Facebook Libra – Going Strong Against the Wind

Facebook has finally announced Libra, its long-anticipated cryptocurrency. ADAPT believes it would be a big mistake for Australian business leaders to ignore this move. Australian CIOs and CFOs should watch the blockchain space carefully.

Australian businesses should start thinking about blockchain

“Libra is a simple global currency and financial infrastructure that empowers billions of people.”

“Facebook is already too big and too powerful, and it has used that power to exploit users’ data without protecting their privacy. We cannot allow Facebook to run a risky new cryptocurrency out of a Swiss bank account without oversight.”

Senator Sherrod Brown, US Senate Banking Committee

“It is out of the question that Libra become a sovereign currency. It can’t and it must not happen.”

Bruno Le Maire, Finance Minister, France

Facebook has finally announced Libra, its long-anticipated cryptocurrency. The project can be traced back in 2014 when the company hired David Marcus, former PayPal president, to run its Messenger app. In May 2018 Facebook registered Libra in Geneva. In December 2018 it announced a WhatsApp stablecoin integration project, aimed at the Indian global remittance market, which is worth over US$69 billion annually.

What makes Libra trustworthy?

- Facebook says Libra’s mission is to act as a global currency that can be used for peer-to-peer money exchange, online commerce transactions, and within various apps and gaming platforms.

- It is built on a secure, scalable, and reliable implementation of blockchain.

- It is backed by a reserve of low volatility assets, such as bank deposits and short-term government securities in currencies from stable and reputable central banks.

- The software platform used for Libra is completely open source.

- The software platform uses a new programming language called Move.

- Libra will begin as a permissioned blockchain that will be administered by the consortium of 27 investors plus Facebook.

Major global firms are partnering with Facebook on the initiative, investing US$10 million each to manage their own node. Big name partners include Visa, PayPal, Mastercard, eBay, Stripe and Uber (complete list). To date, 27 participants are known to have joined the Libra consortium, which will administer the currency. If all goes well, Facebook could gather as much as US$1 billion if 100 companies sign up with the launch of the coin.

What makes Libra doubtful?

All this comes at a time when consumer and government trust in Facebook is at an all-time low. After the Cambridge Analytica scandal, the company admitted in April 2018 that it had collected data on 87 million users without consent.

Facebook lost more than US$100 billion in market capitalisation after that incident, but it has largely recovered the support of its investors. It has been less successful in gaining the confidence of the US Commodity Futures Trading Commission or other regulators. It has already received an open letter from the Senators on the US Banking Committee inquiring about the workings of the new coin and security concerns around it.

Regulators and political groups in the USA and Europe have raised significant concerns and are opposing Facebook’s move into the highly regulated financial sector. Its past record of showing disregard for privacy and using personal data for doubtful purposes has encouraged regulators’ condemnation of Facebook’s big move into cryptocurrency.

It may seem ironic for regulators to be concerned about a financial system that is already fragile and lacks consumer trust after the 2008 global financial crisis. A greater reason for concern is the fact that many consumers are genuinely struggling with existing financial systems. As the recent Australian Royal Commission showed, the financial system is rife with hidden costs and complexity and traps for unwary consumers.

Another reason the authorities may be concerned is that Libra will provide a new and accessible financial system to the 1.7 billion adults worldwide who remain outside of the current financial system. This potentially poses a threat to the regulators’ ability to control their world.

Pre-empting regulatory scrutiny, Facebook has appointed Ed Bowles, the former head of public and regulatory affairs at UK’s Standard Chartered Bank, as its Director of Public Policy to promote Libra. It seems Facebook it is preparing itself to answer questions from the US Senate and other regulatory authorities with strong logical arguments around the working of Libra and why it will be much more secure than Bitcoin and other cryptocurrencies.

Cryptocurrencies based on blockchain are highly dependent on trust. They are not secure by design – they can be breached and hacked into. The most recent attack on a Japanese cryptocurrency exchange put more than US$500 million into the hackers’ account. Regardless of its claims that Libra will be different, it’s hard to say how much trust Facebook can garner after its less than honest past and the demonstrable security problems with cryptocurrencies.

Libra blockchain works differently

Despite these problems, it is likely that Facebook money – a.k.a. project Libra – will become a worldwide phenomenon, even if there are a few fails, doubts, and disappointments. Cryptocurrency is still at a nascent stage. It lacks trust, but one of its fundamental drawbacks has been scalability for mass adoption. Facebook says it has solved the scalability issue by using new technologies to secure the system’s integrity.

Libra is being called another cryptocurrency, but in many ways, it is much more. It is essentially a new style of digital currency and financial ecosystem.”

