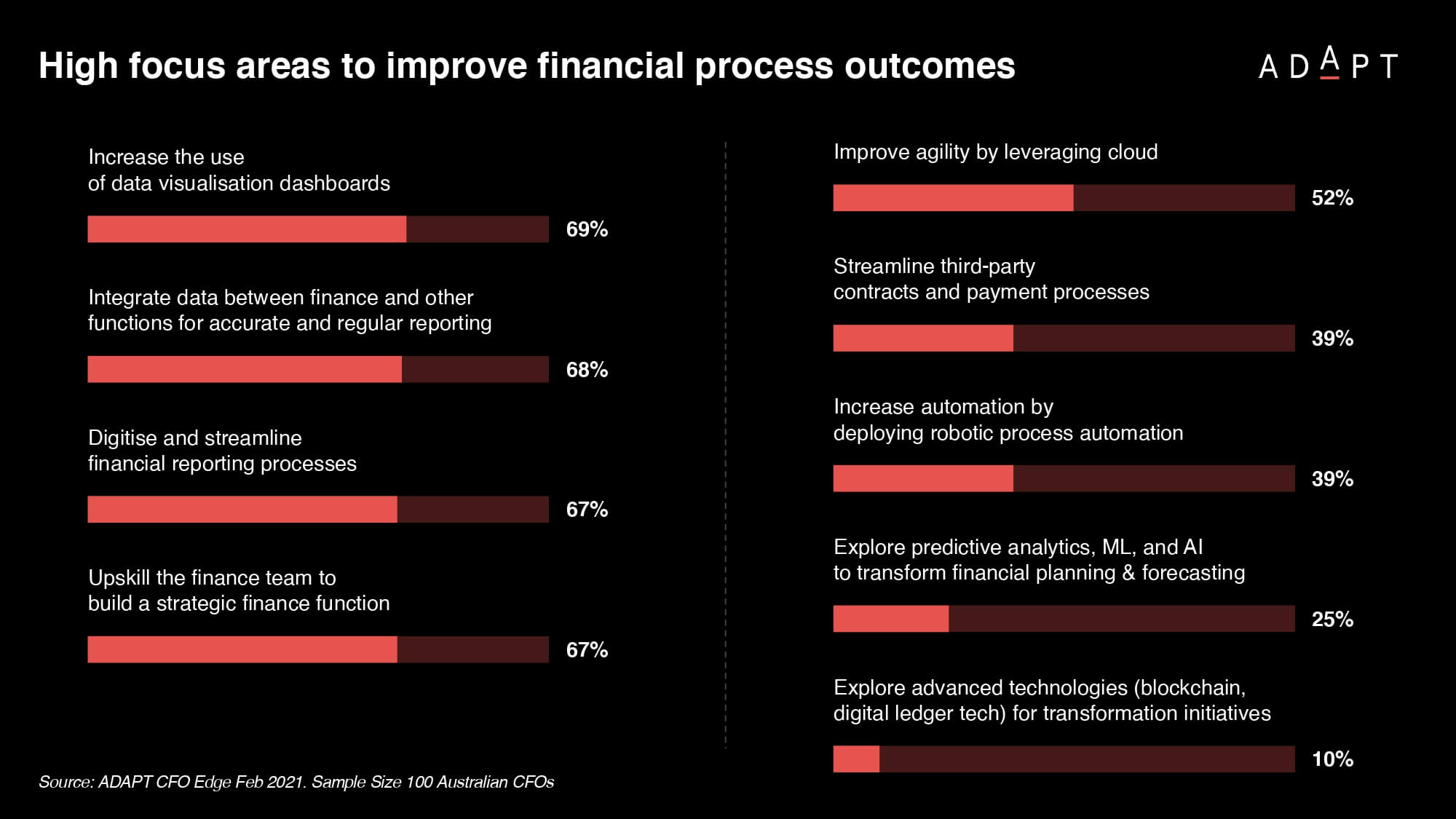

Challenge: 2023 strongly emphasises data-driven decision-making, with one-third of the respondents already investing in dashboards and financial data integration.

