How You Can Earn Customer Loyalty Through Ease of Payment

Payments processing is evolving rapidly. Driven by emerging Fintech companies these innovations offer consumers a heightened customer experience via frictionless payments and greater convenience.

Introduction

It is clear from the dialogue of hundreds of digital executive roundtables ADAPT have hosted that payments processing is one of the most dynamic areas in business today. Nearly every public or private organisation needs to accept payments for goods, services or donations.

Businesses recognise that it is critical to keep up with new offerings and best practices in this space. Otherwise, they risk projecting an antiquated image of themselves and losing customers to more progressive competitors.

What you need to know

As an introduction to the discussion, attendees were asked to outline why they were investigating new payment gateways for their organisation at these roundtables. Across all ten of the events that ADAPT hosted, there were several common themes in these responses. These were:

- IT executives recognise that it is important to keep abreast of the rapid changes in payment functionality. Driven by emerging Fintech companies, these innovations offer consumers a heightened customer experience via frictionless payments and greater convenience.

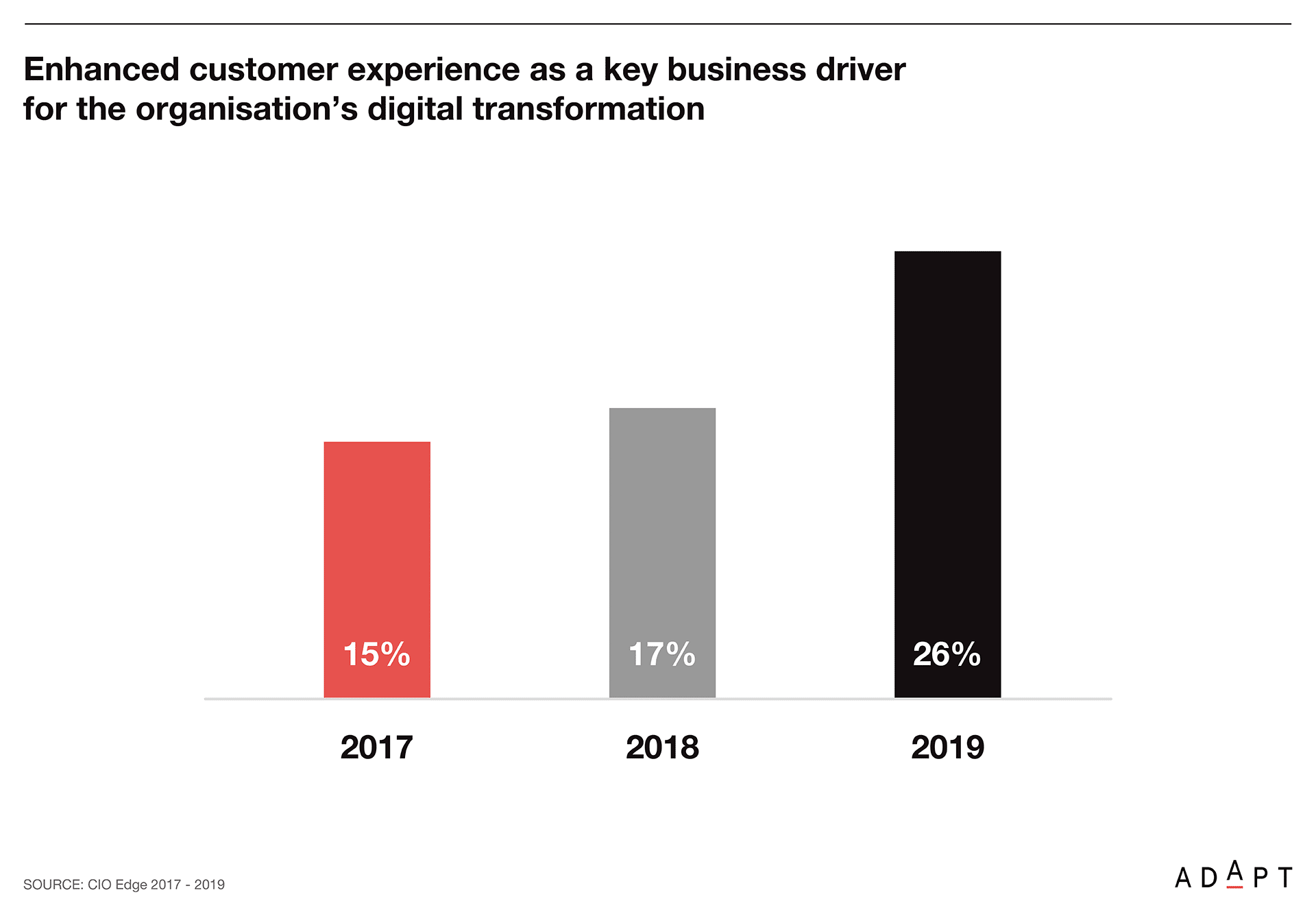

- As the diagram below highlights, IT executives tell ADAPT that improving customer experience is a major driving force in the digital rejuvenation of their businesses.

- New-age digital players like Uber, Apple and Amazon have set new benchmarks for how the customer payment experience can be fast and seamless. Increasingly, customers are bringing these payment expectations to their dealings with more traditional businesses.

- The payment experience is seen as indicative of the brand itself. If it is sleek, flexible and fast, the customers will see they interact with a progressive organisation. If choices are limited and the process is ponderous, clients will regard the brand as old-fashioned.