Based on Libra whitepaper, it’s clear that Libra works differently compared to bitcoin and other cryptocurrencies. There are three key three factors that make Libra different and potentially give it the edge:

- Move – A new language that prioritises preset safety features to keep the blockchain technology secure and scalable.

- Consensus protocol – The nodes are currently administered within the Libra consortium, and the consensus protocol ensures that even if some validators are compromised the system will still maintain its integrity.

- Merkle trees – The data is saved in Merkle trees, a data structure that detects any changes to existing data. Libra blockchain works as a single data structure that records the history of transactions over time, whereas other blockchain implementations work on collections or ‘blocks’ of transactions.

A strong Libra ecosystem

After Cambridge Analytica Facebook lost about 3 million users in Europe, but it still has 2.38 billion monthly active users globally. Add to this 1 billion active monthly Instagram users and half a billion daily active WhatsApp users. All of them will soon have access to Libra. And that is just Facebook’s subscriber base.

When PayPal, Uber, eBay, Stripe, Mastercard and Visa begin promoting Libra, usage will increase, and perception will improve. Even if the new Digital currency fails to deliver on its immediate promises, there is enough investment and risk-appetite among the partner ecosystem to build a currency that will eventually disrupt the financial exchange system.

As the consortium expands, and more organisations join, it will not take long for the currency to become accepted. It may not start in big financial transactions but will take over the smaller online transactions in many marketplaces and apps.

Why should Australian business leaders get serious about blockchain?

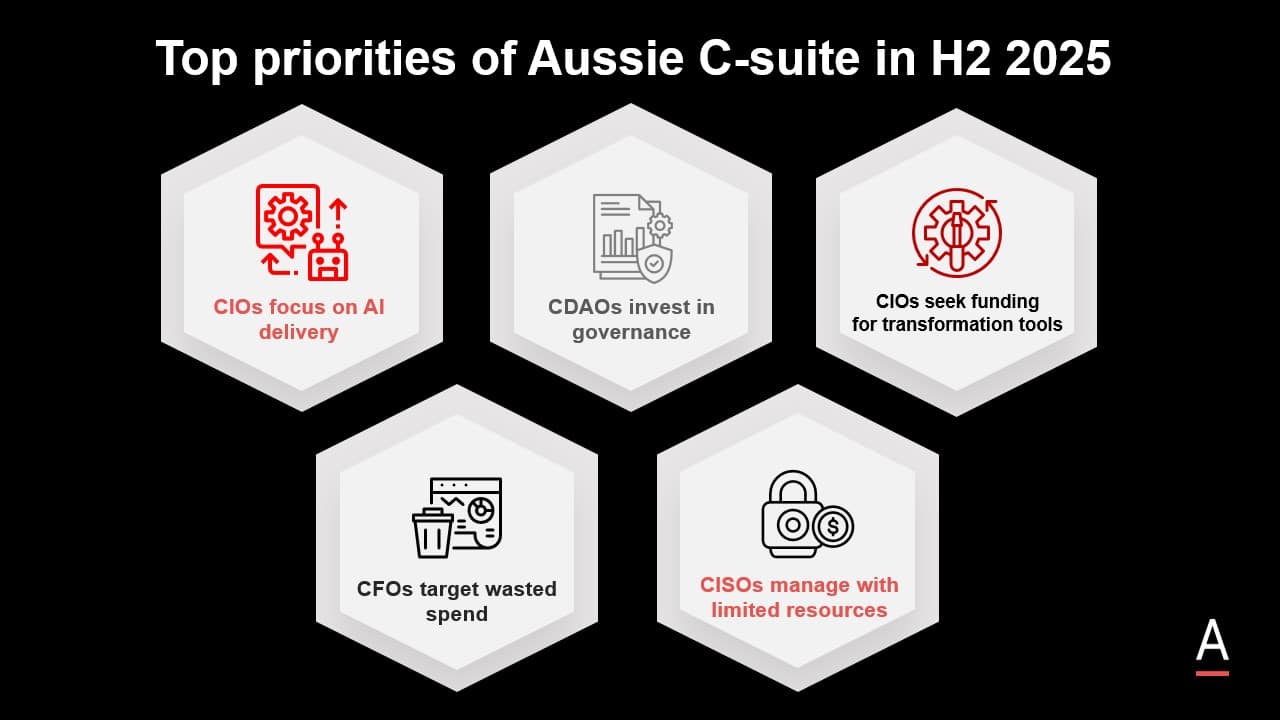

ADAPT believes it would be a big mistake for Australian business leaders to ignore this move. Do not sit back in denial and assume the project will fail and is irrelevant to your businesses. There are some big names behind it. Australian CIOs and CFOs should watch the blockchain space carefully.

Facebook is being questioned at every level, which it must have expected. Both Facebook and cryptocurrencies lack trust, it is true, but both are real disruptors and their potential impact is huge.