Solution: CFOs should lead in driving financial transformation by collaborating closely with IT teams. Implementing FinOps methodologies and strategies ensures optimal value extraction from cloud projects, making technology investments more efficient and ROI-focused.

It’s also worth noting that data-driven decision-making will continue to have a big impact in 2024.

- Quantifying the Value of Technology Initiatives

Challenge: Many CFOs limit their involvement in technology initiatives. 28% of the respondents conclude their assessment at the business case-proof stage.

Solution: To drive digital transformation, technology leaders and IT suppliers should communicate clearly, using metrics and numbers to help CFOs make informed decisions. CFOs should also become more deeply involved in the entire technology project delivery process to maximise value creation.

- Financial Planning and Forecasting in a Tech-Driven Landscape

Challenge: Economic uncertainties, inflation, and supply chain disruptions require CFOs to navigate complex financial planning and forecasting, for which an astounding 78% of the respondents feel prepared.

Solution: Prioritise spending based on the value technology investments can generate, particularly during turbulent times. Harness the power of real-time insights through increased dashboard adoption and seamless financial data integration to enhance decision-making and adapt to rapidly changing environments.

Solution 2: Upskilling Workforce to Adapt to Technologies

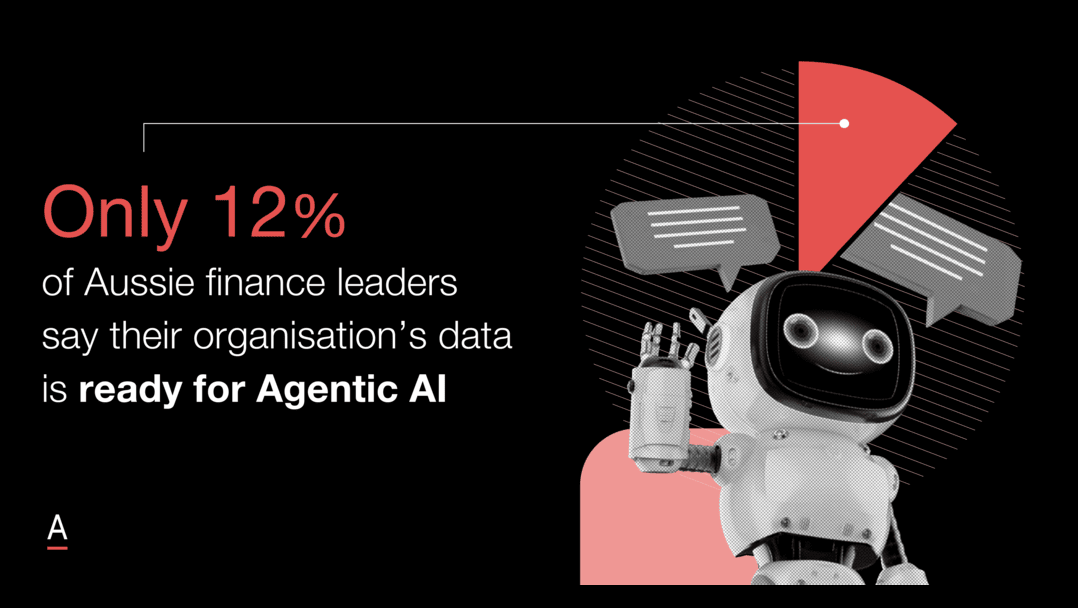

The imperative to keep pace with technological advancements cannot be overstated. A recent ADAPT study, published in 2023, reveals a striking reality: a mere 41% of business risk mitigation workflows are effectively digitised.

An ADAPT Persona Mapping report published in 2023, indicates that 80% of CFOs, CIOs, and CHROs consider skills shortages to be their third most significant obstacle to execution.

These sobering statistics are clearly calls to action, emphasising the critical importance of workforce upscaling.

In an era of relentless technological progress, businesses must ensure employees possess the necessary skills and adaptability to navigate these emerging technologies seamlessly.

The comprehensive approach advocated in the study underscores the breadth of skills required, ranging from foundational digital literacy to specialised areas like coding, data analysis, and artificial intelligence.

The urgency of such holistic training is underscored by the evident gap between existing employee skills and those demanded by today’s fast-evolving tech landscape.

