Tech on the sidelines as Federal Budget 2025 focuses on cost-of-living and core services

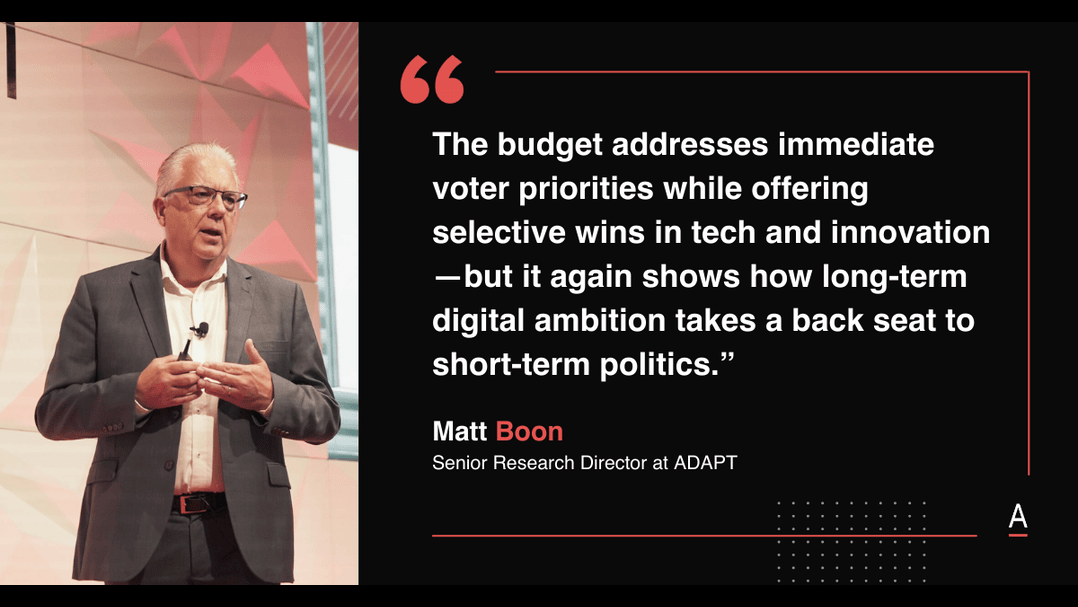

ADAPT’s Senior Research Director Matt Boon unpacks key Federal Budget 2025 signals for tech leaders—from digital infrastructure to green innovation.

ADAPT’s Senior Director of Strategic Research Matt Boon unpacks what Budget 2024 signals for tech leaders—from digital infrastructure to green innovation.

As expected for an election-eve budget, last night’s announcements focused heavily on voter-impactful measures. Tech can wait for another day.

TAFE, apprenticeships, and HECS relief all featured prominently, as did funding for family safety, defence, water security, and food resilience.

While those are critical foundations, technology, infrastructure and cyber took a back seat this year compared to previous budgets.

That said, there are still a few signals worth noting for tech execs.

National broadband and connectivity

There’s still a clear effort to revive and future-proof Australia’s digital backbone.

Labor is continuing its work to return the NBN to its original vision, while also expanding mobile and satellite access to improve reach and equity.

- NBN Co. investment: $3 billion to complete the NBN rollout, upgrading 622,000 premises to faster fibre-to-the-node connections.

- Universal Outdoor Mobile Obligation: Basic SMS and voice coverage across the continent by 2027, using Low Earth Orbit Satellite tech.

- School Student Broadband Initiative: $5.3 million over four years (2024–25 to 2028) to connect up to 30,000 currently unconnected families. More than one-third of these are in rural and regional areas.

Infrastructure innovation

Better connectivity pairs naturally with more accessible regions—and that’s a key part of the Government’s broader push to address the cost-of-living challenge.

Making regional areas more liveable could reduce pressure on cities and unlock new talent pools.

- Investment pipeline: Part of a $120 billion 10-year national infrastructure program, with a focus on sustainable, high-impact road and rail projects and the integration of advanced technologies.

- Notable investments: $17.1 billion allocated to regional projects designed to improve connectivity, productivity, and enable future digital transport capabilities.

Backing green technologies

There’s a strong green manufacturing thread running through this year’s budget, with a focus on helping traditional industries decarbonise without losing competitiveness.

Green metals initiatives:

- $2 billion Green Aluminium Production Credit to promote renewable-powered aluminium production

- $1 billion Green Iron Investment Fund to establish a sustainable green iron industry

Additional clean energy bets coming from the Future Made in Australia Innovation Fund:

- $750 million for green metals

- $500 million for clean energy tech manufacturing

- $250 million for low-carbon liquid fuels

Building the STEM pipeline

There are more dollars flowing into STEM programs this year, with a focus on extending reach and access.

Still, many in the sector will see this as incremental rather than transformational—especially when it comes to diversity and equity.

- $2.2 million in 2025–26 to extend Australian Academy of Science programs in schools

- $1.2 million in 2025–26 to continue CSIRO’s STEM Professionals in Schools program

- $0.9 million in 2025–26 to keep the National Lending Library running

- $0.7 million in 2025–26 for the Little Scientists programs (early childhood STEM education)

- $0.7 million in 2025–26 for the Curious Minds initiative, aimed at increasing female participation—particularly from disadvantaged backgrounds

Innovation outlook still mixed

Australia has moved up slightly in the Global Innovation Index, from 24th to 23rd—but the climb remains slow.

The budget tells a similar story: positive signals in some areas, pullbacks in others.

- Positive advancements

Payments related to the Australian Screen and Digital Game Production Incentive program are forecasted to increase by $46 million in 2025–26 and $478.8 million over five years to 2028–29.

This growth reflects a rise in the number and scale of large-budget project applications.

- Challenges

Payments under the Research and Development Tax Incentive program are projected to increase by $55.8 million in 2025–26 but decrease by $640.6 million over five years to 2028–29 due to lower-than-expected claims.

This represents a setback for innovation-driven activities.

Tougher protections for consumers and businesses

Some good progress here, especially in light of growing scams, fraud, and ongoing financial vulnerability across key sectors like construction and small business.

- National Anti-Scam Centre: $6.7 million in 2025–26 to extend operations under the ACCC

- ASIC data capability: $3 million over four years from 2025–26 for the Australian Securities and Investments Commission to improve data analytics for better enforcement targeting illegal phoenixing activities, particularly in the construction sector

While tech wasn’t the headline act this year, there are signals worth tracking—particularly around digital infrastructure, green industries, and innovation incentives.

For now, it’s a wait-and-see moment for the sector, as election momentum continues to shape where attention lands next.