- There was interest in how the payment process could be better structured to more effectively service clients. For example, could consumers from lower socio-economic groups be offered the option of paying large periodic transactions, (e.g. insurance fees), overtime weekly in smaller components or on a consumption basis.

- The international Chinese consumer is increasingly important to many businesses. In China, Alipay and WeChat have come to dominate the market. Many local businesses see that offering these payment options will help them secure more business from these customers.

- Transactions with most clients are rarely single events. The real challenge for businesses is securing the ongoing, repeat patronage of their customers. The payment process is the culmination of a transaction. If this is cumbersome, clients will be frustrated and could abandon the transaction. If so, they are likely to switch their business to a competitor.

- Customers often interact with multiple financial touchpoints in an organisation, (e.g. a university student could pay for accommodation, meals, gym facilities or library services). If these payment interactions are not consistent, the customer will likely have to re-enter previously captured details. This will be frustrating and cause unnecessary delays for them.

- Besides frustrating customers, outdated payment systems are costly to maintain. Moreover, these payments are usually with old-guard financial institutions who have become accustomed to ‘clipping the ticket’ of every credit-card transaction with large service fees.

What you need to do

The business executive must appreciate the challenges that IT faces in integrating any new payment service into the other business systems in the organisation. This work is seldom straightforward and often costly.

One delegate advised that the introduction of Afterpay as a new payment option required his organisation to modify 15 business processes to accommodate this functionality.