Ultimately, the study’s findings present a compelling directive: organisations must empower themselves to harness technology’s full potential.

Achieving this hinges upon equipping their workforce with the tools to remain agile and responsive amidst ongoing technological disruptions.

By embracing this strategic imperative, businesses can not only survive but thrive in an increasingly tech-driven world where adaptability and innovation are the cornerstones of success.

Solution 3: Building a Data-Driven Culture that Makes Informed Decisions and Innovates

CFOs are taking decisive steps to nurture a data-driven organisational culture, redirecting their investments towards transforming data into actionable insights.

This shift from the traditional role of record custodians to trusted advisors equips CFOs with a unique blend of conventional and contemporary metrics to safeguard value and propel business growth.

An impressive 73% of CFOs are wholeheartedly committed to instilling a data-driven ethos within their organisations.

Data’s role in decision-making is paramount, given the inherently mathematical nature of financial planning, analysis, and management accounting.

An ADAPT expert presentation by Dr. Ian Oppermann published in August 2020 underscores the pivotal role CFOs play in steering their organisations towards data-driven practices.

By emphasising the criticality of data in the decision-making process, CFOs can:

- Leverage automation: This reduces time consumption and eliminates the potential for human errors.

- Enhance accuracy: Financial decisions benefit from more precise forecasts and predictions.

- Advocate ROI-centric choices: CFOs can champion organisational decisions that promise the highest return on investment.

A comprehensive exploration of this transformative journey from record-keeping to insights generation is documented in an ADAPT report, published in June 2021.

CFOs consistently identify competing business priorities as the most substantial impediment to technology initiatives.

This sentiment resonates with CIOs, who cite competing priorities as their primary obstacle to delivering technology projects.

Reviewing the top three business priorities of Australian business executives, these personas align closely in three key areas:

- Talent mix and depth: There’s a shared desire for the right combination and depth of talent.

- Operational excellence: The pursuit of operational excellence spans people, processes, and technology strategies.

- Data-driven culture: aspire to foster a data-driven culture underpinned by shared values and understanding.

The CFO holds a higher hierarchical position in many Australian enterprise organisations than technology-focused personas.

As a senior executive, the CFO is well-placed to cultivate a collaborative culture that yields superior technology and business outcomes.

Notably, five of the top ten investment priorities for CFOs in 2023 revolve around data-centric initiatives, underscoring the unwavering commitment to becoming a data-driven organisation.

Financial Planning and Analysis (1st Priority): CFOs understand that robust financial planning and analysis are foundational for informed decision-making.

Through investments in advanced analytical tools and processes, they gain deeper insights into financial data, enabling more precise forecasting and strategic planning.

Business Intelligence (2nd Priority): Business intelligence solutions empower CFOs to extract valuable insights from their data.

These insights inform critical financial decisions and support the development of data-driven strategies that enhance overall business performance.

Data Visualisation (3rd Priority): Data visualisation tools enable CFOs to present complex financial information in a clear and accessible manner.

Investing in these technologies ensures stakeholders can quickly grasp financial insights, fostering better decision-making at all levels.

Forecasting and Planning (4th Priority): CFOs recognise the significance of accurate forecasting and planning in achieving business goals.

Investments in forecasting tools and methodologies allow them to model various scenarios, anticipate financial trends, and make proactive decisions to mitigate risks and seize opportunities.

Data Quality and Integration (5th Priority): Since data is the lifeblood of informed decision-making, CFOs prioritise enhancing data quality and integration.

These investments ensure that financial data is accurate, consistent, and accessible across the organisation, forming the basis for trustworthy insights and strategic actions.

By strategically aligning these investment priorities, CFOs are laying the groundwork for a data-driven culture that empowers their organisations to make informed decisions and drive innovation.

These solutions collectively enhance financial agility, risk management, and overall business resilience in an ever-evolving business landscape.

Conclusion

As inflation and interest rates rise globally, stakeholders express concerns.

Businesses must reassess risk strategies and foster resilience.

CFOs play a pivotal role in aligning organisations amid growing risks, incorporating modern practices to pave the way forward.