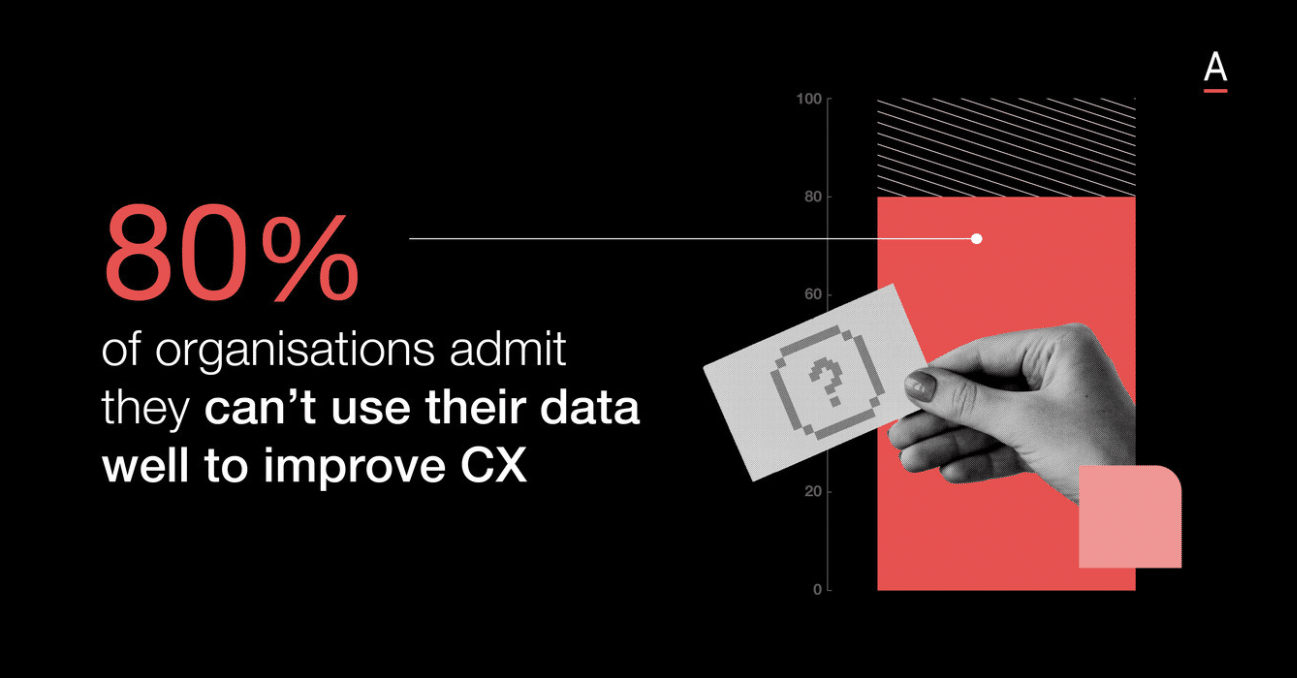

According to ADAPT’s 2018 CFO Edge survey, 75% of CFOs have not even started thinking about blockchain, while 95% are unprepared for AI, blockchain and automation technologies.”

From ADAPT’s conversations with CIOs and CFOs, and from survey responses by digital leaders in Australia across our Edge events, we know that the risk appetite for innovation in Australia is low. Playing safe has already cost Australia significantly by putting us behind in technology adoption and innovation. It’s time for Australian business leaders, especially CFOs, to take a new perspective on risk and failure and start exploring blockchain within their organisations.

Facebook’s Libra project is one of its boldest blockchain moves yet. Its introduction resonates with ADAPT’s findings around how Australian businesses should start thinking differently.

Three things Australian business and technology leaders can learn from Facebook’s Libra project:

- Risk Appetite. Despite significant credibility problems and ongoing trust issues, Facebook maintains its vision and direction of connecting the world, first through its social network and now through Libra. Many companies would have stepped back, moved into a highly safe zone or even become invisible and eventually vanish. Facebook has done the exact opposite.

- Long-term vision. Facebook started the project in 2014 and has gradually gathered investment and support from major financial institutions and other organisations with high credibility. This aligns with ADAPT’s advice to the Australian businesses to redefine traditional measures of ROI for deploying transformation projects. A long-term vision needs an open approach to perceiving failures and working on them rather than try, fail, and stop approach.

- Understanding consumer psyche. Facebook understands the current gaps in the financial system and its rich body of data has helped it study consumer behaviour since it conceived the project. It is true that many subscribers quit Facebook after the Cambridge Analytica scandal, but many more stayed on. With Libra, Facebook seems to be determined to gain more trust by being transparent about the system from the beginning.

Image source by: GETTY IMAGES