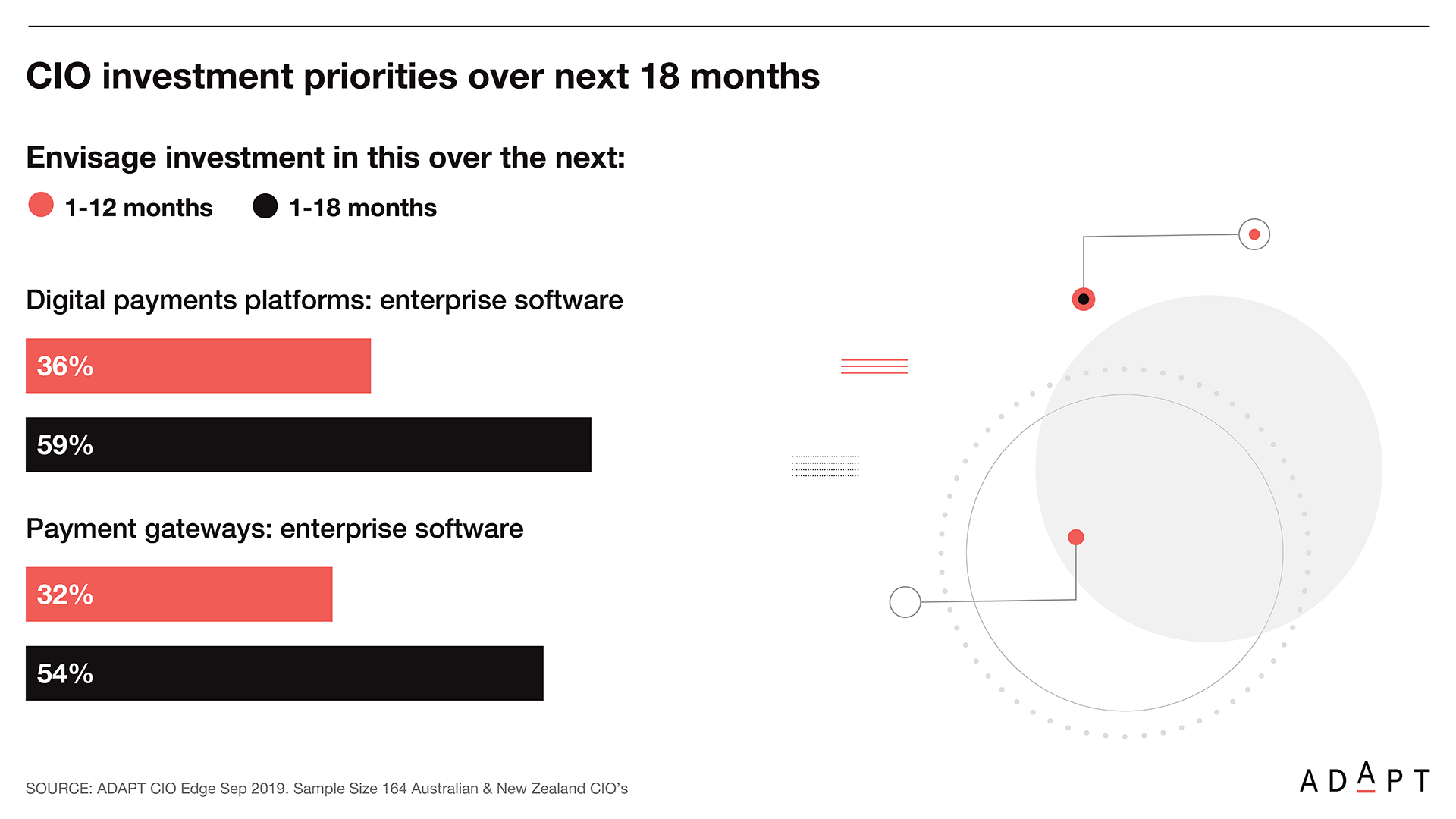

CIOs should join with their local peers who, as ADAPT’s local research reveals, plan to investigate the capabilities of Integrated Payment Gateway products and Digital Payment Platforms over the next 18 months.

These systems connect with payment functionality via an application programming interface (API) to allow for transaction data derived from credit cards and other electronic payments to automatically flow into a business’ accounting or ERP system when a sale is made.

IT must challenge their executives on whether they see incorporating a new payment service as a single integration task or whether they think it is better to create an architectural framework that can rapidly and inexpensively incorporate every new payment functionality that emerges. The former approach is a quick fix.

However, it will exacerbate the overall system integration challenges and add to future costs. It will also mean that run activities rather than transformation initiatives will consume more and more of the corporate IT budget.

Selection criteria to consider in the choice of an Integrated Payments Gateway product include the quality of its application programming interface (API) components, the robustness of its security functionality, the capabilities and user-friendliness of the payment processing features, and the post-sale support resources available for customers and developers.

Minimising fraud is an important implementation consideration. The costs of fraud are, typically, worn by the merchants and not financial institutions. The problems of fraud have been exacerbated by the growing popularity of online commerce where the card is not physically presented to the merchant when the sale is finalised, (i.e. a card not present transaction).

Online payments fraud on all Australian credit grew to $476 million in 2017. [1] This represents 87.5% of all fraud on credit cards in Australia.

How you need to do it

IT executives must take the time to articulate, in layman’s language, possibly using illustrations and videos, a roadmap, (i.e. an architectural framework) that will guide the business in the evolution of its business systems.

This roadmap will provide the principles for how all new payment functionality is integrated into the other systems already in use in the business. Other business units with different requirements are likely allies in need of such a framework.

CIOs need to find ways and stories to motivate their executives to support this roadmap. There will be cost savings in areas like application maintenance.

However, most of the benefits are largely intangible, (e.g. customer experience, operational agility, corporate brand status and cost avoidance), where the financial benefits are difficult to quantify.

An important aspect of the proposition to the executive should be undertaking small scale stand-alone experiments to test new payment functionality. A starting goal should be to simplify the payment process for customers.

These experiments aim to gather evidence that will support wide-scale adoption of the functionality. They can also help answer how corporate conundrums like business unit revenue allocation are handled.

Be attuned to the business language that is used around payment systems. Incorporate this vernacular into your business cases.

Three examples are incremental value (what extra revenue has a new payment service generated?), basket size (are customers spending more with you because of better payment functionality?) and reduced card abandonment (are more customers now concluding their online investigations with a purchase?).

Investigate embracing a microservices architecture approach. It is too costly for a business to build one-off applications to address a need like a new payments service.

Instead, it is better to create an ecosystem of individual applications integrated via standardised APIs. Integral to this approach is a focus on how data can be harnessed to provide enhanced customer outcomes.

Be patient and keep the faith. Two delegates at the roundtables advised that it took around nine months to get traction from their first microservices application. They had to placate the impatience of their executives.

However, the approach is now generating dividends. The reuse of APIs has enabled subsequent modules to be implemented almost ‘instantaneously’.

A microservices approach to payments offers organisations greater independence in their dealings with financial institutions, which, up until now, have mandated that clients use their terminals if they wanted a credit card processing service.

Fintech company offerings using standardised APIs can negate the need for expensive, dedicated terminals.

CIOs concerned with potential card-not-present fraud and card abandonment behaviour by consumers should investigate tokenisation. This enables businesses to securely hold the credit card details of their clients and speeds up online transaction processing.

Explore how you might use payment services to collaborate with others to achieve mutually beneficial outcomes.

For example, AT Local is an on-demand rideshare service operating on Auckland’s North Shore that uses Auckland Transport’s AT Hop electronic fare payment card. It is a joint venture between Auckland Transport and the New Zealand Transport Agency, which aims to reduce traffic congestion and better optimise public bus services.

The bottom line

The pace of change in the payment space is only likely to accelerate. Moreover, the Reserve Bank Governors of Australia and New Zealand, and the Prime Minister of Singapore, have all projected that their countries’ economies will become cashless within the next decade.

CIOs need to prepare today for that eventuality. To do this, they must be able to and seamlessly integrate the new and innovative functionality that Fintech companies worldwide are creating.

The importance of this task was highlighted by recent research [2], revealing that the payment/billing services segment of Fintech is expected to lead to a revenue generation of USD 207.11 Bn by 2023.

This is attributed to the evolution of contactless cards, the emergence of retail-focused fintech companies looking to expand this functionality and the growing popularity of payment apps like Stripe and Amazon Pay.

[1] ‘Online payments fraud in Australia explodes to $476 million’ – iTnews (22/8/2018)

[2] Global Fintech Market (2018-2023) – ResearchAndMarkets (2019)